5.38 - Estimate the interest rate paid by P&G on the 5/30 swap in Business Snapshots 5.4 if (a) the CP rate is 6.5% and the Treasury yield curve is flat at 6% and (b) the CP rate is 7.5% and the Treasury yield curve is flat at 7% with semiannual compounding.

Here is the answer everyone is giving, but please show me the spreadsheet look that they're talking about.

Answer - (a) When the CP rate is 6.5% and Treasury rates are 6% with semiannual compounding, the CMT% is 6% and an Excel spreadsheet can be used to show that the price of a 30-year bond with a 6.25% coupon is about 103.46. The spread is zero and the rate paid by P&G is 5.75%. (b) When the CP rate is 7.5% and Treasury rates are 7% with semiannual compounding, the CMT% is 7% and the price of a 30-year bond with a 6.25% coupon is about 90.65. The spread is therefore max[0, (98.5 7/5.78 90.65)/100] or 28.64%. The rate paid by P&G is 35.39%

Business Snapshot 5.4

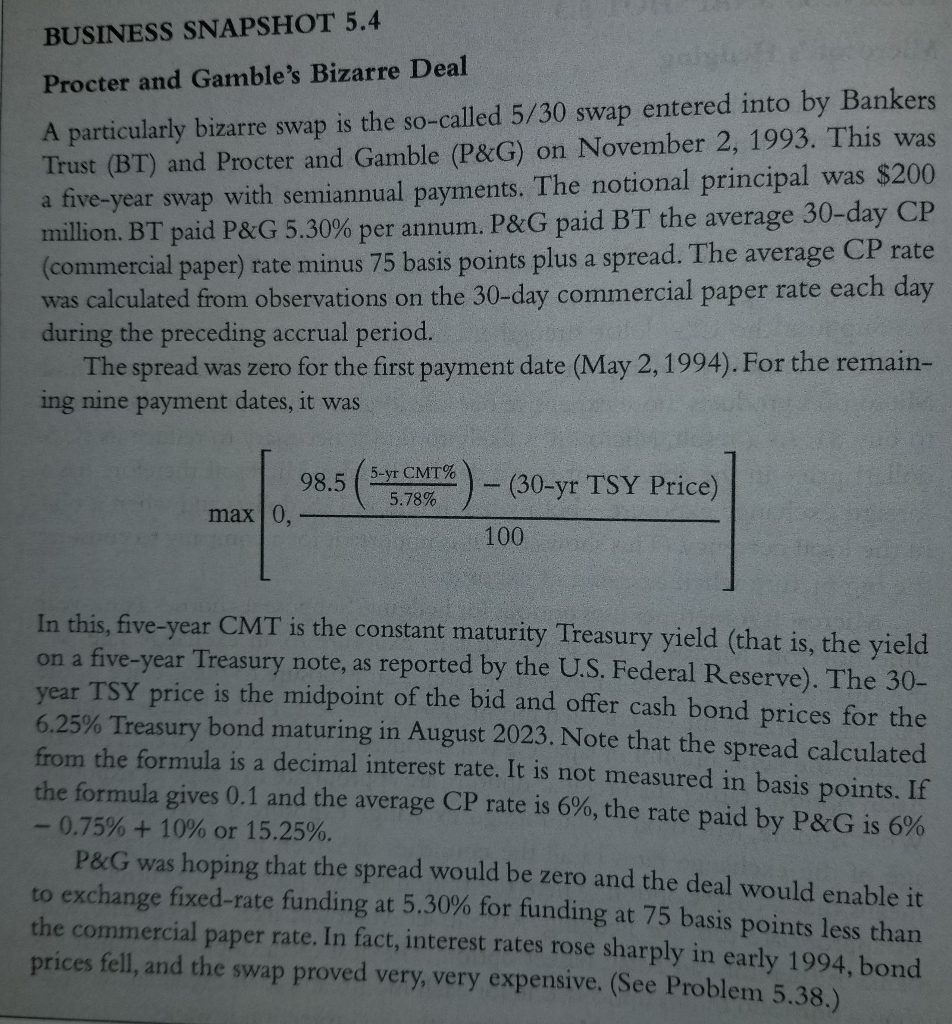

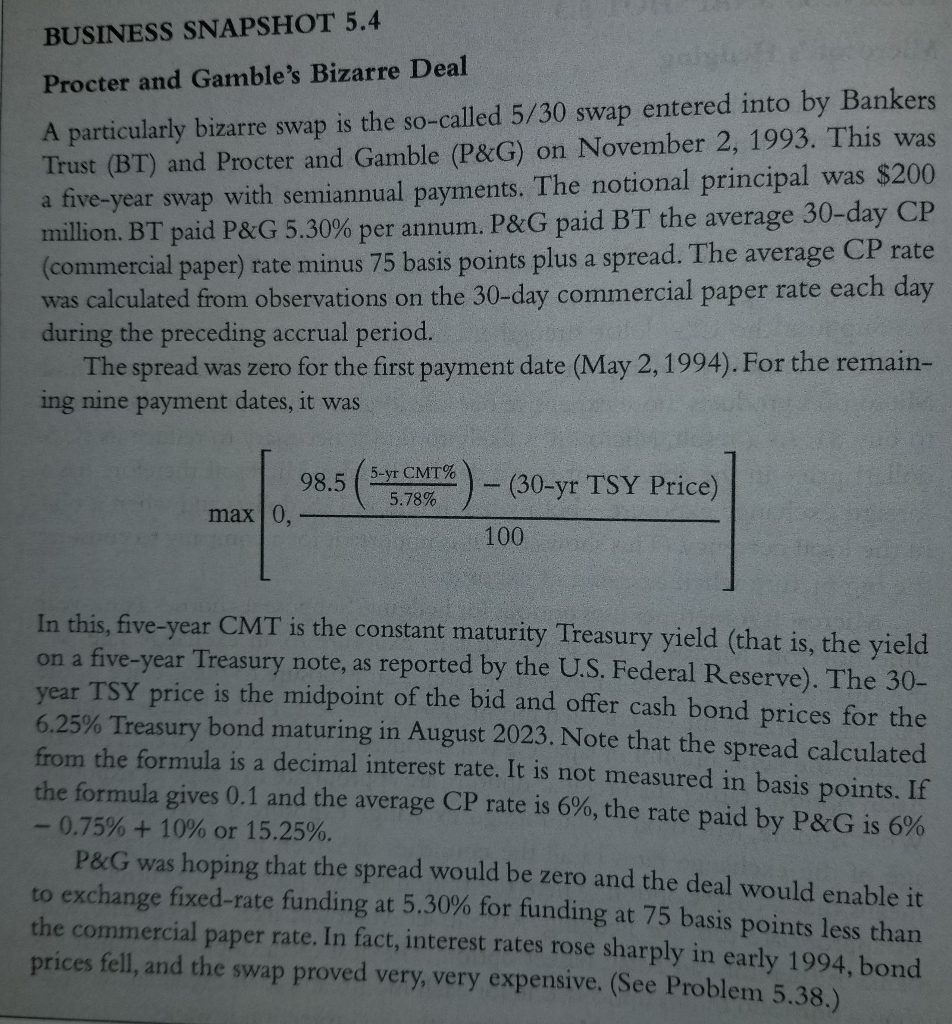

BUSINESS SNAPSHOT 5.4 Procter and Gamble's Bizarre Deal A particularly bizarre swap is the so-called 5/30 swap entered into by Bankers Trust (BT) and Procter and Gamble (P&G) on November 2, 1993. This was a five-year swap with semiannual payments. The notional principal was $200 million. BT paid P&G 5.30% per annum. P&G paid BT the average 30-day CP (commercial paper) rate minus 75 basis points plus a spread. The average was calculated from observations on the 30-day commercial paper rate each day during the preceding accrual period. The spread was zero for the first payment date (May 2, 1994). For the remain- ing nine payment dates, it was CP rate 98.5 max 0, 5-yr CMT% 5.78% (30-yr TSY Price) - 100 In this, five-year CMT is the constant maturity Treasury yield (that is, the yield on a five-year Treasury note, as reported by the U.S. Federal Reserve). The 30- year TSY price is the midpoint of the bid and offer cash bond prices for the 6.25% Treasury bond maturing in August 2023. Note that the spread calculated from the formula is a decimal interest rate. It is not measured in basis points. If the formula gives 0.1 and the average CP rate is 6%, the rate paid by P&G is 6% 0.75% + 10% or 15.25%. P&G was hoping that the spread would be zero and the deal would enable it to exchange fixed-rate funding at 5.30% for funding at 75 basis points less than the commercial paper rate. In fact, interest rates rose sharply in early 1994, bond prices fell, and the swap proved very, very expensive. (See Problem 5.38.) BUSINESS SNAPSHOT 5.4 Procter and Gamble's Bizarre Deal A particularly bizarre swap is the so-called 5/30 swap entered into by Bankers Trust (BT) and Procter and Gamble (P&G) on November 2, 1993. This was a five-year swap with semiannual payments. The notional principal was $200 million. BT paid P&G 5.30% per annum. P&G paid BT the average 30-day CP (commercial paper) rate minus 75 basis points plus a spread. The average was calculated from observations on the 30-day commercial paper rate each day during the preceding accrual period. The spread was zero for the first payment date (May 2, 1994). For the remain- ing nine payment dates, it was CP rate 98.5 max 0, 5-yr CMT% 5.78% (30-yr TSY Price) - 100 In this, five-year CMT is the constant maturity Treasury yield (that is, the yield on a five-year Treasury note, as reported by the U.S. Federal Reserve). The 30- year TSY price is the midpoint of the bid and offer cash bond prices for the 6.25% Treasury bond maturing in August 2023. Note that the spread calculated from the formula is a decimal interest rate. It is not measured in basis points. If the formula gives 0.1 and the average CP rate is 6%, the rate paid by P&G is 6% 0.75% + 10% or 15.25%. P&G was hoping that the spread would be zero and the deal would enable it to exchange fixed-rate funding at 5.30% for funding at 75 basis points less than the commercial paper rate. In fact, interest rates rose sharply in early 1994, bond prices fell, and the swap proved very, very expensive. (See Problem 5.38.)