Answered step by step

Verified Expert Solution

Question

1 Approved Answer

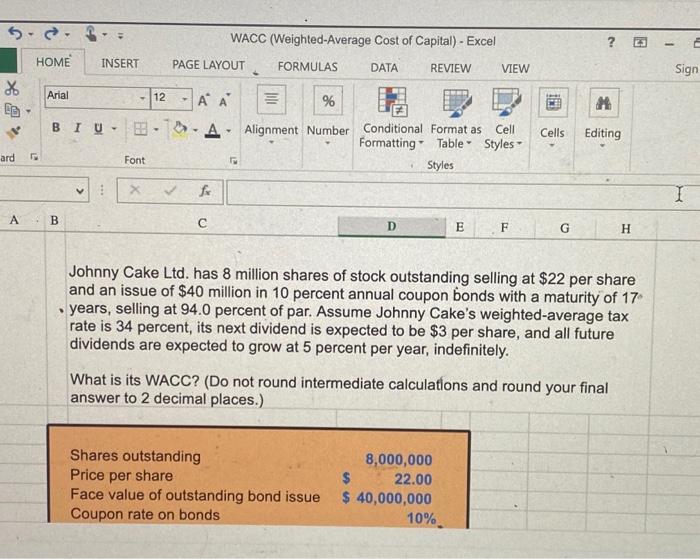

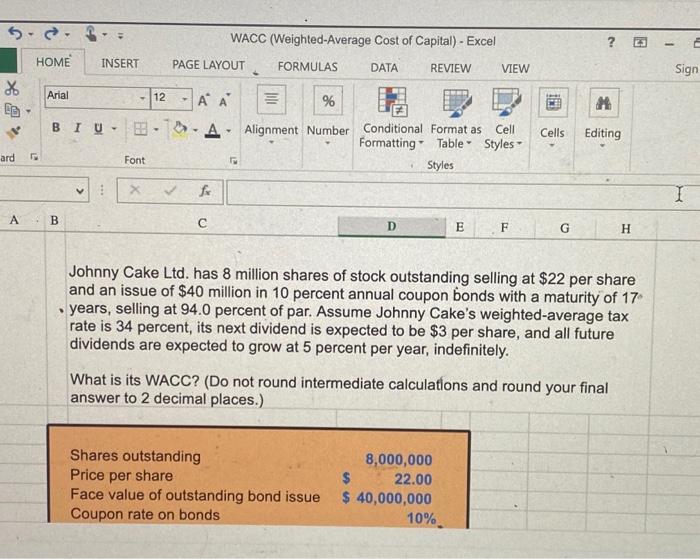

5.2.1 HOME * ard A Arial B INSERT D % BIU A Alignment Number *** Font PAGE LAYOUT 12 T WACC (Weighted-Average Cost of Capital)

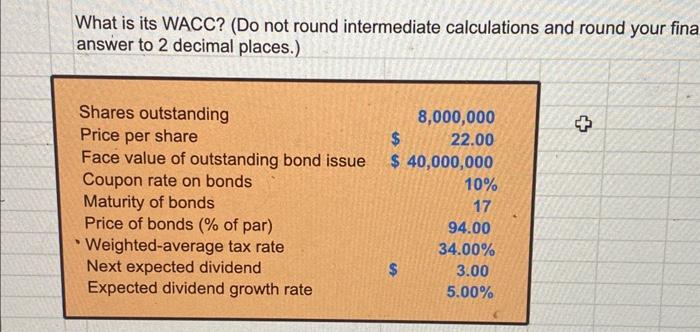

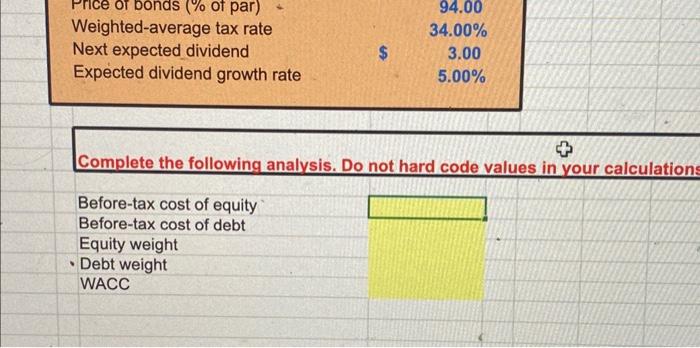

5.2.1 HOME * ard A Arial B INSERT D % BIU A Alignment Number *** Font PAGE LAYOUT 12 T WACC (Weighted-Average Cost of Capital) - Excel DATA fx C T FORMULAS M D REVIEW Cell Conditional Format as Formatting Table Styles Styles f Shares outstanding Price per share Face value of outstanding bond issue Coupon rate on bonds VIEW E 8,000,000 22.00 $ $ 40,000,000 F 10% ? G IN M Cells Editing Johnny Cake Ltd. has 8 million shares of stock outstanding selling at $22 per share and an issue of $40 million in 10 percent annual coupon bonds with a maturity of 17 years, selling at 94.0 percent of par. Assume Johnny Cake's weighted-average tax rate is 34 percent, its next dividend is expected to be $3 per share, and all future dividends are expected to grow at 5 percent per year, indefinitely. What is its WACC? (Do not round intermediate calculations and round your final answer to 2 decimal places.) H - E Sign I

i need the excel formulas too not just the answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started