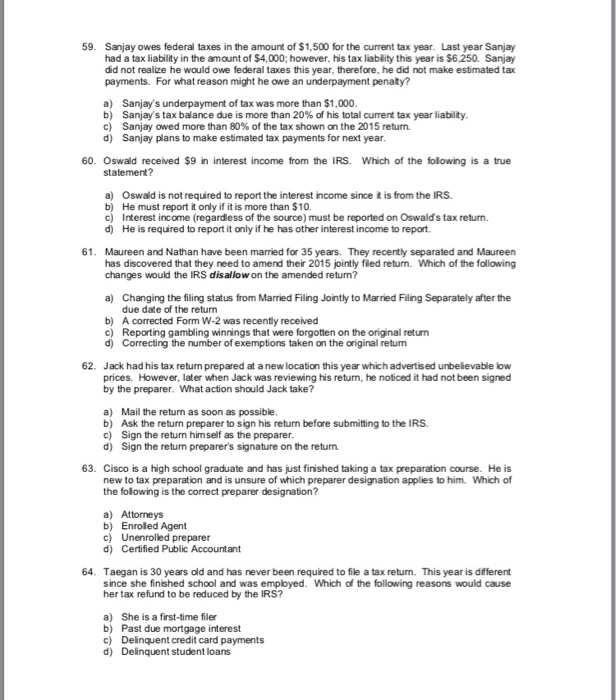

59. Sanjay owes federal taxes in the amount of $1,500 for the current tax year. had a tax liability in the amount of $4,000; however, his tax liablity this year is $6,250. Sanjay did not realize he would owe federal taxes this year, therefore, he did not make estimated tax payments. For what reason might he owe an underpayment penaty? Last year Sanjay a) b) c) d) Sanjay's underpayment of tax was more than $1,000 Sanjay's tax balance due is more than 20% of his total current tax year liability. Sanjay owed more than 80% of the tax shown on the 2015 return. Sanjay plans to make estimated tax payments for next year 60. Oswald received $9 in interest income from the IRS. Which of the folowing is a true statement? a) Oswald is not required to report the interest income since t is from the IRS. b) He must report it only if it is more than $10. c) Interest income (regardless of the source) must be reported on Oswald's tax return. d) He is required to report it only if he has other interest income to report 61. Maureen and Nathan have been married for 35 years. They recently separated and Maureen has discovered that they need to amend their 2015 jointly filed return. Which of the following changes would the IRS disallow on the amended return? a) Changing the filing status from Married Filing Jointly to Married Filing Separately after the due date of the return b) A corrected Form W-2 was recently received c) Reporting gambling winnings that were forgotilen on the original returrn d) Correcting the number of exemptions taken on the original return 62. Jack had his tax return prepared at a new location this year which advertis ed unbelievable low prices. However, later when Jack was reviewing his return, he noticed it had not been signed by the preparer. What action should Jack take? a) Mail the return as soon as possible. b) Ask the return preparer to sign his return before submitting to the IRS. c) Sign the return himself as the preparer d) Sign the return preparers signature on the returm. 63. Cisco is a high school graduate and has just finished taking a tax preparation course. He is Which of new to tax preparation and is unsure of which preparer designation applies to him. the folowing is the correct preparer designation? a) Attorneys b) Enroled Agent c) Unenrolled preparer d) Certified Public Accountant 64. Taegan is 30 years old and has never been required to file a tax return. This year is different cause since she finished school her tax refund to be reduced by the IRS? and was employed. Which of the following reasons would a) b) c) d) She is a first-time filer Past due mortgage interest Delinquent credit card payments Delinquent student loans