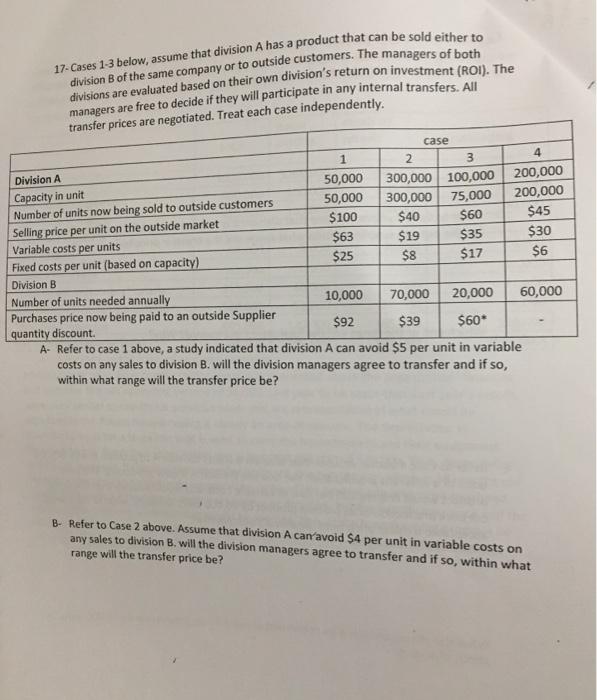

54 Assume a situation where a mutually beneficial exchange can occur between two divisions of a large company. The "selling" division has extra capacity and is selling its products for $50 to outside customers. The unit variable cost for those units is $30. The "buying division is buying from outside suppliers for $48. Thus, the range of the likely transfer price is $30 - $48. Within this identified range, approximately what is your predicted agreed-upon price? Why? Assume that you are the boss of Division A (a subsidiary of Big Company.) Your Division is selling all of its possible production (500,000 units) to outside customers. Division B (also a subsidiary of Big Company) is in need of a small number (25,000 units) of Division A's product. The CEO of Big Company (your boss) suggests that Division A should sell 25,000 units to Division B and the transaction won't hurt your Division (A) because the transfer price would equal your regular price to outside customers. What risk to Division A from this transaction is not being considered by the CEO? 17. Cases 1-3 below, assume that division A has a product that can be sold either to division B of the same company or to outside customers. The managers of both divisions are evaluated based on their own division's return on investment (ROI). The managers are free to decide if they will participate in any internal transfers. All transfer prices are negotiated. Treat each case independently. case 1 2 3 4 Division A 50,000 300,000 100,000 200,000 Capacity in-unit 50,000 300,000 75,000 200,000 Number of units now being sold to outside customers $100 $40 $60 $45 Selling price per unit on the outside market $63 Variable costs per units $19 $35 30 Fixed costs per unit (based on capacity) $25 $8 $17 $6 Division B Number of units needed annually 10,000 70,000 20,000 60,000 Purchases price now being paid to an outside Supplier quantity discount $92 $39 $60 A- Refer to case 1 above, a study indicated that division A can avoid $5 per unit in variable costs on any sales to division B. will the division managers agree to transfer and if so, within what range will the transfer price be? B- Refer to Case 2 above. Assume that division A can'avoid $4 per unit in variable costs on any sales to division B. will the division managers agree to transfer and if so, within what range will the transfer price be? C- Refer to Case 2 above. Assume that division A can avoid S4 per unit in variable costs on any sales to division B. assume Division A offers to sell 70,000 units to division B for $38 per unit and that Division B refuse this price. What will be the loss in company profits? D- Refer to Case 3 above, assume that division B is now receiving a 5% quantity discount for the outside supplier, within what range will the transfer price be? Which end of the range will the final price tend toward? Why? E- Refer to Case 4 above. Assume that division B wants division A to provide it with 60,000 units of a different product from the one the division A is now producing. The new product would require $25 per unit in variable costs and would require that division A cut back production of its present product by 30,000 units annually. what is the lowest acceptable transfer price from division A's perspective? What else should division A be concerned about if it cuts production by 30,000 units to satisfy division B