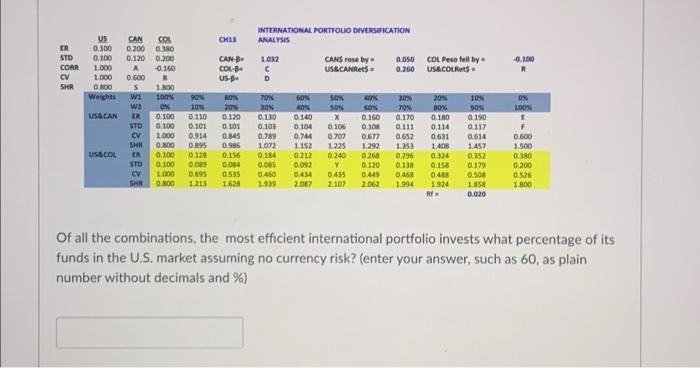

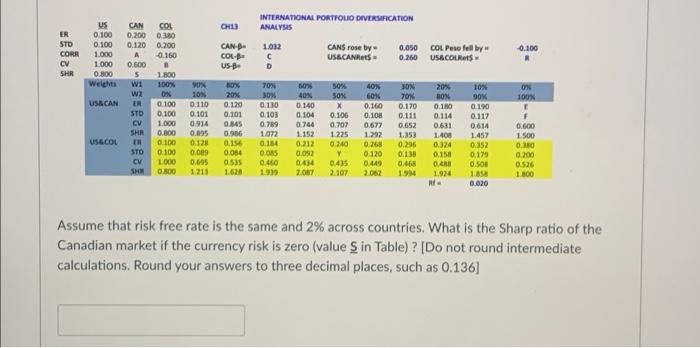

56 CHIS ER STD CORR CV SHR 0.100 0.100 1.000 1.000 COL 0.380 0.200 -0.160 INTERNATIONAL PORTFOLIO DIVERSIFICATION ANALYSIS 1.012 CANS rose by 0.050 COL Peso fell by US&CANet 0.260 USSCOLA D CAN- COL-B -0.100 R OOR O Weights GON 20% CAN 0.200 0.120 0.600 5 wi W2 ER STD CV SHR ER STD CV SHR NOE 1800 100N ON 0.100 0.100 1.000 NOG NOT SOX SON OX 100% NOD BOX USACAN X 3 BON 20N 0.120 0.101 0.145 0.986 0.156 0.054 0.110 0.101 0.914 0.895 0123 0.080 0.695 70 SON 0.130 0.103 0.79 1072 0164 DOWO 0.106 0.707 1 225 0.240 OK OX 0.160 0.10 0.677 1.292 0.268 0.120 0.449 2.062 0.140 0 104 0.744 1.152 0.212 0.092 0.44 2017 70% 0.170 0.111 0.652 1.353 0.296 0.138 0.468 1.994 USECOL 10% 90% 0.190 0.117 0.614 1457 0152 0.179 0.500 1.650 0.020 0.100 0.100 1.000 0.180 0.114 0,631 1.405 0.324 0.150 0488 1924 RI 5000 A 0.600 1.500 0.380 0.200 0.525 1.800 SESO 0.800 1213 1,620 0.460 1999 0.435 2.107 Of all the combinations, the most efficient international portfolio invests what percentage of its funds in the U.S. market assuming no currency risk? (enter your answer, such as 60, as plain number without decimals and %) INTERNATIONAL PORTFOLIO DIVERSIFICATION ANALYSIS CHI ER STD CORR CV SHR US 0.100 0.100 1.000 1000 0.800 Weights 0.100 CAN BE COL US- 1.032 C D CAN rose by USSCANS 0.050 COL Peso fell by 0.260 USACOLAS 100% 50% CAN COL 0.200 0.380 0.120 0.200 0.160 0.600 5 1.800 wi wa DX ER 0.100 STD 0.100 CV 1.000 SHA 0.800 ER 0.100 STO 0.100 CV 1000 SH Sox USACAN SON 10% 0.110 0.101 0914 0.95 0.128 0.009 0.695 1.213 BOX 20% 0.120 0.101 0.845 0.986 0.156 0.084 0.55 1.620 70% 30% 0.110 0.103 0.789 1072 0.154 0.08 0.460 1999 SOX 40% 0.140 0.104 0.744 1.152 0.212 0.092 0434 2.087 40% 60% 0.160 0.108 0.677 1.292 0.268 0.120 0.449 X 0.106 0.709 1225 0.240 Y 0.415 2.107 30N 70% 0.170 0.111 0.652 1.353 0.295 0.138 0468 1.5 20% BON 0.180 0.114 0.631 1.408 0.124 0.158 0.480 1.924 R. 10% 90% 0.190 0.117 0614 1457 0.152 0.179 0.500 1.850 0.020 ow 100% E F 0.600 1.500 0.10 0.700 0.526 1.800 USCOL Assume that risk free rate is the same and 2% across countries. What is the Sharp ratio of the Canadian market if the currency risk is zero (value $ in Table) ? (Do not round intermediate calculations. Round your answers to three decimal places, such as 0.136] 56 CHIS ER STD CORR CV SHR 0.100 0.100 1.000 1.000 COL 0.380 0.200 -0.160 INTERNATIONAL PORTFOLIO DIVERSIFICATION ANALYSIS 1.012 CANS rose by 0.050 COL Peso fell by US&CANet 0.260 USSCOLA D CAN- COL-B -0.100 R OOR O Weights GON 20% CAN 0.200 0.120 0.600 5 wi W2 ER STD CV SHR ER STD CV SHR NOE 1800 100N ON 0.100 0.100 1.000 NOG NOT SOX SON OX 100% NOD BOX USACAN X 3 BON 20N 0.120 0.101 0.145 0.986 0.156 0.054 0.110 0.101 0.914 0.895 0123 0.080 0.695 70 SON 0.130 0.103 0.79 1072 0164 DOWO 0.106 0.707 1 225 0.240 OK OX 0.160 0.10 0.677 1.292 0.268 0.120 0.449 2.062 0.140 0 104 0.744 1.152 0.212 0.092 0.44 2017 70% 0.170 0.111 0.652 1.353 0.296 0.138 0.468 1.994 USECOL 10% 90% 0.190 0.117 0.614 1457 0152 0.179 0.500 1.650 0.020 0.100 0.100 1.000 0.180 0.114 0,631 1.405 0.324 0.150 0488 1924 RI 5000 A 0.600 1.500 0.380 0.200 0.525 1.800 SESO 0.800 1213 1,620 0.460 1999 0.435 2.107 Of all the combinations, the most efficient international portfolio invests what percentage of its funds in the U.S. market assuming no currency risk? (enter your answer, such as 60, as plain number without decimals and %) INTERNATIONAL PORTFOLIO DIVERSIFICATION ANALYSIS CHI ER STD CORR CV SHR US 0.100 0.100 1.000 1000 0.800 Weights 0.100 CAN BE COL US- 1.032 C D CAN rose by USSCANS 0.050 COL Peso fell by 0.260 USACOLAS 100% 50% CAN COL 0.200 0.380 0.120 0.200 0.160 0.600 5 1.800 wi wa DX ER 0.100 STD 0.100 CV 1.000 SHA 0.800 ER 0.100 STO 0.100 CV 1000 SH Sox USACAN SON 10% 0.110 0.101 0914 0.95 0.128 0.009 0.695 1.213 BOX 20% 0.120 0.101 0.845 0.986 0.156 0.084 0.55 1.620 70% 30% 0.110 0.103 0.789 1072 0.154 0.08 0.460 1999 SOX 40% 0.140 0.104 0.744 1.152 0.212 0.092 0434 2.087 40% 60% 0.160 0.108 0.677 1.292 0.268 0.120 0.449 X 0.106 0.709 1225 0.240 Y 0.415 2.107 30N 70% 0.170 0.111 0.652 1.353 0.295 0.138 0468 1.5 20% BON 0.180 0.114 0.631 1.408 0.124 0.158 0.480 1.924 R. 10% 90% 0.190 0.117 0614 1457 0.152 0.179 0.500 1.850 0.020 ow 100% E F 0.600 1.500 0.10 0.700 0.526 1.800 USCOL Assume that risk free rate is the same and 2% across countries. What is the Sharp ratio of the Canadian market if the currency risk is zero (value $ in Table) ? (Do not round intermediate calculations. Round your answers to three decimal places, such as 0.136]