Answered step by step

Verified Expert Solution

Question

1 Approved Answer

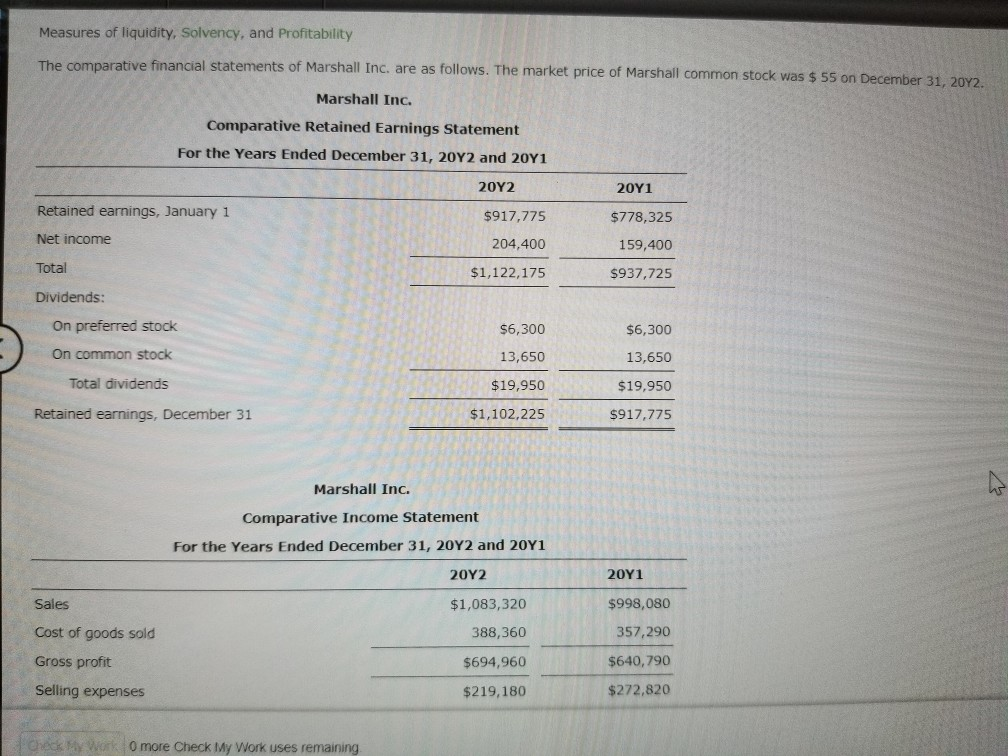

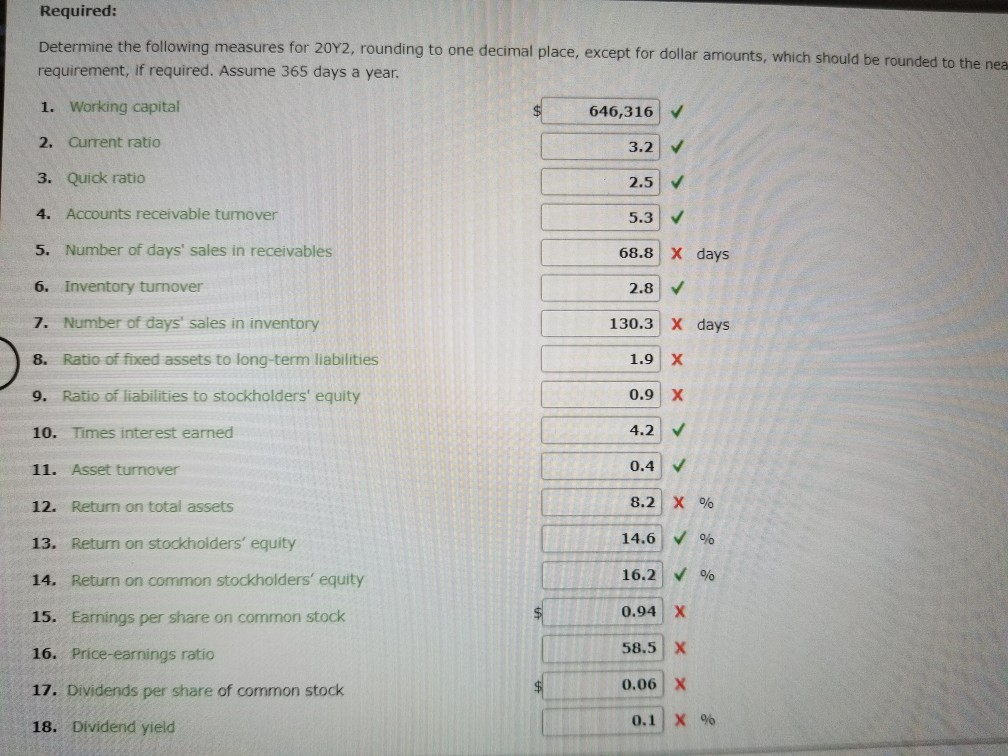

#5,7,8,9,12,15,16,17,18 please Measures of liquidity, Solvency, and Profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock

#5,7,8,9,12,15,16,17,18 please

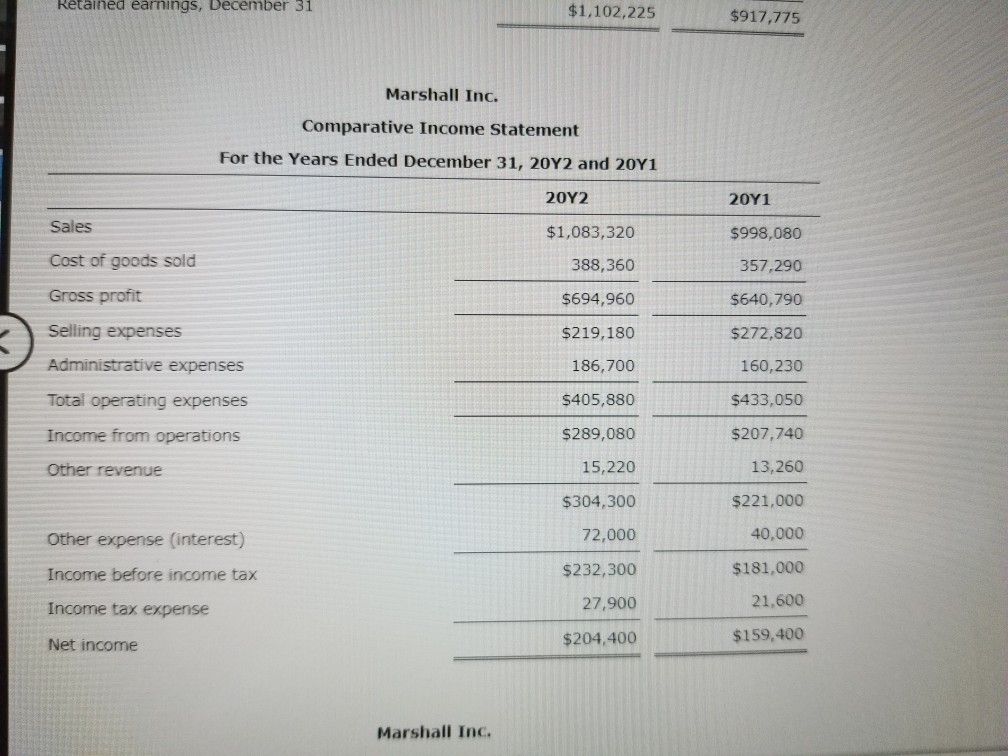

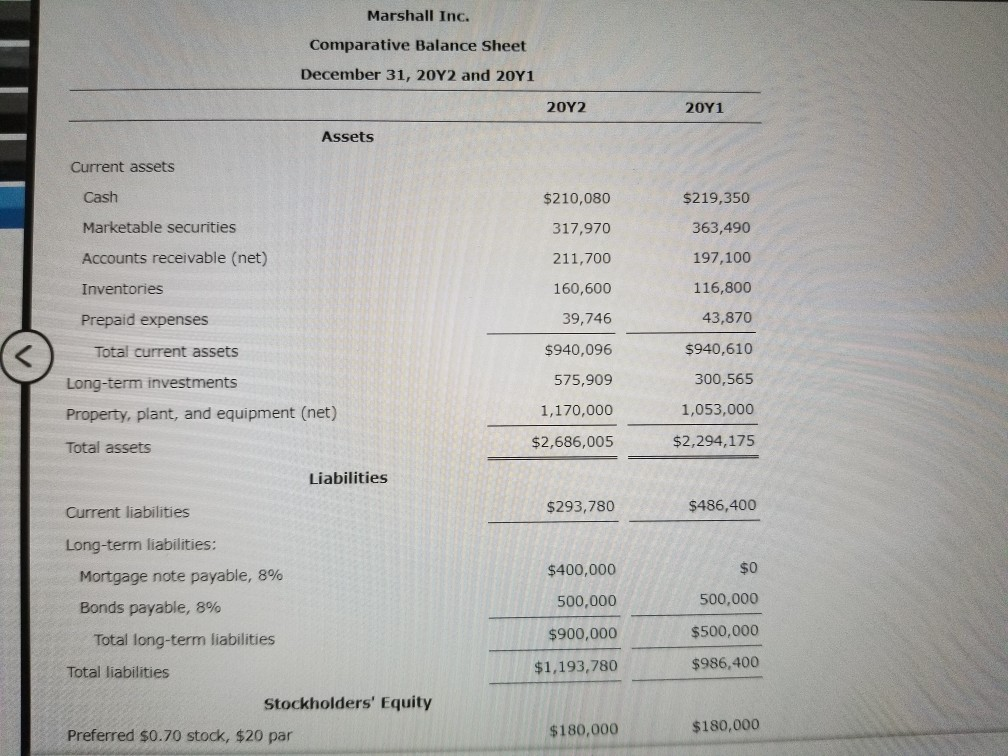

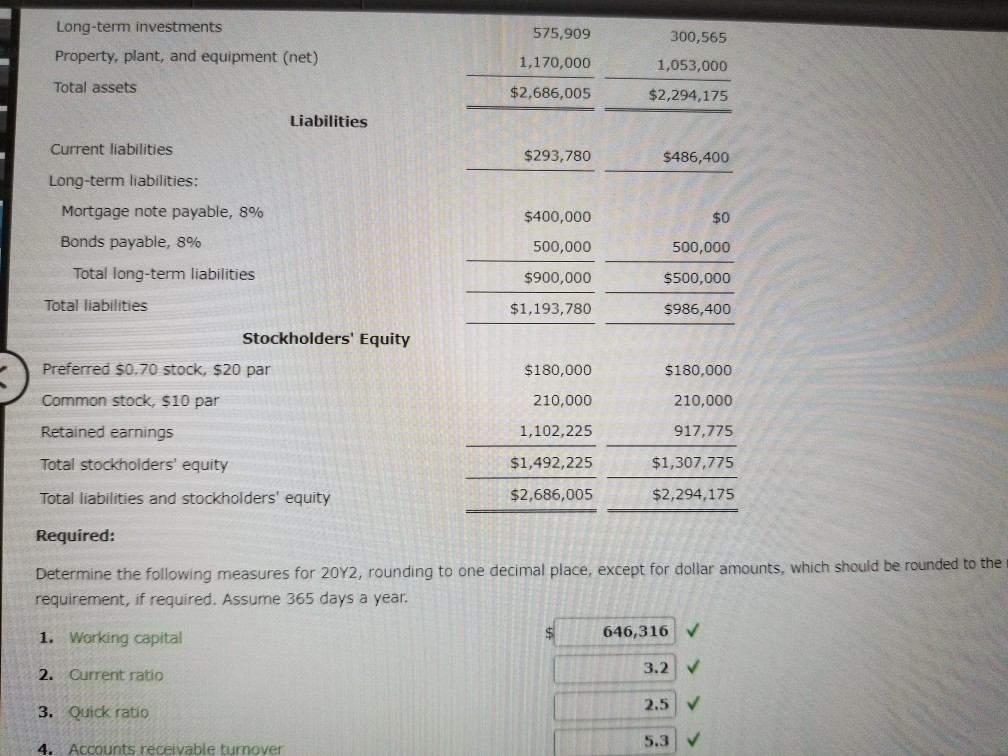

Measures of liquidity, Solvency, and Profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $ 55 on December 31, 20Y2. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 202 201 Retained earnings, January 1 $917,775 $778,325 Net income 204,400 159,400 Total $1,122,175 $937,725 Dividends: On preferred stock $6,300 $6,300 On common stock 13,650 13,650 Total dividends $19,950 $19,950 Retained earnings, December 31 $1,102,225 $917,775 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 201 202 Sales $998,080 $1,083,320 Cost of goods sold 357,290 388,360 Gross profit $640,790 $694,960 Selling expenses $272,820 $219,180 POeck My Wrk 0 more Check My Work uses remaining Retained earnings, December 31 $1,102,225 $917,775 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 202 201 Sales $1,083,320 $998,080 Cost of goods sold 388,360 357,290 Gross profit $694,960 $640,790 Selling expenses $219,180 $272,820 Administrative expenses 186,700 160,230 Total operating expenses $405,880 $433,050 Income from operations $289,080 $207,740 13,260 15,220 Other revenue $221,000 $304,300 40,000 72,000 Other expense (interest) $181,000 $232,300 Income before income tax 21,600 27,900 Income tax expense $159,400 $204,400 Net income Marshall InC. Marshall Inc. Comparative Balance Sheet December 31, 20Y2 and 20Y1 202 201 Assets Current assets Cash $210,080 $219,350 Marketable securities 363,490 317,970 Accounts receivable (net) 197,100 211,700 116,800 160,600 Inventories 43,870 39,746 Prepaid expenses $940,096 $940,610 Total current assets 300,565 575,909 Long-term investments 1,170,000 1,053,000 Property, plant, and equipment (net) $2,294,175 $2,686,005 Total assets Liabilities $486,400 $293,780 Current liabilities Long-term liabilities: $0 $400,000 Mortgage note payable, 8% 500,000 500,000 Bonds payable, 8% $500,000 $900,000 Total long-term liabilities $986,400 $1,193,780 Total liabilities Stockholders' Equity $180,000 $180,000 Preferred $0.70 stock, $20 par Long-term investments 575,909 300,565 Property, plant, and equipment (net) 1,170,000 1,053,000 Total assets $2,686,005 $2,294,175 Liabilities Current liabilities $293,780 $486,400 Long-term liabilities: Mortgage note payable, 8% $400,000 $0 Bonds payable, 8% 500,000 500,000 Total long-term liabilities $900,000 $500,000 Total liabilities $1,193,780 $986,400 Stockholders' Equity Preferred $0.70 stock, $20 par $180,000 $180,000 Common stock, $10 par 210,000 210,000 Retained earnings 1,102,225 917,775 $1,492,225 $1,307,7 Total stockholders' equity Total liabilities and stockholders' equity $2,294,175 $2,686,005 Required: Determine the following measures for 20Y2, rounding to one decimal place, except for dollar amounts, which should be rounded to the requirement, if required. Assume 365 days a year. $ 646,316 1. Working capital 3.2 2. Current ratio 2.5 3. Quick ratio 5.3 4. Accounts receivable turnover Required: Determine the following measures for 20Y2, rounding to one decimal place, except for dollar amounts, which should be rounded to the nea requirement, if required. Assume 365 days a year. 1. Working capital 646,316 2. Current ratio 3.2 3. Quick ratio 2.5 4. Accounts receivable tumover 5.3 5. Number of days' sales in receivables 68.8 X days 6. Inventory turnover 2.8 7. Number of days' sales in inventory 130.3 X days 8. Ratio of fixed assets to long-term liabilities 1.9 X 0.9 X 9. Ratio of liabilities to stockholders' equity 10. Times interest earned 4.2 0.4 11. Asset turnover 8.2 X % 12. Return on total assets V% 14.6 13. Return on stockholders' equity 16.2 % 14. Return on common stockholders' equity $1 X 0.94 15. Eamings per share on common stock 58.5 X 16. Price-earnings ratio 0.06 X 17. Dividends per share of common stock X % 0.1 18. Dividend yieldStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started