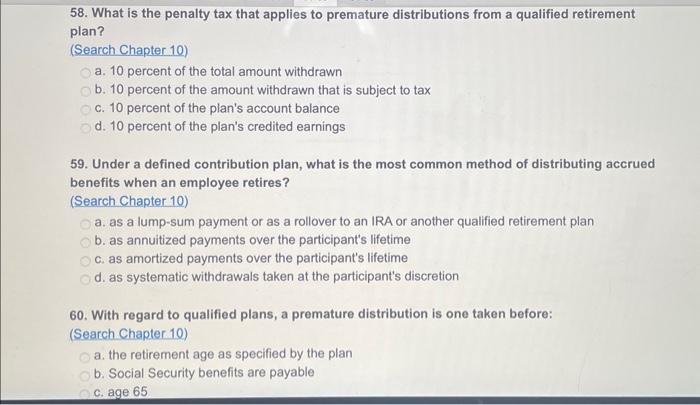

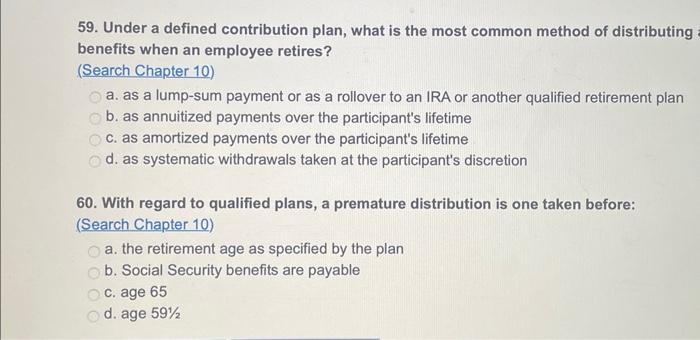

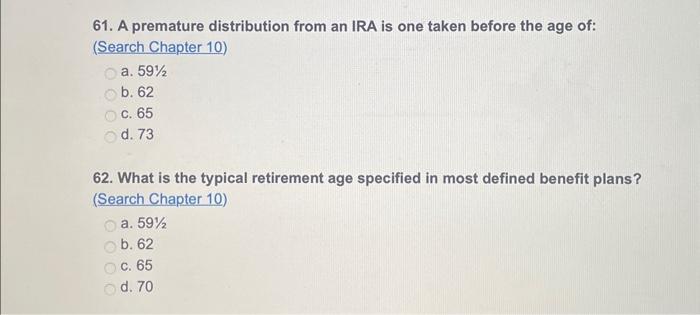

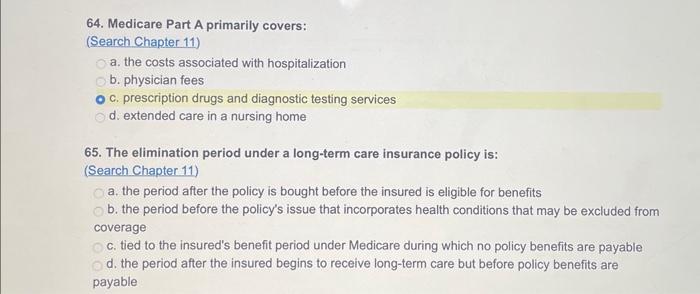

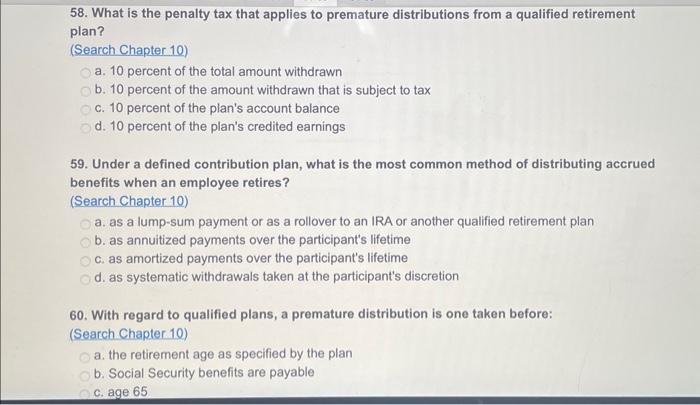

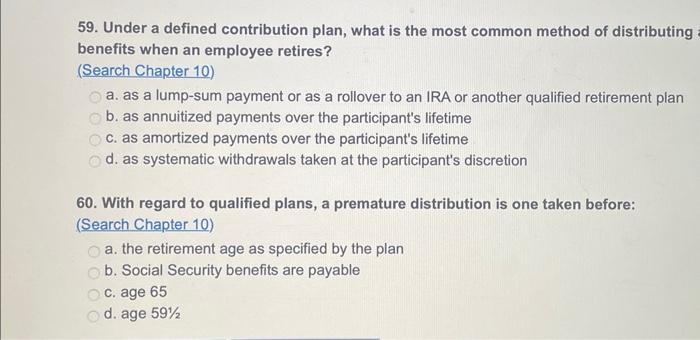

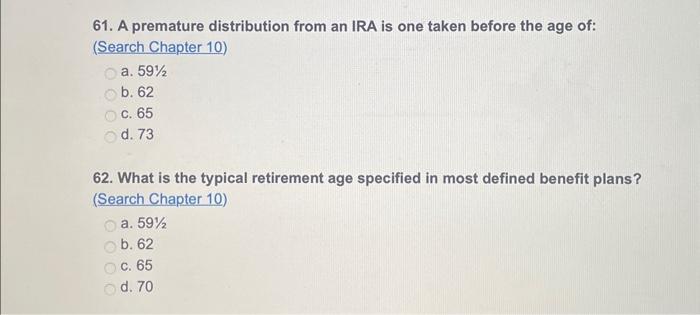

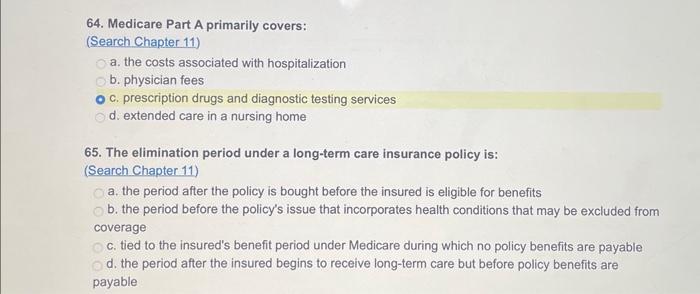

53. What type of investment most closely resembles a variable annuity? (Search Chapter 9) a. stock b. bond c. mutual fund d. certificate of deposit 54. Harold invested in a variable annuity and bought 1,000 accumulation units, each valued $15. How much did Harold invest in the variable annuity? (Search Chapter 9) a. $1,000 b. $1,500 c. $15,000 d. $150,000 53. What type of investment most closely resembles a variable annuity? (Search Chapter.9) a. stock b. bond c. mutual fund d. certificate of deposit 54. Harold invested in a variable annuity and bought 1,000 accumulation units, each valued at $15. How much did Harold invest in the variable annuity? (Search Chapter 9) a. $1,000 b. $1,500 c. $15,000 d. $150,000 55. Ellen invested $100,000 in an annuity. One month later she received her first monthly payment from the contract. Based only on these facts, what kind of annuity did Ellen buy? (Search Chapter 9) a. fixed annuity 64. Medicare Part A primarily covers: (Search Chapter 11) a. the costs associated with hospitalization b. physician fees c. prescription drugs and diagnostic testing services d. extended care in a nursing home 65. The elimination period under a long-term care insurance policy is: (Search Chapter 11) a. the period after the policy is bought before the insured is eligible for benefits b. the period before the policy's issue that incorporates health conditions that may be excluded from coverage c. tied to the insured's benefit period under Medicare during which no policy benefits are payable d. the period after the insured begins to receive long-term care but before policy benefits are payable 59. Under a defined contribution plan, what is the most common method of distributing benefits when an employee retires? (Search Chapter 10) a. as a lump-sum payment or as a rollover to an IRA or another qualified retirement plan b. as annuitized payments over the participant's lifetime c. as amortized payments over the participant's lifetime d. as systematic withdrawals taken at the participant's discretion 60. With regard to qualified plans, a premature distribution is one taken before: (Search Chapter 10) a. the retirement age as specified by the plan b. Social Security benefits are payable c. age 65 d. age 591/2 61. A premature distribution from an IRA is one taken before the age of: (Search Chapter 10) a. 5921 b. 62 c. 65 d. 73 62. What is the typical retirement age specified in most defined benefit plans? (Search Chapter 10) a. 5921 b. 62 c. 65 d. 70 51. At the age of 65 , Michael annuitized his fixed annuity under a life and ten-year certain payout and named his younger brother, Gene, as the beneficiary. At the age of 79, Michael dies. Which of the following statements is true? (Search Chapter 9) a. No more annuity payments will be made. b. Gene will receive annuity payments for ten years. c. Gene will receive annuity payments for his life or for ten years, whichever is shorter. d. Gene will receive annuity payments for his life or for ten years, whichever is longer. 52. At the age of 60 , Marcia annuitized her fixed annuity under a life and 20 -year certain payout and named her husband, Kent, as the beneficiary. At the age of 65 , Marcia dies. Which of the following statements is true? (Search Chapter 9) a. The annuity will continue income payments to Kent for the remainder of his life. b. The annuity will continue income payments to Kent for 20 years. c. The annuity will continue income payments to Kent for 15 years. d. The annuity will continue income payments to Kent for the remainder of his life or for 20 years, whichever comes first. 58. What is the penalty tax that applies to premature distributions from a qualified retirement plan? (Search Chapter 10) a. 10 percent of the total amount withdrawn b. 10 percent of the amount withdrawn that is subject to tax c. 10 percent of the plan's account balance d. 10 percent of the plan's credited earnings 59. Under a defined contribution plan, what is the most common method of distributing accrued benefits when an employee retires? (Search Chapter 10) a. as a lump-sum payment or as a rollover to an IRA or another qualified retirement plan b. as annuitized payments over the participant's lifetime c. as amortized payments over the participant's lifetime d. as systematic withdrawals taken at the participant's discretion 60. With regard to qualified plans, a premature distribution is one taken before: (Search Chapter 10) a. the retirement age as specified by the plan b. Social Security benefits are payable c. age 65 55. Ellen invested $100,000 in an annuity. One month later she received her first monthly payment from the contract. Based only on these facts, what kind of annuity did Ellen buy? (Search Chapter 9) a. fixed annuity b. variable annuity c. immediate annuity d. deferred annuity 56. What form do distributions from defined benefit pension plans typically take? (Search Chapter 10) a. lump-sum payments b. periodic withdrawals taken at the participant's discretion c. annuitized lifetime payments d. amortized payments over the participant's working years 57. All of the following exempt a premature IRA distribution from the penalty tax EXCEPT: (Search Chapter 10) a. first-time home buying b. financial hardship c. paying for the owner's college tuition d. the owner hecomino disabled