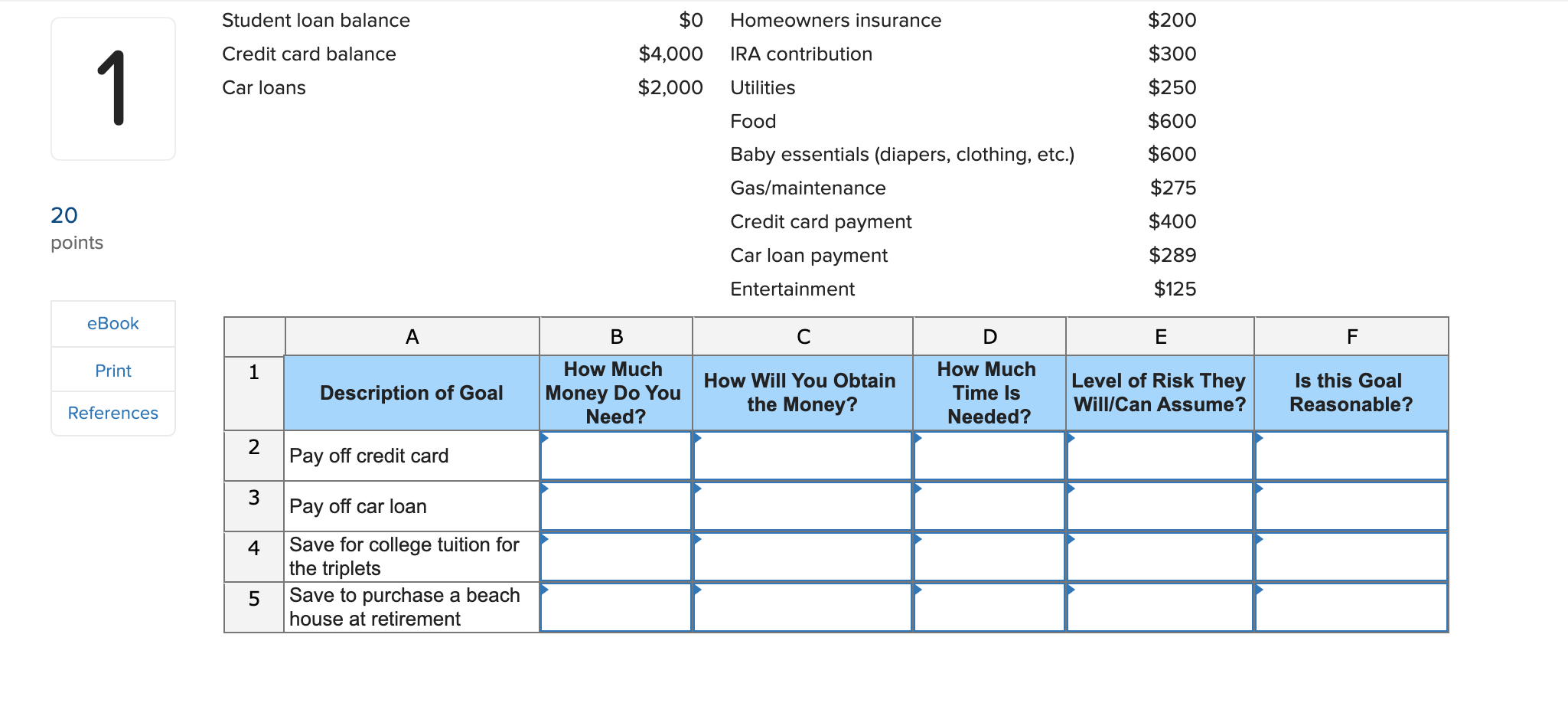

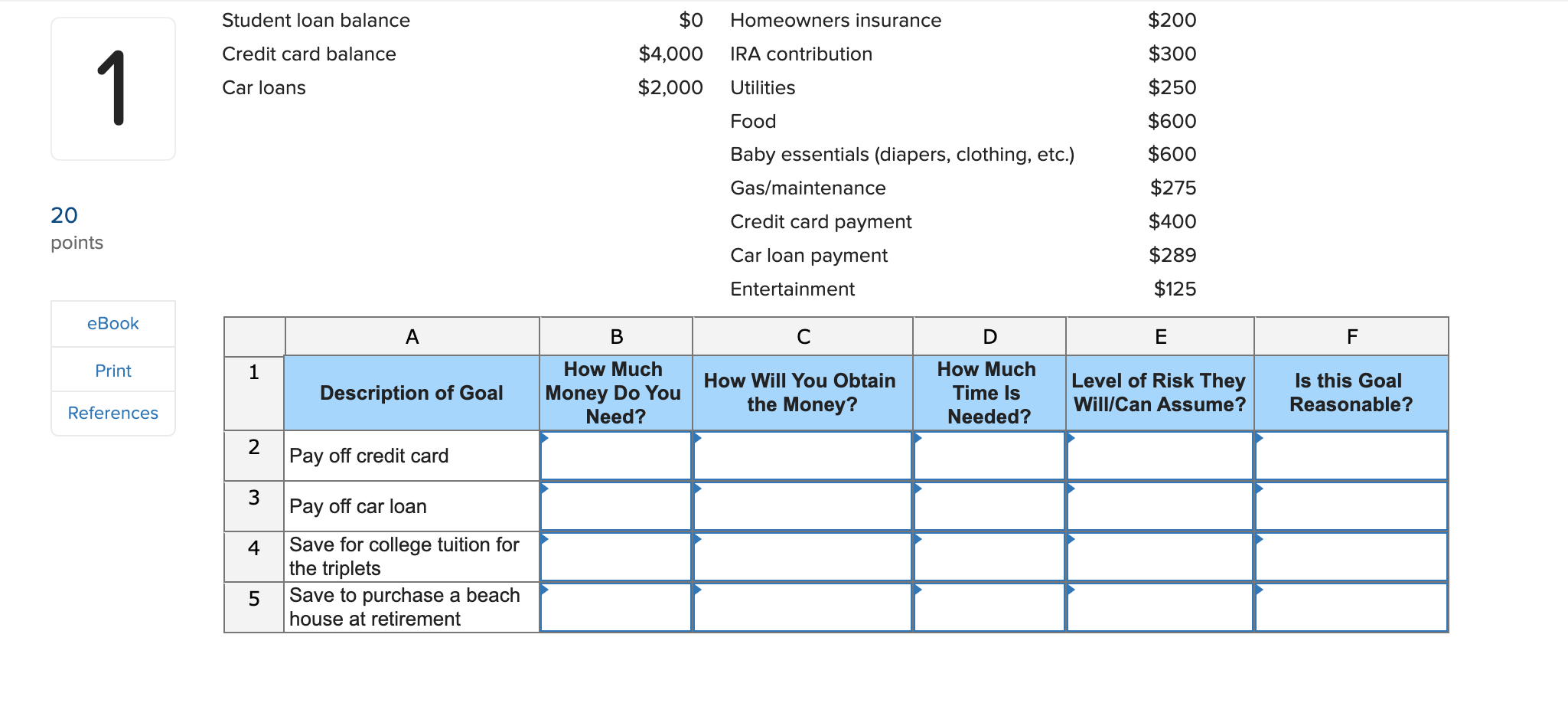

55. Investment Objectives The triplets are now three and a half years old, and Jamie Lee and Ross, both 38, are finally beginning to settle down in to a regular routine now that their children are a little more self-sufficient. The first three years were a blur of diapers, feedings, baths, mounds of laundry, and crying babies! Jamie Lee and Ross finally had a welcomed dinner out on their own as Ross's parents were minding the triplets. They were having a conversation about their future and the future of the triplets. College expenses, which they figured to be \\( \\$ 100,000 \\), and their eventua retirement seemed to be a major worry of the both of them. They both have dreamed of owning a beach house when they retire. Tha could be another \\( \\$ 350,000 \\) thirty years from now. They wondered how could they possibly afford all of this? They agreed that it was time to talk to an investment counselor, and they need to organize all of their financial information and determine their family's short- and long-term goals for investing before meeting with an advisor. Use the information below to complete their investment objectives and organize their information. \\begin{tabular}{|l|} \\hline \\\\ \\hline eBook \\\\ \\hline Points \\\\ \\hline Print \\\\ \\hline References \\\\ \\hline \\end{tabular} \\begin{tabular}{|c|l|c|c|c|c|c|} \\hline & \\multicolumn{1}{|c|}{ A } & \\multicolumn{1}{|c|}{ B } & \\multicolumn{1}{|c|}{ C } & D & E \\\\ \\hline 1 & \\multicolumn{1}{|c|}{ Description of Goal } & \\( \\begin{array}{c}\\text { How Much } \\\\ \\text { Money Do You } \\\\ \\text { Need? }\\end{array} \\) & \\( \\begin{array}{c}\\text { How Will You Obtain } \\\\ \\text { the Money? }\\end{array} \\) & \\( \\begin{array}{c}\\text { How Much } \\\\ \\text { Time Is } \\\\ \\text { Needed? }\\end{array} \\) & \\( \\begin{array}{l}\\text { Level of Risk They } \\\\ \\text { Will/Can Assume? }\\end{array} \\) & \\( \\begin{array}{c}\\text { Is this Goal } \\\\ \\text { Reasonable? }\\end{array} \\) \\\\ \\hline 2 & Pay off credit card & & & \\\\ \\hline 3 & Pay off car loan & & & \\\\ \\hline 4 & \\( \\begin{array}{l}\\text { Save for college tuition for } \\\\ \\text { the triplets }\\end{array} \\) & & & \\\\ \\hline 5 & \\( \\begin{array}{l}\\text { Save to purchase a beach } \\\\ \\text { house at retirement }\\end{array} \\) & & & \\\\ \\hline \\end{tabular}