Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5.Juwan and Timi Clarke are planning for retirement. Juwan has a number of retirement related questions he needs help answering. Use your retirement planning

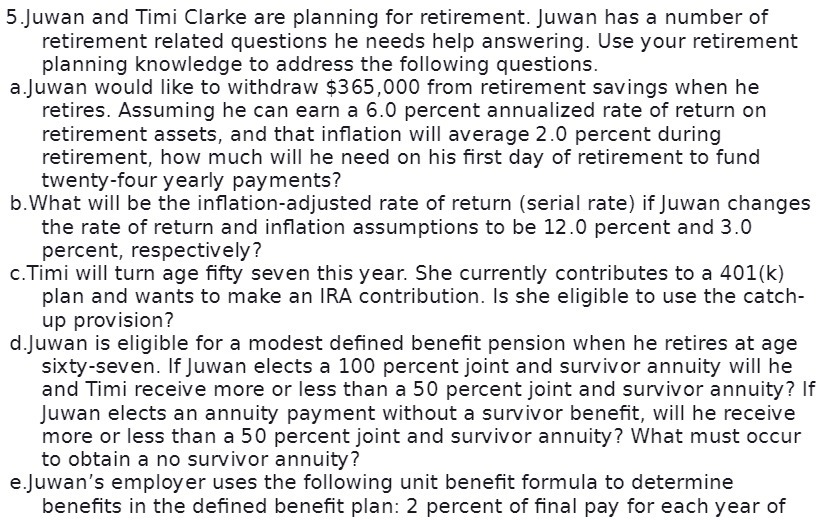

5.Juwan and Timi Clarke are planning for retirement. Juwan has a number of retirement related questions he needs help answering. Use your retirement planning knowledge to address the following questions. a.Juwan would like to withdraw $365,000 from retirement savings when he retires. Assuming he can earn a 6.0 percent annualized rate of return on retirement assets, and that inflation will average 2.0 percent during retirement, how much will he need on his first day of retirement to fund twenty-four yearly payments? b. What will be the inflation-adjusted rate of return (serial rate) if Juwan changes the rate of return and inflation assumptions to be 12.0 percent and 3.0 percent, respectively? c. Timi will turn age fifty seven this year. She currently contributes to a 401(k) plan and wants to make an IRA contribution. Is she eligible to use the catch- up provision? d.Juwan is eligible for a modest defined benefit pension when he retires at age sixty-seven. If Juwan elects a 100 percent joint and survivor annuity will he and Timi receive more or less than a 50 percent joint and survivor annuity? If Juwan elects an annuity payment without a survivor benefit, will he receive more or less than a 50 percent joint and survivor annuity? What must occur to obtain a no survivor annuity? e.Juwan's employer uses the following unit benefit formula to determine benefits in the defined benefit plan: 2 percent of final pay for each year of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer a To calculate how much Juwan will need on his first day of retirement to fund twentyfour yearly payments we can use the Present Value of an An...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started