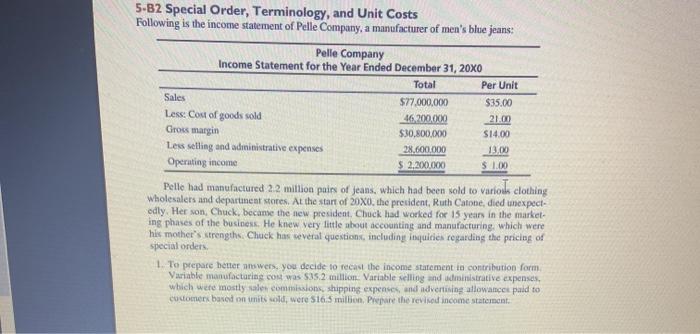

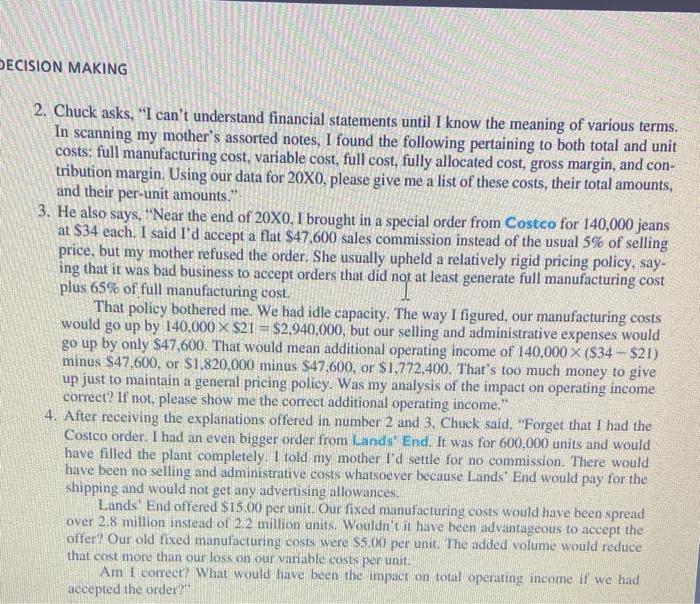

5-B2 Special Order, Terminology, and Unit Costs Following is the income statement of Pelle Company, a manufacturer of men's blue jeans: Pelle Company Income Statement for the Year Ended December 31, 20X0 Total Per Unit Sales $77.000.000 $35.00 Less: Cost of goods sold 46,200,000 21.00 Gross margin $30,800,000 $14.00 Less selling and administrative expenses 28,600,000 13.00 Operating income $ 2.200.000 $ 1.00 Pelle had manufactured 2.2 million pairs of jeans, which had been sold to variok clothing Wholesalers and department stores. At the start of 20X0, the president, Ruth Catone, died unexpect odly. Her son, Chuck, became the new president. Chuck had worked for 15 years in the market- ing phases of the business. He knew very little about accounting and manufacturing, which were his mother's strengths Chuck has several questions, including inquiries regarding the pricing of special orders 1. To prepare better answers, you decide to recast the income statement in contribution form Variable manufacturing cost was $35.2 million. Variable selling and constrative expenses, which were mostly sales commissions, shipping expenses and advertising allowance paid to co come based on units old, were $16.5 million, Prepare the revised income statement DECISION MAKING 2. Chuck asks, "I can't understand financial statements until I know the meaning of various terms. In scanning my mother's assorted notes, I found the following pertaining to both total and unit costs: full manufacturing cost, variable cost, full cost, fully allocated cost, gross margin, and con- tribution margin. Using our data for 20X0, please give me a list of these costs, their total amounts, and their per-unit amounts." 3. He also says, "Near the end of 20X0, I brought in a special order from Costco for 140,000 jeans at $34 each. I said I'd accept a flat $47,600 sales commission instead of the usual 5% of selling price, but my mother refused the order. She usually upheld a relatively rigid pricing policy, say- ing that it was bad business to accept orders that did not at least generate full manufacturing cost plus 65% of full manufacturing cost. That policy bothered me. We had idle capacity. The way I figured, our manufacturing costs would go up by 140,000 X $21 = $2.940,000, but our selling and administrative expenses would go up by only $47,600. That would mean additional operating income of 140,000 X ($34 - $21) minus $47,600, or $1.820,000 minus $47.600, or $1.772,400. That's too much money to give up just to maintain a general pricing policy. Was my analysis of the impact on operating income correct? If not, please show me the correct additional operating income." 4. After receiving the explanations offered in number 2 and 3. Chuck said. "Forget that I had the Costco order. I had an even bigger order from Lands' End. It was for 600,000 units and would have filled the plant completely. I told my mother I'd settle for no commission. There would have been no selling and administrative costs whatsoever because Lands' End would pay for the shipping and would not get any advertising allowances. Lands' End offered $15.00 per unit. Our fixed manufacturing costs would have been spread over 2.8 million instead of 2.2 million units. Wouldn't it have been advantageous to accept the offer? Our old fixed manufacturing costs were $5.00 per unit. The added volume would reduce that cost more than our loss on our variable costs per unit. Am I correct? What would have been the impact on total operating income if we had accepted the order