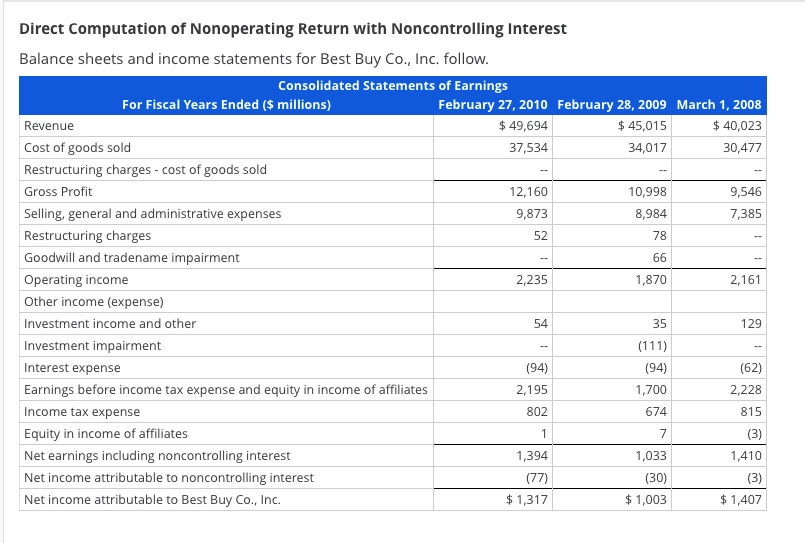

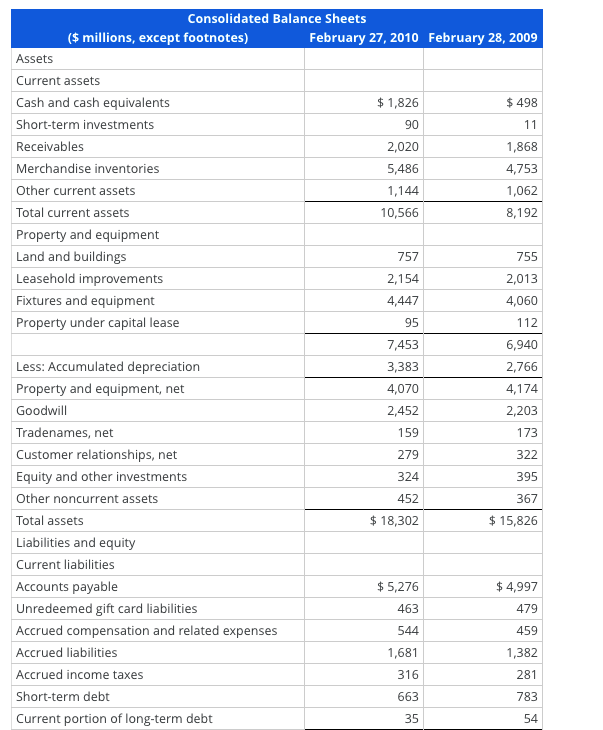

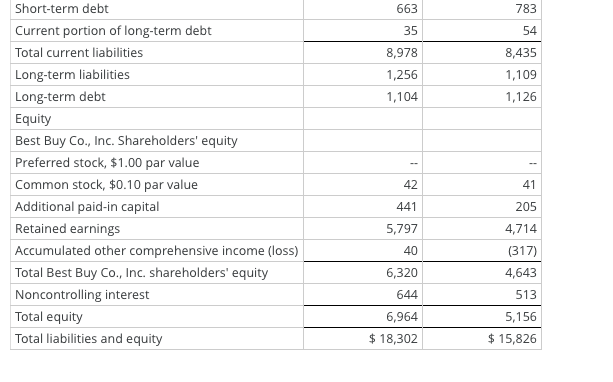

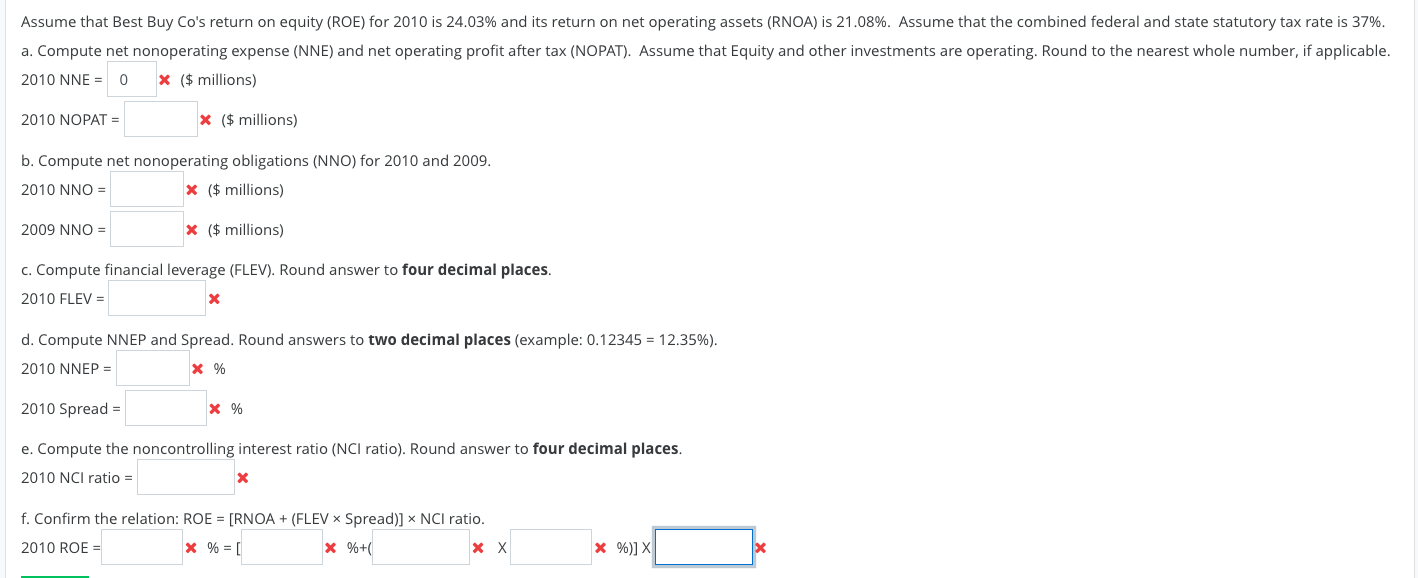

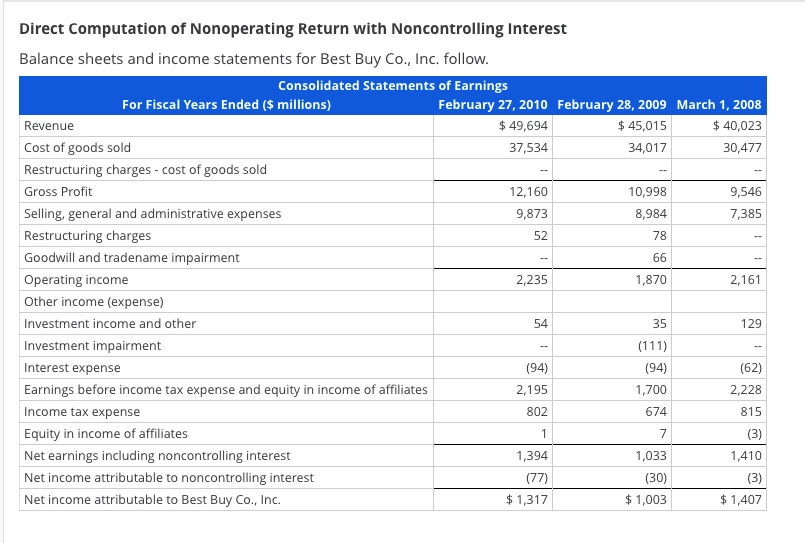

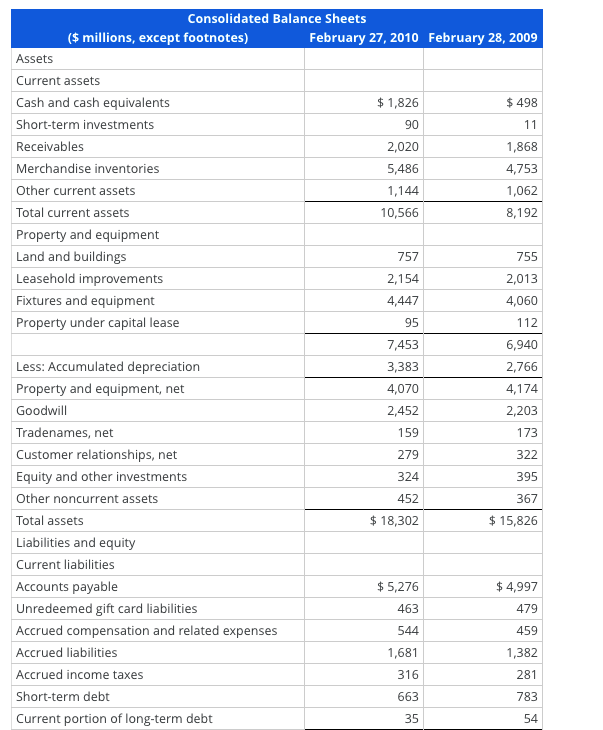

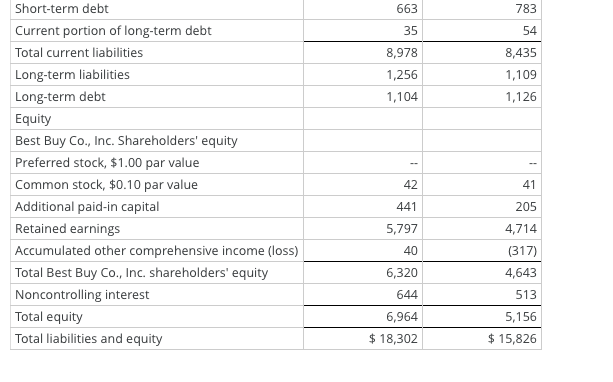

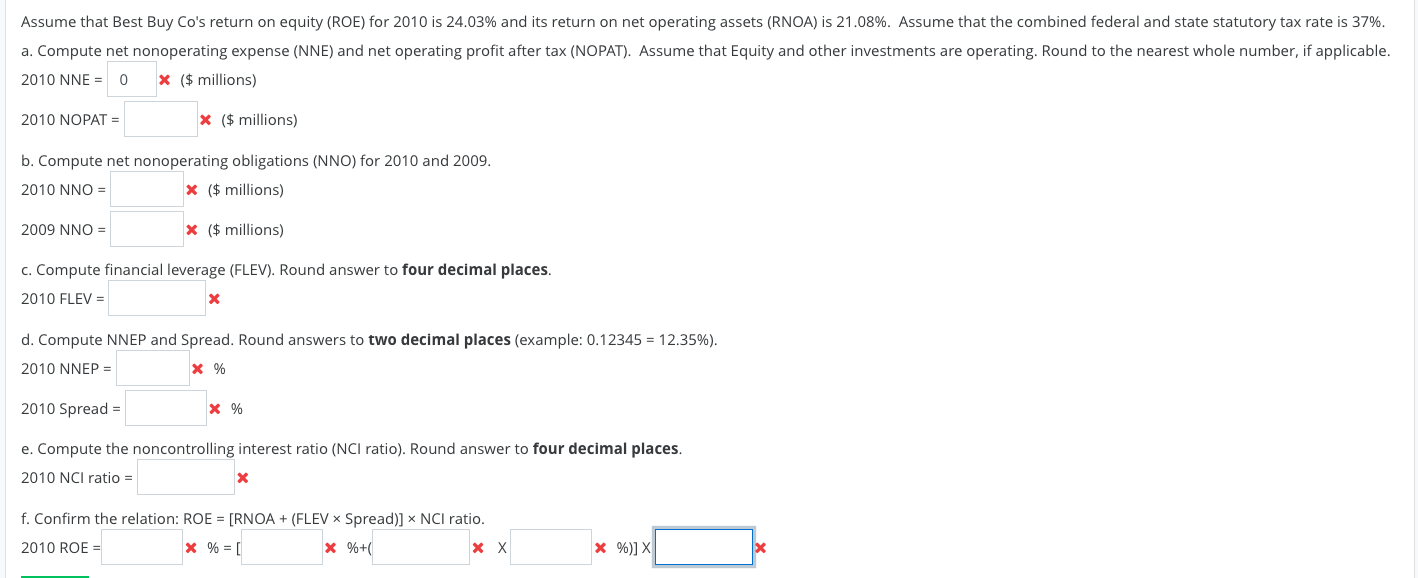

52 66 Direct Computation of Nonoperating Return with Noncontrolling Interest Balance sheets and income statements for Best Buy Co., Inc. follow. Consolidated Statements of Earnings For Fiscal Years Ended ($ millions) February 27, 2010 February 28, 2009 March 1, 2008 Revenue $ 49,694 $ 45,015 $ 40,023 Cost of goods sold 37,534 34,017 30,477 Restructuring charges - cost of goods sold Gross Profit 12,160 10,998 9,546 Selling, general and administrative expenses 9,873 8,984 7,385 Restructuring charges 78 Goodwill and tradename impairment Operating income 2,235 1,870 2,161 Other income (expense) Investment income and other 35 Investment impairment (111) Interest expense (94) (94) (62) Earnings before income tax expense and equity in income of affiliates 2,195 1,700 2,228 Income tax expense 674 Equity in income of affiliates (3) Net earnings including noncontrolling interest 1,394 1,033 1,410 Net income attributable to noncontrolling interest (77) (30) (3) Net income attributable to Best Buy Co., Inc. $ 1,317 $ 1,003 $1,407 54 129 802 815 1 7 95 Consolidated Balance Sheets ($ millions, except footnotes) February 27, 2010 February 28, 2009 Assets Current assets Cash and cash equivalents $ 1,826 $ 498 Short-term investments 90 11 Receivables 2,020 1,868 Merchandise inventories 5,486 4,753 Other current assets 1,144 1,062 Total current assets 10,566 8,192 Property and equipment Land and buildings 757 755 Leasehold improvements 2,154 2,013 Fixtures and equipment 4,447 4,060 Property under capital lease 112 7,453 6,940 Less: Accumulated depreciation 3,383 2,766 Property and equipment, net 4,070 4,174 Goodwill 2,452 2,203 Tradenames, net 159 173 Customer relationships, net 279 322 Equity and other investments 324 395 Other noncurrent assets 452 367 Total assets $ 18,302 $ 15,826 Liabilities and equity Current liabilities Accounts payable $ 5,276 $ 4,997 Unredeemed gift card liabilities 463 479 Accrued compensation and related expenses 544 459 Accrued liabilities 1,681 1,382 Accrued income taxes 316 281 Short-term debt 663 783 Current portion of long-term debt 35 54 663 783 35 54 8,978 1,256 1,104 8,435 1,109 1,126 -- Short-term debt Current portion of long-term debt Total current liabilities Long-term liabilities Long-term debt Equity Best Buy Co., Inc. Shareholders' equity Preferred stock, $1.00 par value Common stock, $0.10 par value Additional paid-in capital Retained earnings Accumulated other comprehensive income (loss) Total Best Buy Co., Inc. shareholders' equity Noncontrolling interest Total equity Total liabilities and equity 42 41 441 205 5,797 40 6,320 644 4,714 (317) 4,643 513 5,156 $ 15,826 6,964 $ 18,302 Assume that Best Buy Co's return on equity (ROE) for 2010 is 24.03% and its return on net operating assets (RNOA) is 21.08%. Assume that the combined federal and state statutory tax rate is 37%. a. Compute net nonoperating expense (NNE) and net operating profit after tax (NOPAT). Assume that Equity and other investments are operating. Round to the nearest whole number, if applicable. 2010 NNE = 0 x ($ millions) 2010 NOPAT = * ($ millions) b. Compute net nonoperating obligations (NNO) for 2010 and 2009. 2010 NNO = X ($ millions) 2009 NNO = X ($ millions) c. Compute financial leverage (FLEV). Round answer to four decimal places. 2010 FLEV = X d. Compute NNEP and Spread. Round answers to two decimal places (example: 0.12345 = 12.35%). 2010 NNEP = X % 2010 Spread = X % e. Compute the noncontrolling interest ratio (NCI ratio). Round answer to four decimal places. 2010 NC ratio = X f. Confirm the relation: ROE = [RNOA + (FLEV Spread)] NCI ratio. 2010 ROE * % = [ * %+ xx * %)] X X 52 66 Direct Computation of Nonoperating Return with Noncontrolling Interest Balance sheets and income statements for Best Buy Co., Inc. follow. Consolidated Statements of Earnings For Fiscal Years Ended ($ millions) February 27, 2010 February 28, 2009 March 1, 2008 Revenue $ 49,694 $ 45,015 $ 40,023 Cost of goods sold 37,534 34,017 30,477 Restructuring charges - cost of goods sold Gross Profit 12,160 10,998 9,546 Selling, general and administrative expenses 9,873 8,984 7,385 Restructuring charges 78 Goodwill and tradename impairment Operating income 2,235 1,870 2,161 Other income (expense) Investment income and other 35 Investment impairment (111) Interest expense (94) (94) (62) Earnings before income tax expense and equity in income of affiliates 2,195 1,700 2,228 Income tax expense 674 Equity in income of affiliates (3) Net earnings including noncontrolling interest 1,394 1,033 1,410 Net income attributable to noncontrolling interest (77) (30) (3) Net income attributable to Best Buy Co., Inc. $ 1,317 $ 1,003 $1,407 54 129 802 815 1 7 95 Consolidated Balance Sheets ($ millions, except footnotes) February 27, 2010 February 28, 2009 Assets Current assets Cash and cash equivalents $ 1,826 $ 498 Short-term investments 90 11 Receivables 2,020 1,868 Merchandise inventories 5,486 4,753 Other current assets 1,144 1,062 Total current assets 10,566 8,192 Property and equipment Land and buildings 757 755 Leasehold improvements 2,154 2,013 Fixtures and equipment 4,447 4,060 Property under capital lease 112 7,453 6,940 Less: Accumulated depreciation 3,383 2,766 Property and equipment, net 4,070 4,174 Goodwill 2,452 2,203 Tradenames, net 159 173 Customer relationships, net 279 322 Equity and other investments 324 395 Other noncurrent assets 452 367 Total assets $ 18,302 $ 15,826 Liabilities and equity Current liabilities Accounts payable $ 5,276 $ 4,997 Unredeemed gift card liabilities 463 479 Accrued compensation and related expenses 544 459 Accrued liabilities 1,681 1,382 Accrued income taxes 316 281 Short-term debt 663 783 Current portion of long-term debt 35 54 663 783 35 54 8,978 1,256 1,104 8,435 1,109 1,126 -- Short-term debt Current portion of long-term debt Total current liabilities Long-term liabilities Long-term debt Equity Best Buy Co., Inc. Shareholders' equity Preferred stock, $1.00 par value Common stock, $0.10 par value Additional paid-in capital Retained earnings Accumulated other comprehensive income (loss) Total Best Buy Co., Inc. shareholders' equity Noncontrolling interest Total equity Total liabilities and equity 42 41 441 205 5,797 40 6,320 644 4,714 (317) 4,643 513 5,156 $ 15,826 6,964 $ 18,302 Assume that Best Buy Co's return on equity (ROE) for 2010 is 24.03% and its return on net operating assets (RNOA) is 21.08%. Assume that the combined federal and state statutory tax rate is 37%. a. Compute net nonoperating expense (NNE) and net operating profit after tax (NOPAT). Assume that Equity and other investments are operating. Round to the nearest whole number, if applicable. 2010 NNE = 0 x ($ millions) 2010 NOPAT = * ($ millions) b. Compute net nonoperating obligations (NNO) for 2010 and 2009. 2010 NNO = X ($ millions) 2009 NNO = X ($ millions) c. Compute financial leverage (FLEV). Round answer to four decimal places. 2010 FLEV = X d. Compute NNEP and Spread. Round answers to two decimal places (example: 0.12345 = 12.35%). 2010 NNEP = X % 2010 Spread = X % e. Compute the noncontrolling interest ratio (NCI ratio). Round answer to four decimal places. 2010 NC ratio = X f. Confirm the relation: ROE = [RNOA + (FLEV Spread)] NCI ratio. 2010 ROE * % = [ * %+ xx * %)] X X