Question

53-54: Dividends and Capital Gains. Calculate the total tax owed by each individual in the following pairs (FICA and income taxes). Compare their overall tax

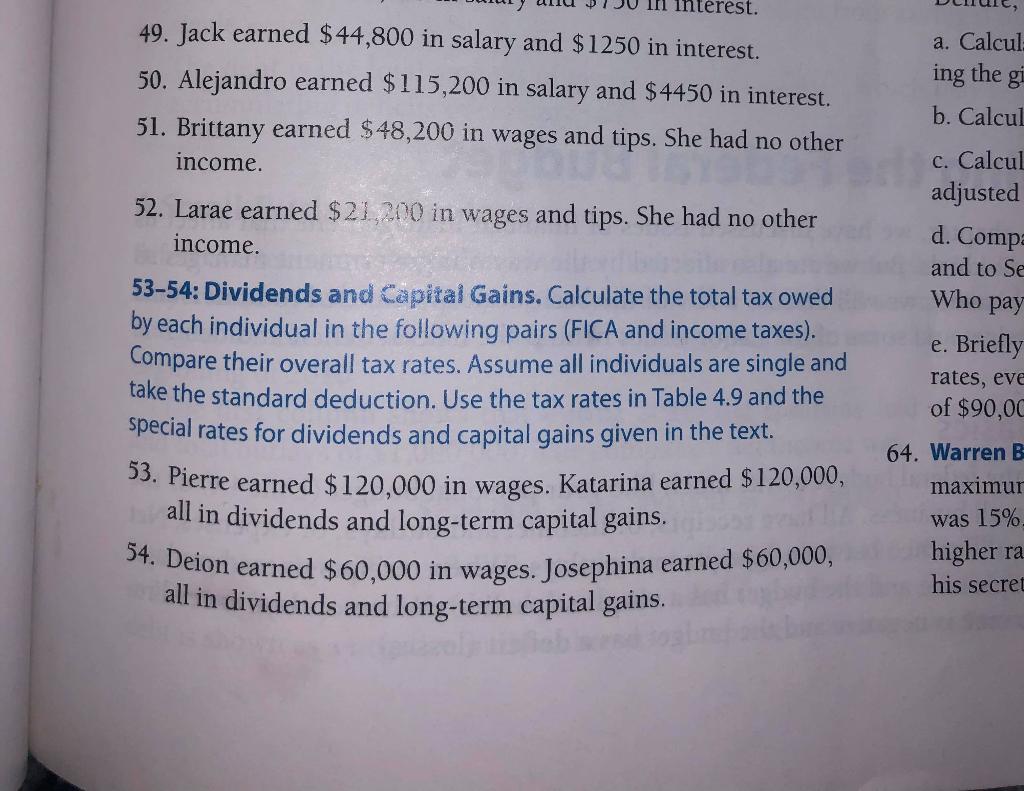

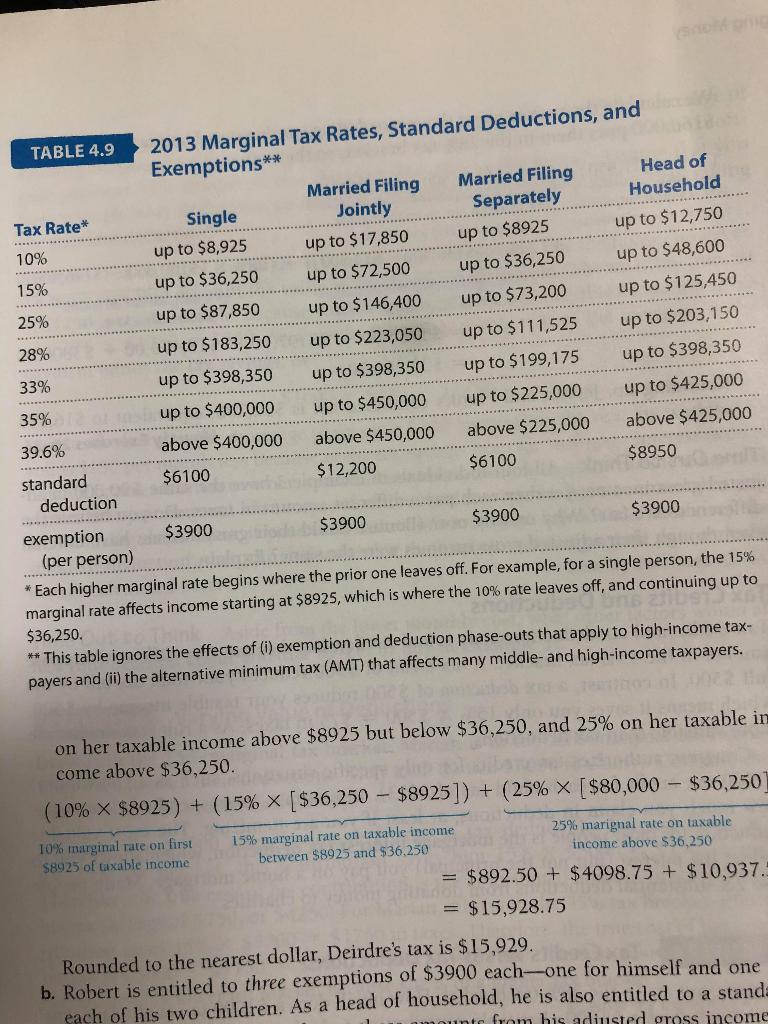

53-54: Dividends and Capital Gains. Calculate the total tax owed by each individual in the following pairs (FICA and income taxes). Compare their overall tax rates. Assume all individuals are single and take the standard deduction. Use the tax rates in Table 4.9 and the special rates for dividends and capital gains given in the text.

53. Pierre earned $120,000 in wages. Katarina earned $120,000, all in dividends and long-term capital gains.

Please answer question 53. I know the answers but I don't know how they get these answers and please explain as well.Fica tax rate: 7.65%. The answers for Pierre: FICA:8789; Income ta:24093; total tax:32883; Tax rate:27.4%

Katarina: FICA tax = 0; Income tax=11063; Total tax:11063; Tax Rate:9.2%

interest. a. Calcul ing the gi b. Calcul 49. Jack earned $44,800 in salary and $1250 in interest. 50. Alejandro earned $115,200 in salary and $4450 in interest. 51. Brittany earned $48,200 in wages and tips. She had no other income. 52. Larae earned $21,200 in wages and tips. She had no other income. c. Calcul adjusted d. Compa and to se Who pay e. Briefly rates, eve of $90,00 53-54: Dividends and Capital Gains. Calculate the total tax owed by each individual in the following pairs (FICA and income taxes). Compare their overall tax rates. Assume all individuals are single and take the standard deduction. Use the tax rates in Table 4.9 and the special rates for dividends and capital gains given in the text. 53. Pierre earned $ 120,000 in wages. Katarina earned $120,000, all in dividends and long-term capital gains. 54. Deion earned $60,000 in wages. Josephina earned $60,000, all in dividends and long-term capital gains. 64. Warren B maximur was 15% higher ra his secret . 15% TABLE 4.9 2013 Marginal Tax Rates, Standard Deductions, and Exemptions** Married Filing Married Filing Head of Tax Rate* Single Jointly Separately Household 10% up to $8,925 up to $17,850 up to $8925 up to $12,750 up to $36,250 up to $72,500 up to $36,250 up to $48,600 25% up to $87,850 up to $146,400 up to $73,200 up to $125,450 28% up to $183,250 up to $223,050 up to $111,525 up to $203,150 33% up to $398,350 up to $398,350 up to $199,175 up to $398,350 35% up to $400,000 up to $450,000 up to $225,000 up to $425,000 39.6% above $400,000 above $450,000 above $225,000 above $425,000 standard $6100 $12,200 $6100 $8950 deduction exemption $3900 $3900 $3900 $3900 (per person) * Each higher marginal rate begins where the prior one leaves off. For example, for a single person, the 15% marginal rate affects income starting at $8925, which is where the 10% rate leaves off, and continuing up to $36,250. ** This table ignores the effects of (1) exemption and deduction phase-outs that apply to high-income tax- payers and (ii) the alternative minimum tax (AMT) that affects many middle and high-income taxpayers. on her taxable income above $8925 but below $36,250, and 25% on her taxable in come above $36,250. (10%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started