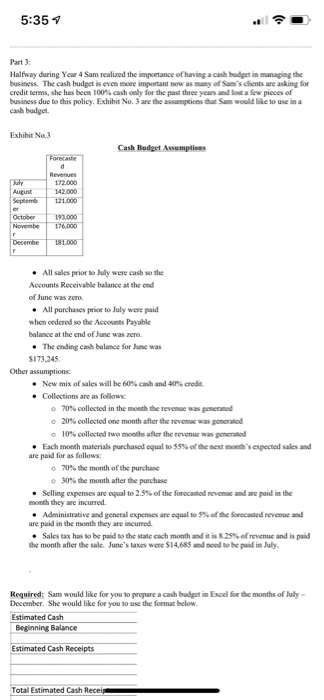

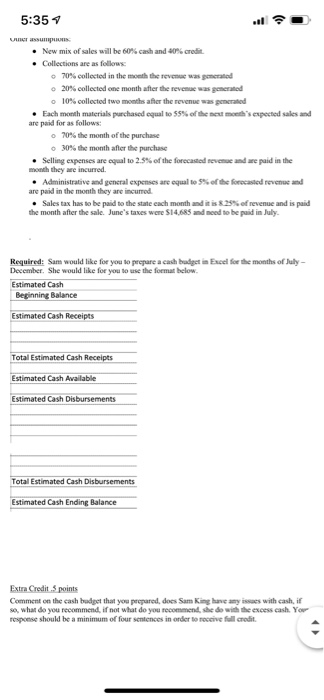

5:357 Part 3 Halfway during Year 4 Sam realized the importance of having a cash badpet in managing the business. The cash budget is even more important now as many of Sam's clients are asking for credit terms, she has been 100% cashewly for the past three years and lost a few pieces of business due to this policy. Exhibit No. 3 are the assumptions that Sam would like to use in a cash budget Exhibit No 3 Cash Budget Assumptions All sales prior to My were cash so the Accounts Receivable balance at the end of June was zero All purchases prior to July were paid when ordered so the Accounts Payable balance at the end of June was zero. The ending cash balance for June was 5173.245 Other assumptions: New mix of sales will be 60% cash and 40% credit Collections are as follows: 70% collected in the month the revenue was generated 20% collected one month after the revenue was ponerad 10% collected two months after the revenue was generated . Each month materials purchased equal to 55% of the next month's expected sales and are paid for as follows: 70% the month of the purchase 30% the month after the purchase Selling expenses are equal to 2.5% of the forecasted revenue and are paid in the month they are incurred. Administrative and general expenses are equal to 5% of the forecasted revenue and are paid in the month they are incurred Sales tax has to be paid to the state each month and is 25% of revenue and is paid the month after the sale June's taxes were $14.685deed to be paid in July Required: Sam would like for you to prepare a cash budget in Excel for the months of July - December. She would like for you to use the format below. Estimated Cash Beginning Balance Estimated Cash Receipts Total Estimated Cash Recei 5:35 7 ACT US New mix of sales will be 60% cash and 90% credit . Collections are as follows: 70% collected in the month the revenue was generated 20% collected one month after the revenue was generated o 10% collected two months after the revenue was generated Each month materials purchased equal to 55% of the next month's expected sales and are paid for as follows: 70% the month of the purchase 30% the month after the purchase Selling expenses are equal to 2.5% of the forecasted revenue and are paid in the month they are incurred. Administrative and general expenses are equal to 5% of the forecasted revenue and are paid in the month they are incurred Sales tax has to be paid to the state each month and it is 8 25% of revenue and is paid the month after the sale. June's taxes were $14.685 and need to be paid in July Required: Sam would like for you to prepare a cash budget in Excel for the months of July - December. She would like for you to use the format below Estimated Cash Beginning Balance Estimated Cash Receipts Total Estimated Cash Receipts Estimated Cash Available Estimated Cash Disbursements Total Estimated Cash Disbursements Estimated Cash Ending Balance Extra Credit 5 points Comment on the cash budget that you prepared, does Sam King have any issues with cash, if so, what do you recommend, if not what do you recommendshed with the excess cash. You response should be a minimum of four sciences in order to cove full credit