Answered step by step

Verified Expert Solution

Question

1 Approved Answer

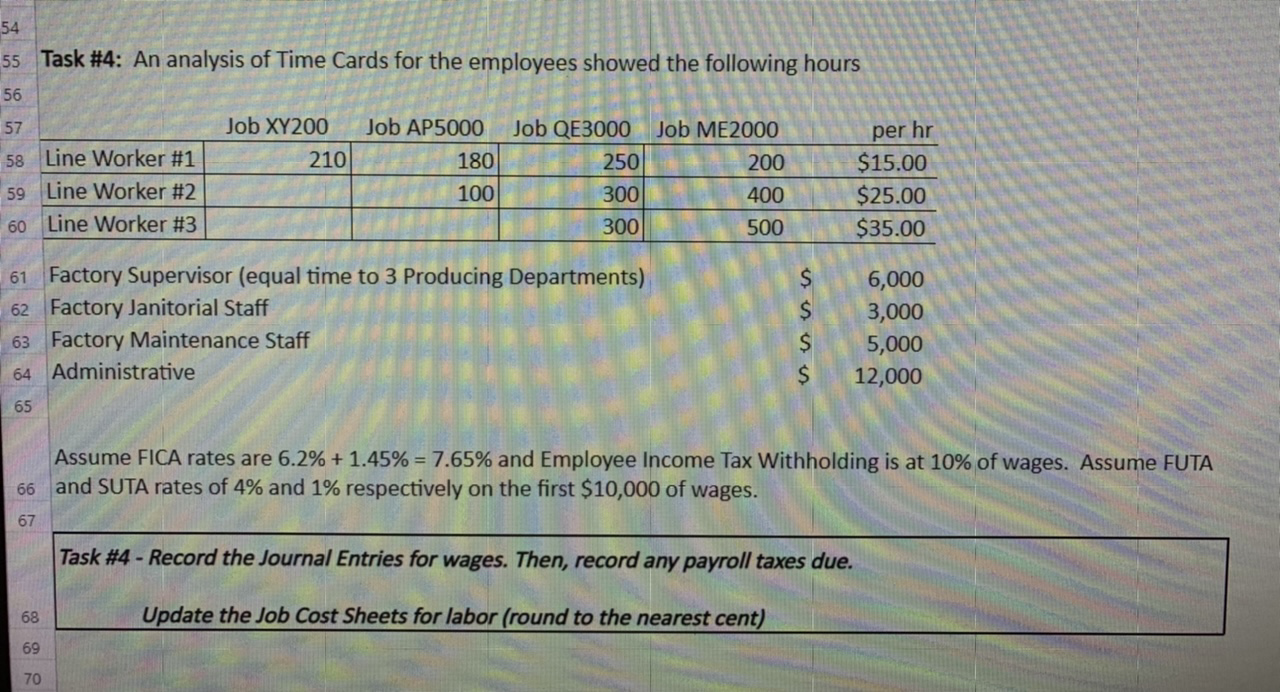

54 55 Task #4: An analysis of Time Cards for the employees showed the following hours 56 57 Job XY200 Job AP5000 Job QE3000

54 55 Task #4: An analysis of Time Cards for the employees showed the following hours 56 57 Job XY200 Job AP5000 Job QE3000 Job ME2000 58 Line Worker #1 210 180 250 200 per hr $15.00 59 Line Worker #2 100 300 400 $25.00 60 Line Worker #3 300 500 $35.00 61 Factory Supervisor (equal time to 3 Producing Departments) 62 Factory Janitorial Staff 63 Factory Maintenance Staff 64 Administrative 65 $ SSSS 6,000 3,000 5,000 12,000 Assume FICA rates are 6.2% + 1.45% = 7.65% and Employee Income Tax Withholding is at 10% of wages. Assume FUTA 66 and SUTA rates of 4% and 1% respectively on the first $10,000 of wages. 67 Task #4-Record the Journal Entries for wages. Then, record any payroll taxes due. 68 Update the Job Cost Sheets for labor (round to the nearest cent) 69 70

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the journal entries to record wages and payroll taxes 1 Record ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started