Answered step by step

Verified Expert Solution

Question

1 Approved Answer

54. John is a supervisory employee of Manhattan Corporation He received the following during the year: Salaries, net of mandatory contributions, P800,000 Representation and

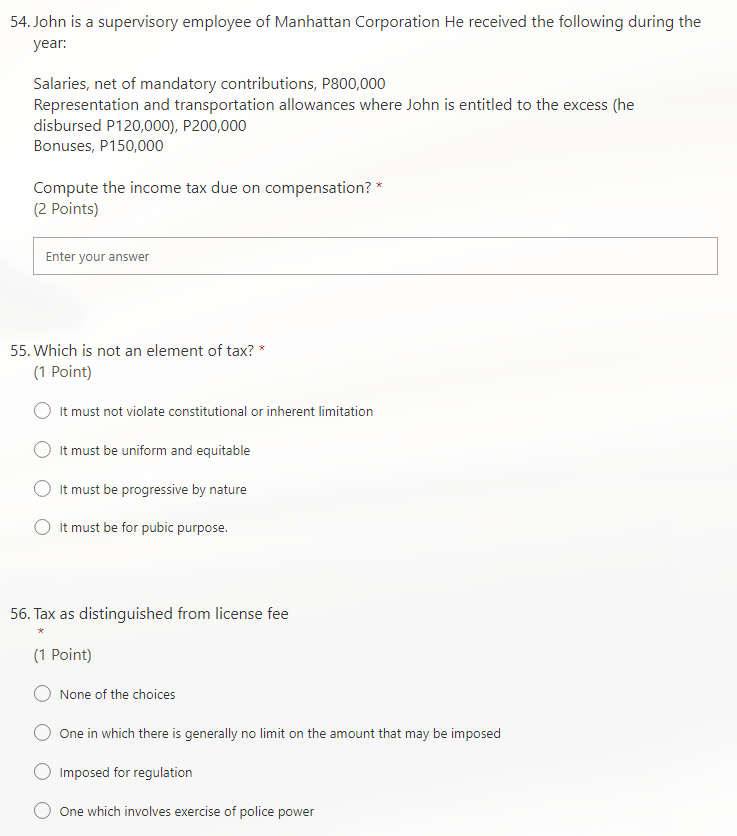

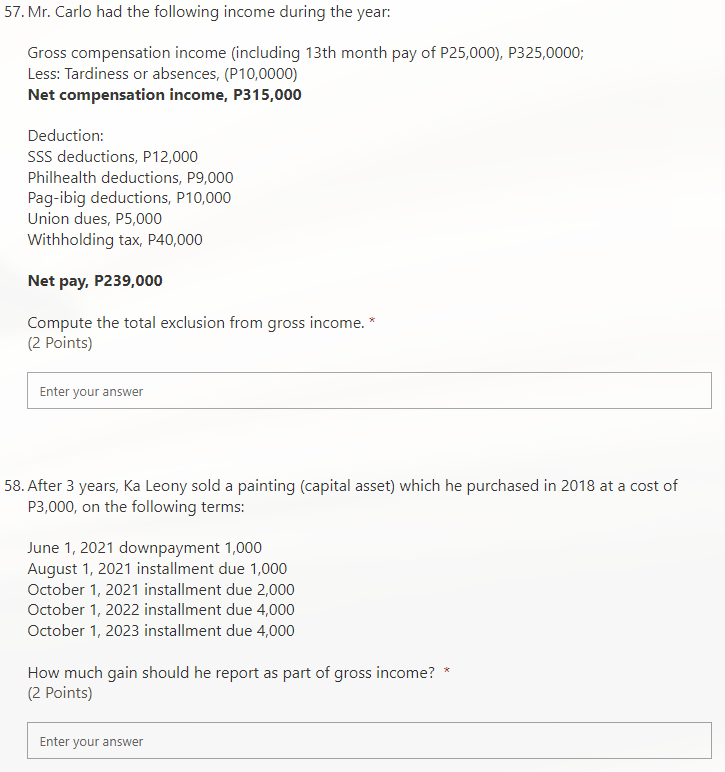

54. John is a supervisory employee of Manhattan Corporation He received the following during the year: Salaries, net of mandatory contributions, P800,000 Representation and transportation allowances where John is entitled to the excess (he disbursed P120,000), P200,000 Bonuses, P150,000 Compute the income tax due on compensation? (2 Points) Enter your answer 55. Which is not an element of tax? * (1 Point) It must not violate constitutional or inherent limitation It must be uniform and equitable It must be progressive by nature It must be for pubic purpose. 56. Tax as distinguished from license fee (1 Point) None of the choices One in which there is generally no limit on the amount that may be imposed Imposed for regulation One which involves exercise of police power 57. Mr. Carlo had the following income during the year: Gross compensation income (including 13th month pay of P25,000), P325,0000; Less: Tardiness or absences, (P10,0000) Net compensation income, P315,000 Deduction: SSS deductions, P12,000 Philhealth deductions, P9,000 Pag-ibig deductions, P10,000 Union dues, P5,000 Withholding tax, P40,000 Net pay, P239,000 Compute the total exclusion from gross income. * (2 Points) Enter your answer 58. After 3 years, Ka Leony sold a painting (capital asset) which he purchased in 2018 at a cost of P3,000, on the following terms: June 1, 2021 downpayment 1,000 August 1, 2021 installment due 1,000 October 1, 2021 installment due 2,000 October 1, 2022 installment due 4,000 October 1, 2023 installment due 4,000 How much gain should he report as part of gross income? * (2 Points) Enter your answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Question 54 To compute the income tax due on compensation for John a supervisory employee of Manhatt...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started