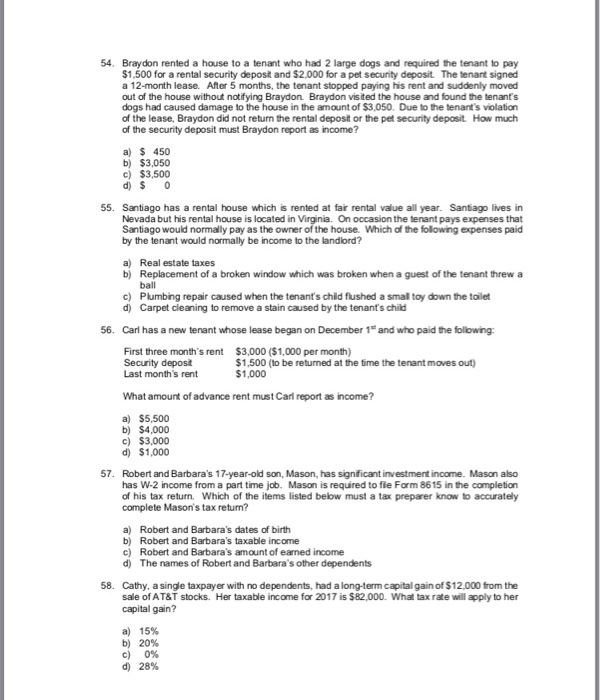

54. Braydon rented a house to a tenant who had 2 large dogs and required the tenant to pay $1,500 for a rental security depost and $2.000 for a pet security deposit The tenant signed a 12-month lease. After 5 months, the tenant stopped paying his rent and suddenly moved out of the house without notifying Braydon Braydon visited the house and found the tenant's dogs had caused damage to the house in the amount of $3,050. Due to the tenant's violation of the lease, Braydon did not return the rental deposit or the pet security deposit How much of the security deposit must Braydon report as income? a) 450 b) $3,050 c) $3,500 d) 0 55. Santiago has a rental house which is rented at fair rental value all year. Saniago lives in Nevada but his rental house is located in Virginia. On occasion the tenant pays expenses that Santiago would normally pay as the owner of the house. Which of the following expenses paid by the tenant would normally be income to the landlord? a) Real estate taxes b) Replacement of a broken window which was broken when a guest of the tenant threw a ball c) Plumbing repair caused when the tenant's child flushed a small toy down the toilet d) Carpet cleaning to remove a stain caused by the tenants child 56. Carl has a new tenant whose lease began on December 1 and who paid the following First three month's rent Security depost Last month 's rent $3,000 ($1,000 per month) $1,500 (to be returned at the time the tenant moves out) $1,000 What amount of advance rent must Carl report as income? a) $5,500 b) $4,000 c) $3,000 d) $1,000 57. Robert and Barbara's 17-year-old son, Mason, has signficant investment income. Mason also has W-2 income from a part time job. Mason is required to fle Form 8615 in the completion of his tax return. Which of the items listed below must a tax preparer know to accurately complete Mason's tax return? a) Robert and Barbara's dates of birth b) Robert and Barbara's taxable income c) Robert and Barbara's amount of eaned income d) The names of Robert and Barbara's other dependents 58. Cathy, a single taxpayer with no dependents, had a long-term capital gain of $12,000 from the sale of AT&T stocks. capital gain? Her taxable income for 2017 is $82,000. What tax rate will apply to her a) 15% b) 20% c) 0% d) 28%