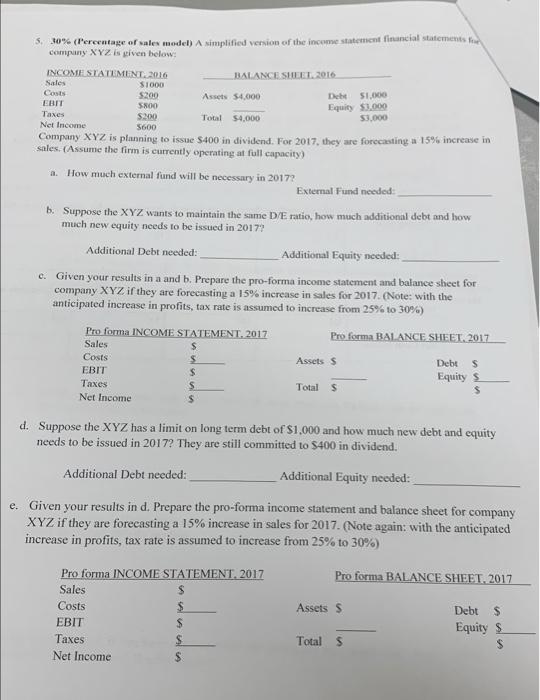

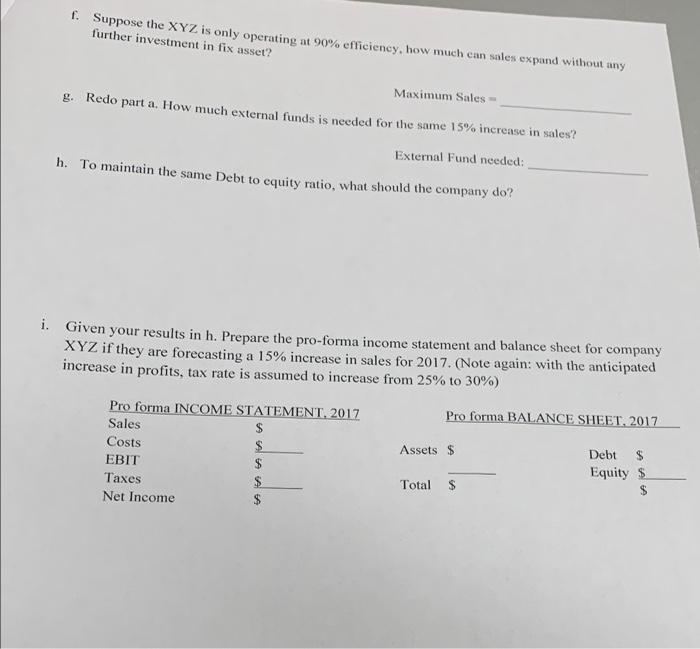

5.30% (Percentage of sales model) A simplified version of the income statement financial statements company XYZ is given below: INCOME STATEMENT. 2016 BALANCE SHEET 2016 Sales $1000 Costs $200 Assets 54.000 Dehe $1.000 EBIT SNOO Equity $1.000 Taxes $200 Total $4,000 53.000 Net Income 5600 Company XYZ is planning to issue $400 in dividend. For 2017, they are forecasting a 15% increase in sales. (Assume the firm is currently operating at full capacity) a. How much external fund will be necessary in 2017? External Fund needed b. Suppose the XYZ wants to maintain the same D/E ratio, how much additional debt and how much new equity needs to be issued in 2017? Additional Debt needed: Additional Equity needed: c. Given your results in a and b. Prepare the pro-forma income statement and balance sheet for company XYZ if they are forecasting a 15% increase in sales for 2017. (Note: with the anticipated increase in profits, tax rate is assumed to increase from 25% to 30%) Proforma INCOME STATEMENT. 2017 Pro forma BALANCE SHEET 2017 Sales Costs Assets s Debt EBIT Equity s Taxes s Total 5 $ Net Income S $ S d. Suppose the XYZ has a limit on long term debt of $1.000 and how much new debt and equity needs to be issued in 2017? They are still committed to $400 in dividend. Additional Debt needed: Additional Equity needed: e. Given your results in d. Prepare the pro-forma income statement and balance sheet for company XYZ if they are forecasting a 15% increase in sales for 2017. (Note again: with the anticipated increase in profits, tax rate is assumed to increase from 25% to 30%) Pro forma BALANCE SHEET 2017 Pro forma INCOME STATEMENT. 2017 Sales S Costs EBIT S Taxes $ Net Income $ Assets $ Debt S Equity $ Total $ 1. Suppose the XYZ is only operating at 90% efficiency, how much ean sales expand without any further investment in fix asset? Maximum Sales g. Redo part a. How much external funds is needed for the same 15% increase in sales? External Fund needed: h. To maintain the same Debt to equity ratio, what should the company do? i. Given your results in h. Prepare the pro-forma income statement and balance sheet for company XYZ if they are forecasting a 15% increase in sales for 2017. (Note again: with the anticipated increase in profits, tax rate is assumed to increase from 25% to 30%) Pro forma BALANCE SHEET 2017 Pro forma INCOME STATEMENT. 2017 Sales Costs EBIT Taxes Net Income Assets $ A Debt S Equity $ Total $ 5.30% (Percentage of sales model) A simplified version of the income statement financial statements company XYZ is given below: INCOME STATEMENT. 2016 BALANCE SHEET 2016 Sales $1000 Costs $200 Assets 54.000 Dehe $1.000 EBIT SNOO Equity $1.000 Taxes $200 Total $4,000 53.000 Net Income 5600 Company XYZ is planning to issue $400 in dividend. For 2017, they are forecasting a 15% increase in sales. (Assume the firm is currently operating at full capacity) a. How much external fund will be necessary in 2017? External Fund needed b. Suppose the XYZ wants to maintain the same D/E ratio, how much additional debt and how much new equity needs to be issued in 2017? Additional Debt needed: Additional Equity needed: c. Given your results in a and b. Prepare the pro-forma income statement and balance sheet for company XYZ if they are forecasting a 15% increase in sales for 2017. (Note: with the anticipated increase in profits, tax rate is assumed to increase from 25% to 30%) Proforma INCOME STATEMENT. 2017 Pro forma BALANCE SHEET 2017 Sales Costs Assets s Debt EBIT Equity s Taxes s Total 5 $ Net Income S $ S d. Suppose the XYZ has a limit on long term debt of $1.000 and how much new debt and equity needs to be issued in 2017? They are still committed to $400 in dividend. Additional Debt needed: Additional Equity needed: e. Given your results in d. Prepare the pro-forma income statement and balance sheet for company XYZ if they are forecasting a 15% increase in sales for 2017. (Note again: with the anticipated increase in profits, tax rate is assumed to increase from 25% to 30%) Pro forma BALANCE SHEET 2017 Pro forma INCOME STATEMENT. 2017 Sales S Costs EBIT S Taxes $ Net Income $ Assets $ Debt S Equity $ Total $ 1. Suppose the XYZ is only operating at 90% efficiency, how much ean sales expand without any further investment in fix asset? Maximum Sales g. Redo part a. How much external funds is needed for the same 15% increase in sales? External Fund needed: h. To maintain the same Debt to equity ratio, what should the company do? i. Given your results in h. Prepare the pro-forma income statement and balance sheet for company XYZ if they are forecasting a 15% increase in sales for 2017. (Note again: with the anticipated increase in profits, tax rate is assumed to increase from 25% to 30%) Pro forma BALANCE SHEET 2017 Pro forma INCOME STATEMENT. 2017 Sales Costs EBIT Taxes Net Income Assets $ A Debt S Equity $ Total $