Question

5-8 Project-Specific WACC In 2014, worldwide capacity of wind-powered generators was growing. Wind power still constitutes a small fraction of worldwide electricity use, but in

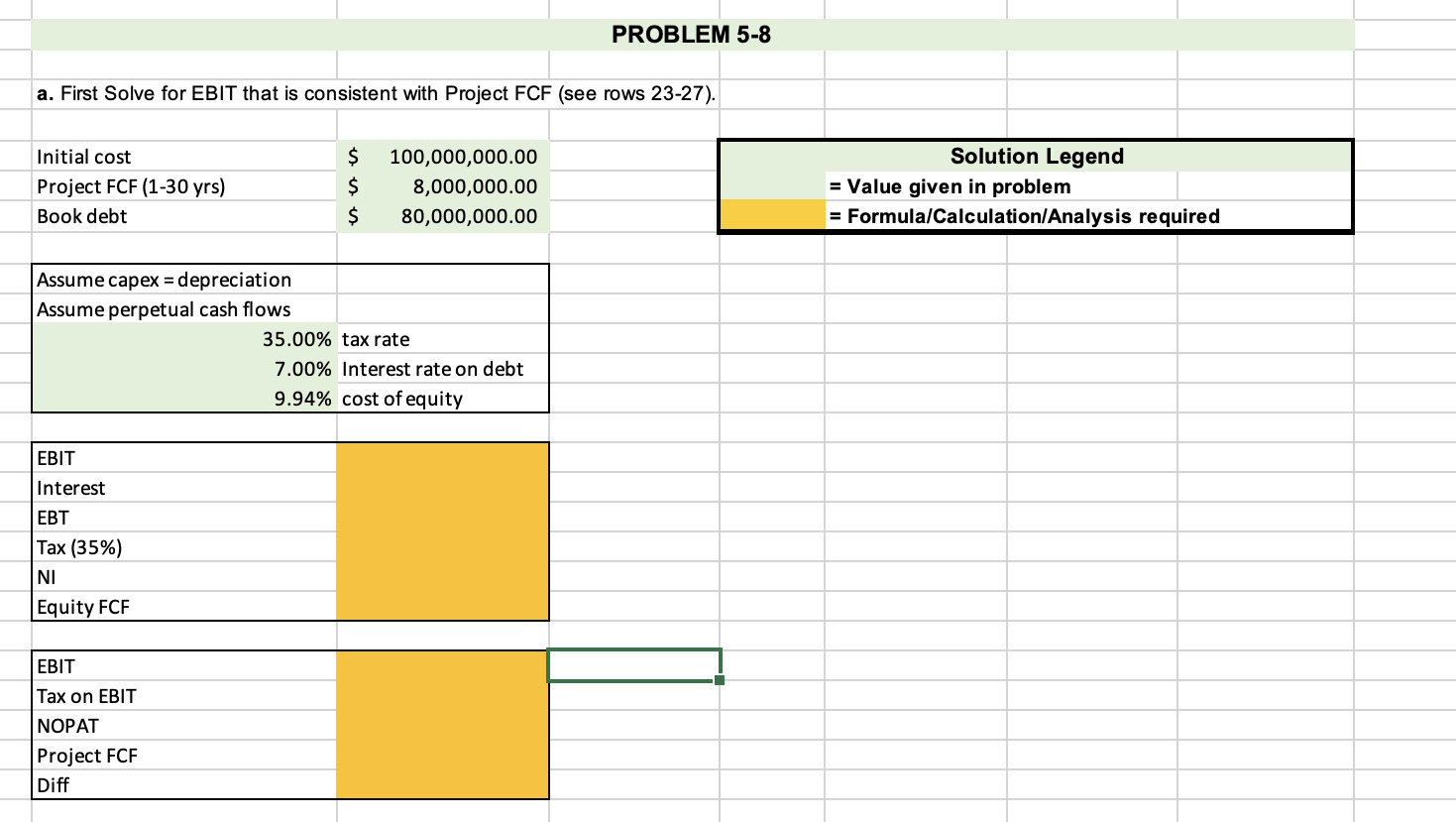

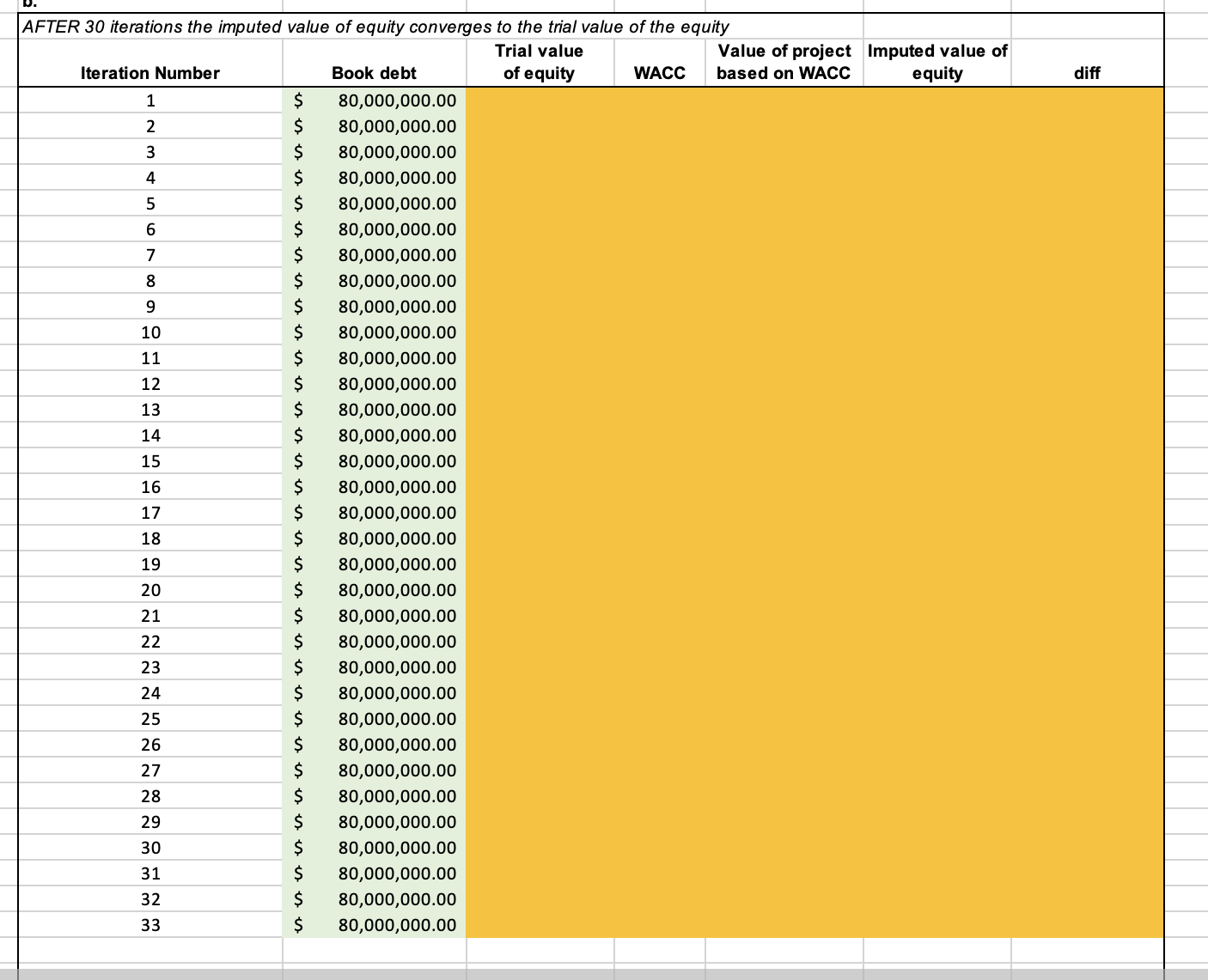

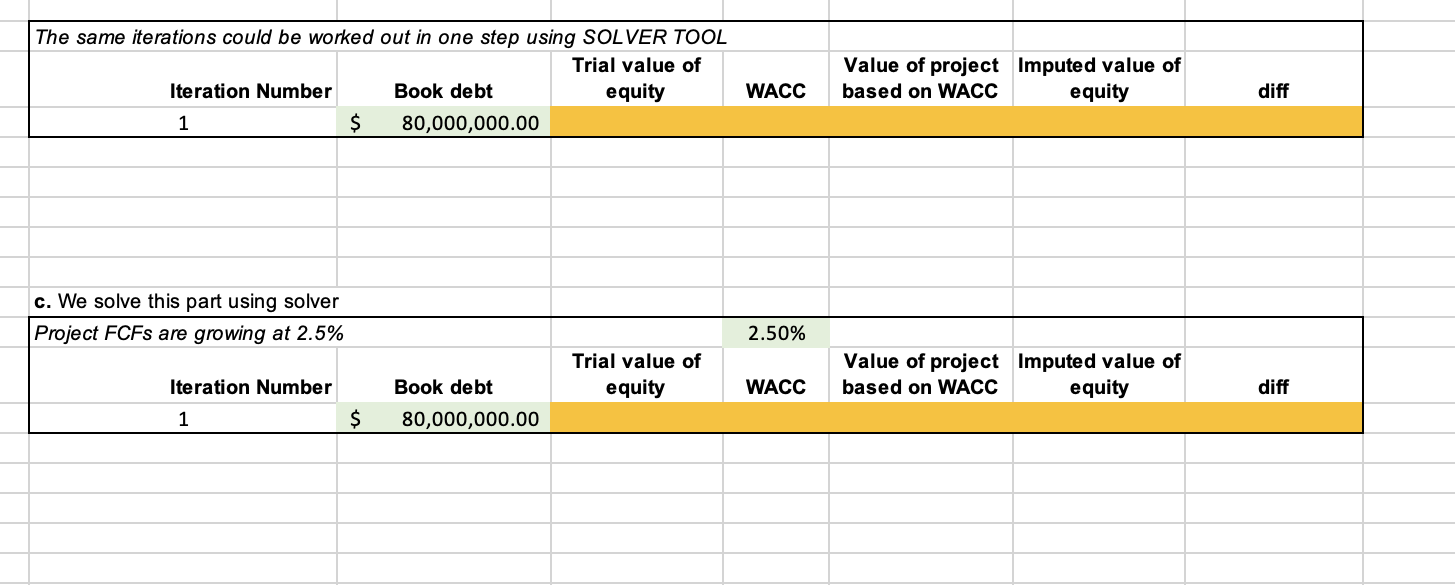

5-8 Project-Specific WACC In 2014, worldwide capacity of wind-powered generators was growing. Wind power still constitutes a small fraction of worldwide electricity use, but in Denmark, wind power provides over 20% of electricity. Moreover, the use of wind power has grown rapidly in recent years. The key feature of wind power is its heavy capital intensity and low ongoing costs (the wind is free). Combined with advances in wind power generation technology, this alternative power source appears to be one of the most promising clean energy sources for the future. Gusty Power Company (GPC) of Amarillo, Texas, builds and operates wind farms that produce electrical power, which is then sold into the electrical grid. GPC has recently been contacted by the Plains Energy Company of Plainview, Texas, to construct one of the largest wind-power farms ever built. Plains Energy is an independent power producer that normally sells all the electrical power it produces back to the power grid at prevailing market prices. In this instance, however, Plains has arranged to sell all of its production to a consortium of electric power companies in the area for a long-term, contractually set price. Assume that the project generates perpetual cash flows (annual project FCF) of $8,000,000, debt principal is never repaid, capital expenditures (CAPEX) equal depreciation in each period, and the tax rate is 35%. The project calls for an investment of $100 million, and Plains has arranged for an $80 million project loan that has no recourse to Plains's other assets. The loan carries a 7% rate of interest, which reflects current market conditions for loans of this type. Plains will invest $10 million in the project, and the remainder will be provided by two local power companies that are part of the consortium that will purchase the electrical power the project produces. #1 What is the project-specific WACC, calculated using the book values of debt and equity as a proportion of the $100 million cost of the project? Given this estimate of the WACC, what is the value of the project? #2 Reevaluate the project-specific WACC using your estimate of the value of the project from part a above as the basis for your weights. Use this WACC to reestimate the value of the project, and then recalculate the weights for the project finance WACC using this revised estimate of WACC. Repeat this process until the value of the project converges to a stable value. What is the project's value? What is the project finance WACC? # 3 Reevaluate the project-specific WACC and project value where the contract calls for a 2.5% rate of increase in the project free cash flow beginning in the second year of the project's life.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started