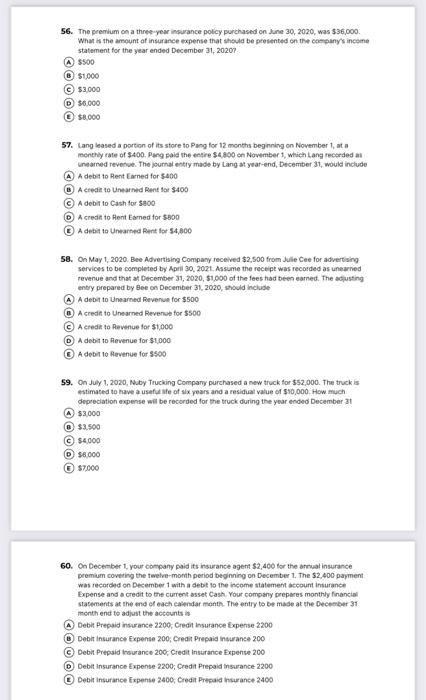

56. The premium on a three-year insurance policy purchased on June 30, 2020, was $36,000 What is the amount of insurance expense that should be presented on the company's income statement for the year ended December 31, 20207 A $500 $1,000 C $3.000 D $6.000 $8,000 57. Langlased a portion of its store to Pang for 12 months beginning on November 1, ata monthly rate of $400. Pag paid the entire $4800 on November 1, which Lang recorded unearned revenue. The Journal ently made by Langat year-end, December 31, would include A debit to Rent Earned for 5400 O A credit to Unearned Rent for $400 A debit to Cash for $800 Acredit to Hent med for 5800 A detit toneared Runt for 54,800 58. On May 1, 2020. Bee Advertising Company received $2.500 from Jule Cee for advertising services to be completed by April 30, 2021. Assume the receipt was recorded as unearned revenue and that at December 31, 2020, 51,000 of the fees had been earned. The adjusting entry prepared by Bee on December 31, 2020, should include A debito Unearned Revenue for $500 Acredit to Unearned Revenue for $500 A credit to Revenue for $1,000 Adebit to Revenue for $1,000 A debit to Revenue for $500 OOOO 59. On July 1, 2020, Nuby Trucking Company purchased a new truck for $52,000. The truck is estimated to have a useful life of six years and a residual value of $10,000. How much depreciation expense will be recorded for the truck during the year ended December 31 A $3.000 $3.500 $4.000 D $6000 $7000 60. On December your company paid its insurance agent $2,400 for the annual insurance premium covering the twelve-month period beginning on December 1. The $2.400 payment was recorded on December 1 with a debit to the income statement account insurance Expense and a credit to the current asset Cash Your company prepares monthly financial statements at the end of each calendar month. The entry to be made at the December 31 month end to adjust the accounts Debit Prepaid insurance 2200, Credit Insurance Expense 2200 Debit insurance Expense 200 Credit Prepaid insurance 200 Debit Prepaid Insurance 200: Credit Insurance Expense 200 Debit insurance Expense 2200, Credit Prepaid insurance 2200 Debit Insurance Expense 2400, Credit Prepaid insurance 2400