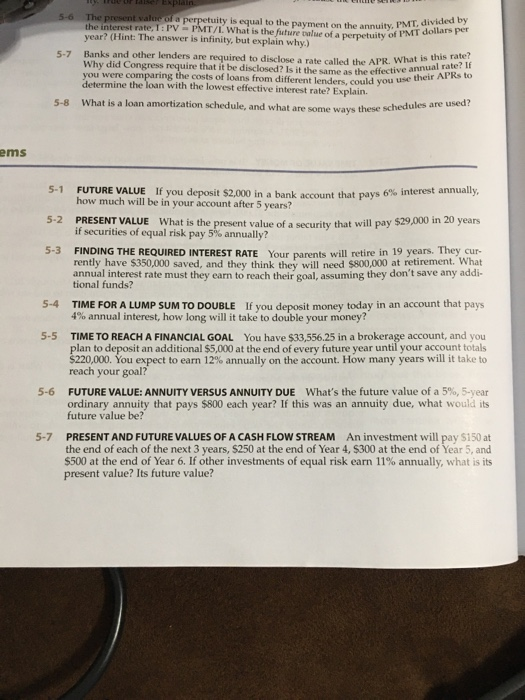

5-7 11. U se Explain The present value of a perpetuity is equal to the payment on the annuity, IMI. Allars per the interest rate, 1: PV - PMT/L What is the future clue of a perpetuity of I'M year? (Hint: The answer is infinity, but explain why.) Banks and other lenders are required to disclose a rate called the APR. What is Why did Congress require that it be disclosed? Is it the same as the effective and you were comparing the costs of loans from different lenders could you use determine the loan with the lowest effective interest rate? Explain. What is a loan amortization schedule, and what are some ways these scheda e a rate called the APR. What is this rate? A lenders, could you use their APRS to 5-8 ems 5-1 5-2 FUTURE VALUE If you deposit $2.000 in a bank that pays 6% interest annually. how much will be in your account after 5 years? PRESENT VALUE What is the present value of a security that will pay $29,000 in 20 years PRESENT VALUE What is the if securities of equal risk pay 5% annually? FINDING THE REQUIRED INTEREST RATE Your parents will retire in 19 years. They cur- rently have $350,000 saved, and they think they will need $800.000 at retirement. What annual interest rate must they earn to reach their goal, assuming they don't save any addi- tional funds? 5-3 5-4 5-5 5-6 TIME FOR A LUMP SUM TO DOUBLE If you deposit money today in an account that pays 4% annual interest, how long will it take to double your money? TIME TO REACH A FINANCIAL GOAL You have $33,556.25 in a brokerage account, and you plan to deposit an additional $5,000 at the end of every future year until your account totals $220,000. You expect to earn 12% annually on the account. How many years will it take to reach your goal? FUTURE VALUE: ANNUITY VERSUS ANNUITY DUE What's the future value of a 5%, 5-year ordinary annuity that pays $800 each year? If this was an annuity due, what would its future value be? PRESENT AND FUTURE VALUES OF A CASH FLOW STREAM An investment will pay $150 at the end of each of the next 3 years, $250 at the end of Year 4, $300 at the end of Year 5, and $500 at the end of Year 6. If other investments of equal risk earn 11% annually, what is its present value? Its future value? 5-7