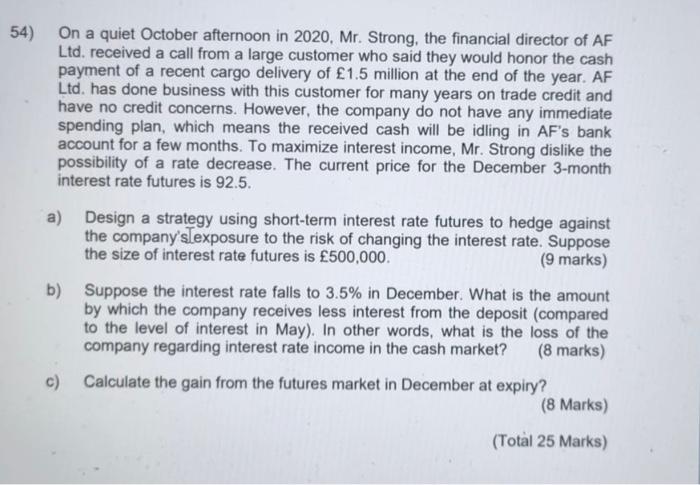

54) On a quiet October afternoon in 2020, Mr. Strong, the financial director of AF Ltd. received a call from a large customer who said they would honor the cash payment of a recent cargo delivery of 1.5 million at the end of the year. AF Ltd. has done business with this customer for many years on trade credit and have no credit concerns. However, the company do not have any immediate spending plan, which means the received cash will be idling in AF's bank account for a few months. To maximize interest income, Mr. Strong dislike the possibility of a rate decrease. The current price for the December 3-month interest rate futures is 92.5. a) Design a strategy using short-term interest rate futures to hedge against the company'slexposure to the risk of changing the interest rate. Suppose the size of interest rate futures is 500,000. (9 marks) b) Suppose the interest rate falls to 3.5% in December. What is the amount by which the company receives less interest from the deposit (compared to the level of interest in May). In other words, what is the loss of the company regarding interest rate income in the cash market? (8 marks) c) Calculate the gain from the futures market in December at expiry? (8 Marks) (Total 25 Marks) 54) On a quiet October afternoon in 2020, Mr. Strong, the financial director of AF Ltd. received a call from a large customer who said they would honor the cash payment of a recent cargo delivery of 1.5 million at the end of the year. AF Ltd. has done business with this customer for many years on trade credit and have no credit concerns. However, the company do not have any immediate spending plan, which means the received cash will be idling in AF's bank account for a few months. To maximize interest income, Mr. Strong dislike the possibility of a rate decrease. The current price for the December 3-month interest rate futures is 92.5. a) Design a strategy using short-term interest rate futures to hedge against the company'slexposure to the risk of changing the interest rate. Suppose the size of interest rate futures is 500,000. (9 marks) b) Suppose the interest rate falls to 3.5% in December. What is the amount by which the company receives less interest from the deposit (compared to the level of interest in May). In other words, what is the loss of the company regarding interest rate income in the cash market? (8 marks) c) Calculate the gain from the futures market in December at expiry? (8 Marks) (Total 25 Marks)