Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5,7,12, 5. Wanda Sotheby purchased 120 shares of Home Depot stock at $235 a share. One year later, she sold the stock for $218 a

5,7,12,

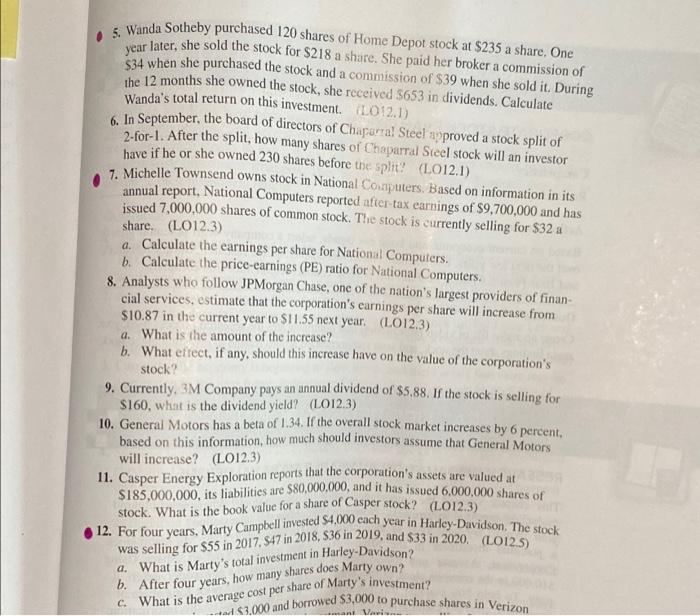

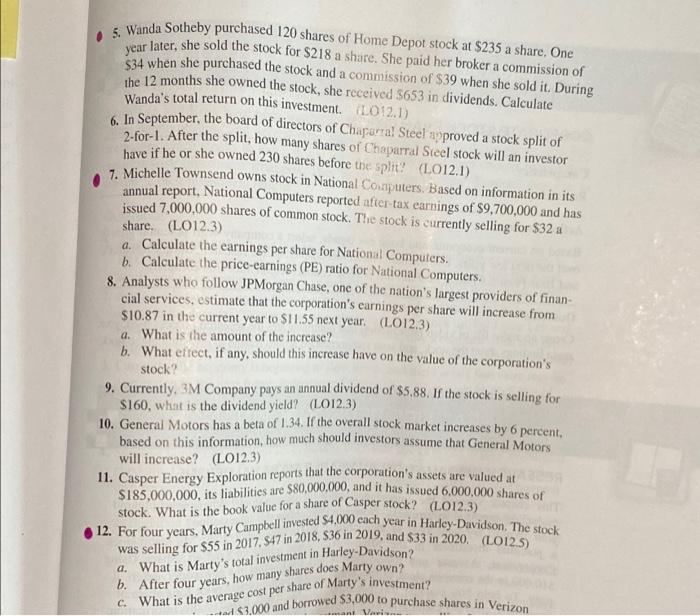

5. Wanda Sotheby purchased 120 shares of Home Depot stock at $235 a share. One year later, she sold the stock for $218 a share. She paid her broker a commission of $34 when she purchased the stock and a commission of $39 when she sold it. During the 12 months she owned the stock, she received 5653 in dividends. Calculate Wanda's total return on this investment. (2012.1) 6. In September, the board of directors of Chaparral Steel approved a stock split of 2-for-1. After the split, how many shares of Chaparral Steel stock will an investor have if he or she owned 230 shares before the split! (2012.1) 7. Michelle Townsend owns stock in National Computers. Based on information in its annual report, National Computers reported after tax earrings of $9,700,000 and has issued 7,000,000 shares of common stock. The stock is currently selling for $32 a share. (LO12.3) a. Calculate the earnings per share for National Computers. b. Calculate the price-earnings (PE) ratio for National Computers. 8. Analysts who follow JPMorgan Chase, one of the nation's largest providers of finan- cial services, estimate that the corporation's earnings per share will increase from $10.87 in the current year to $11.55 next year. (L012.3) a. What is the amount of the increase? b. What et rect, if any, should this increase have on the value of the corporation's stock? 9. Currently, 3M Company pays an annual dividend of $5,88. If the stock is selling for $160, what is the dividend yield? (L0123) 10. General Motors has a beta of 1.34. If the overall stock market increases by 6 percent, based on this information, how much should investors assume that General Motors will increase? (LO12.3) 11. Casper Energy Exploration reports that the corporation's assets are valued at $185,000,000, its liabilities are $80.000.000, and it has issued 6.000.000 shares of stock. What is the book value for a share of Casper stock? (L012.3) 12. For four years, Marty Campbell invested S4,000 cach year in Harley-Davidson. The stock was selling for $55 in 2017. 547 in 2018, S36 in 2019, and $33 in 2020. (L012.5) a. What is Marty's total investment in Harley-Davidson? b. After four years, how many shares does Marty own? C. What is the average cost per share of Marty's investment? ad $3,000 and borrowed $3,000 to purchase shares in Verizon mani Vari

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started