Answered step by step

Verified Expert Solution

Question

1 Approved Answer

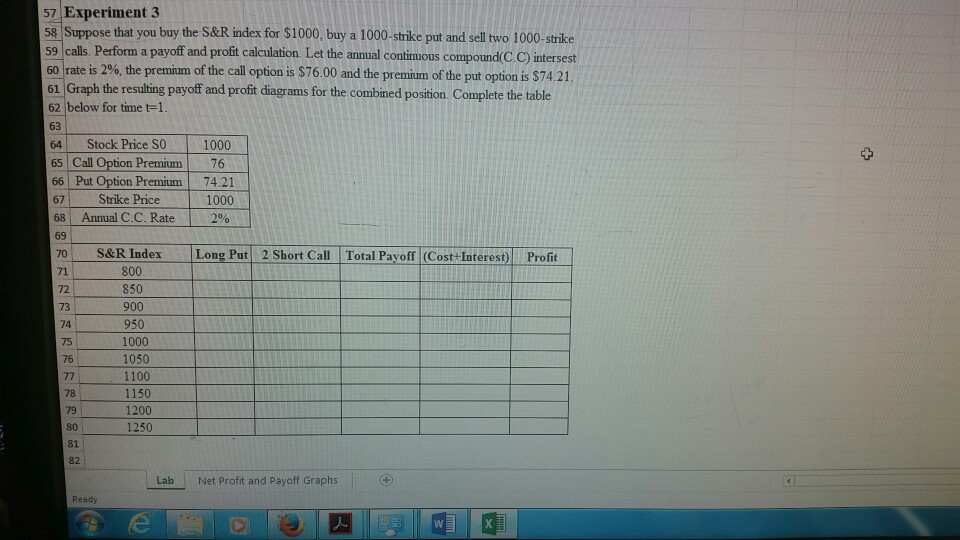

57 Experiment 3 58 Suppose that you buy the S&R index for $1000, buy a 1000-strike put and selltwo 1000-strike 59 calls. Perform a payoff

57 Experiment 3 58 Suppose that you buy the S&R index for $1000, buy a 1000-strike put and selltwo 1000-strike 59 calls. Perform a payoff and profit calculation. Let the annual contimuous compound (C.C) intersest 60 rate is 2% the premium of the call option is $7600 and the pre m of the put option is S742 61 Graph the resulting payoff and profit diagrams for the combined position. Complete the table 62 below for time t-1. 63 4 Stock Price SO 65 Call Option Premium76 66 Put Option Premium 74.21 67 Strike Price 68 Annual C.C. Rate 69 1000 2% 70 S&R Index Long Put 2 Short CallTotal Payoff (Cost+Interest) Profit 71 72 73 74 75 76 800 850 900 950 1050 1100 1150 78 79 80 81 82 1250 -a- Net Profit and payoff Graphs | Ready

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started