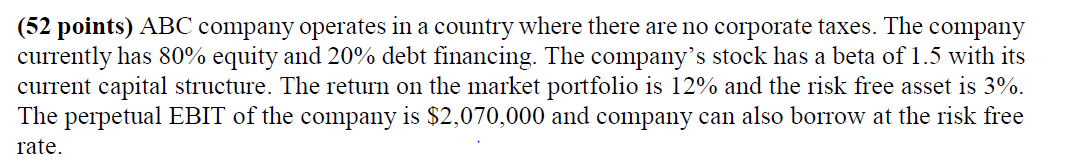

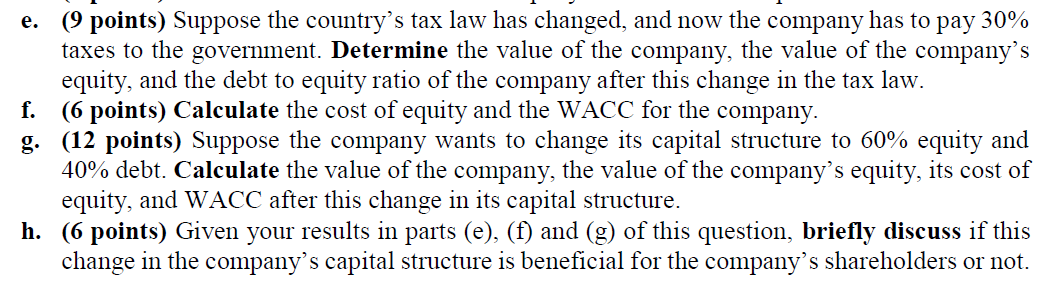

(52 points) ABC company operates in a country where there are no corporate taxes. The company currently has 80% equity and 20% debt financing. The company's stock has a beta of 1.5 with its current capital structure. The return on the market portfolio is 12% and the risk free asset is 3%. The perpetual EBIT of the company is $2,070,000 and company can also borrow at the risk free rate. e. (9 points) Suppose the country's tax law has changed, and now the company has to pay 30% taxes to the government. Determine the value of the company, the value of the company's equity, and the debt to equity ratio of the company after this change in the tax law. f. (6 points) Calculate the cost of equity and the WACC for the company. g. (12 points) Suppose the company wants to change its capital structure to 60% equity and 40% debt. Calculate the value of the company, the value of the company's equity, its cost of equity, and WACC after this change in its capital structure. h. (6 points) Given your results in parts (e), (f) and (g) of this question, briefly discuss if this change in the company's capital structure is beneficial for the company's shareholders or not. (52 points) ABC company operates in a country where there are no corporate taxes. The company currently has 80% equity and 20% debt financing. The company's stock has a beta of 1.5 with its current capital structure. The return on the market portfolio is 12% and the risk free asset is 3%. The perpetual EBIT of the company is $2,070,000 and company can also borrow at the risk free rate. e. (9 points) Suppose the country's tax law has changed, and now the company has to pay 30% taxes to the government. Determine the value of the company, the value of the company's equity, and the debt to equity ratio of the company after this change in the tax law. f. (6 points) Calculate the cost of equity and the WACC for the company. g. (12 points) Suppose the company wants to change its capital structure to 60% equity and 40% debt. Calculate the value of the company, the value of the company's equity, its cost of equity, and WACC after this change in its capital structure. h. (6 points) Given your results in parts (e), (f) and (g) of this question, briefly discuss if this change in the company's capital structure is beneficial for the company's shareholders or not