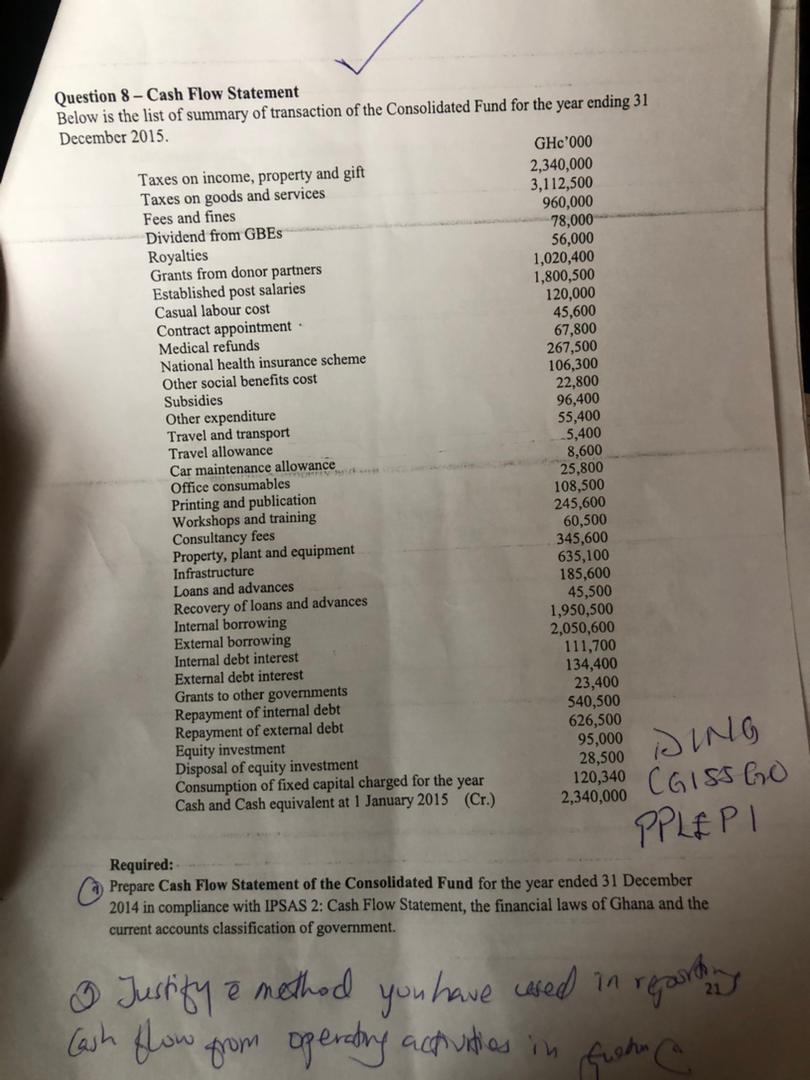

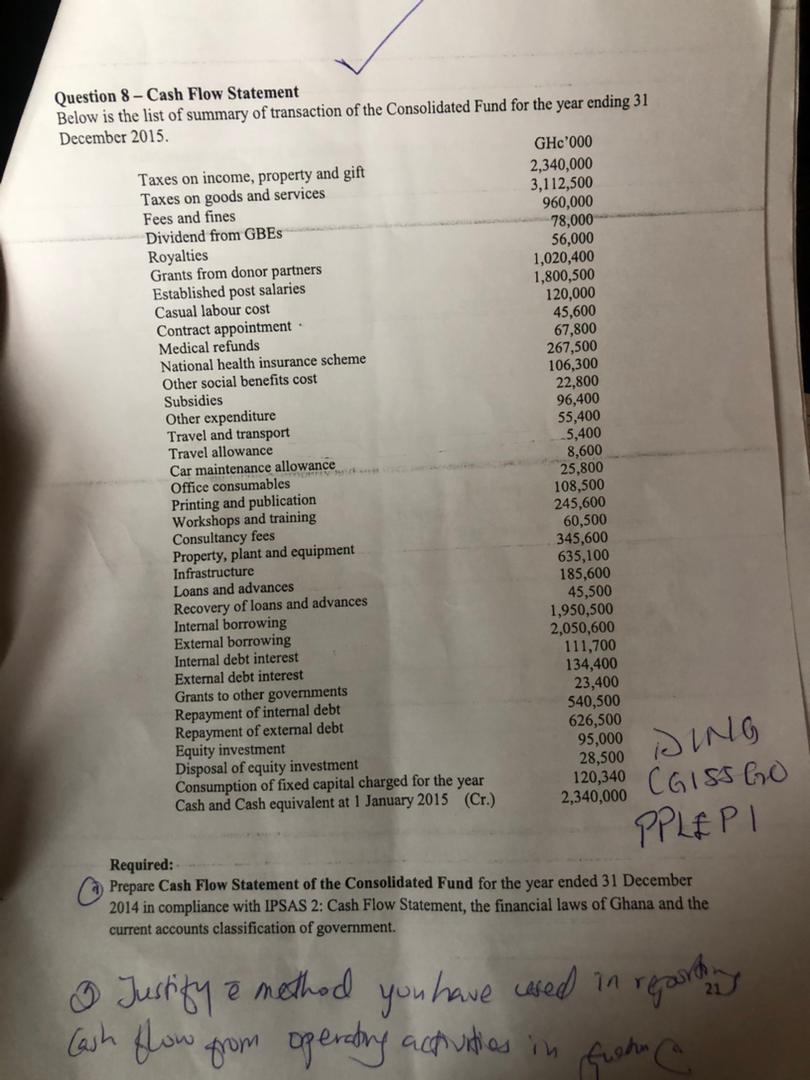

5,400 Question 8 - Cash Flow Statement Below is the list of summary of transaction of the Consolidated Fund for the year ending 31 December 2015 GHC'000 Taxes on income, property and gift 2,340,000 Taxes on goods and services 3,112,500 Fees and fines 960,000 Dividend from GBES 78,000 Royalties 56,000 Grants from donor partners 1,020,400 Established post salaries 1,800,500 Casual labour cost 120,000 Contract appointment 45,600 Medical refunds 67,800 National health insurance scheme 267,500 Other social benefits cost 106,300 Subsidies 22,800 Other expenditure 96,400 Travel and transport 55,400 Travel allowance Car maintenance allowance 8,600 Office consumables 25,800 Printing and publication 108,500 Workshops and training 245,600 Consultancy fees 60,500 Property, plant and equipment 345,600 Infrastructure 635,100 Loans and advances 185,600 Recovery of loans and advances 45,500 Internal borrowing 1,950,500 Extemal borrowing 2,050,600 Internal debt interest 111,700 External debt interest 134,400 Grants to other governments 23,400 Repayment of internal debt 540,500 Repayment of external debt 626,500 Equity investment 95,000 Disposal of equity investment 28,500 Consumption of fixed capital charged for the year 120,340 Cash and Cash equivalent at 1 January 2015 (Cr.) 2,340,000 DING (GISSGO PPLEPI Required: Prepare Cash Flow Statement of the Consolidated Fund for the year ended 31 December 2014 in compliance with IPSAS 2: Cash Flow Statement, the financial laws of Ghana and the current accounts classification of government. report 9 Justify a method you have cased in Cash flow from operatry actunities in fusha e 5,400 Question 8 - Cash Flow Statement Below is the list of summary of transaction of the Consolidated Fund for the year ending 31 December 2015 GHC'000 Taxes on income, property and gift 2,340,000 Taxes on goods and services 3,112,500 Fees and fines 960,000 Dividend from GBES 78,000 Royalties 56,000 Grants from donor partners 1,020,400 Established post salaries 1,800,500 Casual labour cost 120,000 Contract appointment 45,600 Medical refunds 67,800 National health insurance scheme 267,500 Other social benefits cost 106,300 Subsidies 22,800 Other expenditure 96,400 Travel and transport 55,400 Travel allowance Car maintenance allowance 8,600 Office consumables 25,800 Printing and publication 108,500 Workshops and training 245,600 Consultancy fees 60,500 Property, plant and equipment 345,600 Infrastructure 635,100 Loans and advances 185,600 Recovery of loans and advances 45,500 Internal borrowing 1,950,500 Extemal borrowing 2,050,600 Internal debt interest 111,700 External debt interest 134,400 Grants to other governments 23,400 Repayment of internal debt 540,500 Repayment of external debt 626,500 Equity investment 95,000 Disposal of equity investment 28,500 Consumption of fixed capital charged for the year 120,340 Cash and Cash equivalent at 1 January 2015 (Cr.) 2,340,000 DING (GISSGO PPLEPI Required: Prepare Cash Flow Statement of the Consolidated Fund for the year ended 31 December 2014 in compliance with IPSAS 2: Cash Flow Statement, the financial laws of Ghana and the current accounts classification of government. report 9 Justify a method you have cased in Cash flow from operatry actunities in fusha e