Question

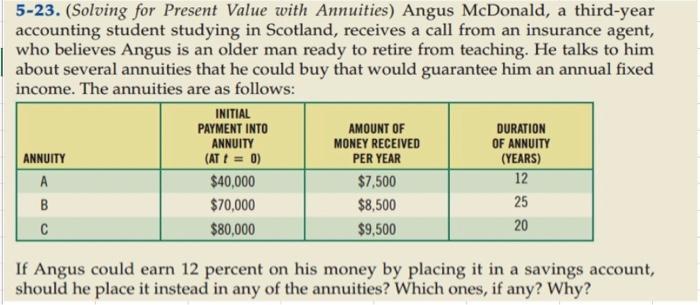

5-23. (Solving for Present Value with Annuities) Angus McDonald, a third-year accounting student studying in Scotland, receives a call from an insurance agent, who

5-23. (Solving for Present Value with Annuities) Angus McDonald, a third-year accounting student studying in Scotland, receives a call from an insurance agent, who believes Angus is an older man ready to retire from teaching. He talks to him about several annuities that he could buy that would guarantee him an annual fixed income. The annuities are as follows: ANNUITY A B C INITIAL PAYMENT INTO ANNUITY (AT t = 0) $40,000 $70,000 $80,000 AMOUNT OF MONEY RECEIVED PER YEAR $7,500 $8,500 $9,500 DURATION OF ANNUITY (YEARS) 12 25 20 If Angus could earn 12 percent on his money by placing it in a savings account, should he place it instead in any of the annuities? Which ones, if any? Why?

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Management Principles and Applications

Authors: Sheridan Titman, Arthur Keown, John Martin

12th edition

133423824, 978-0133423822

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App