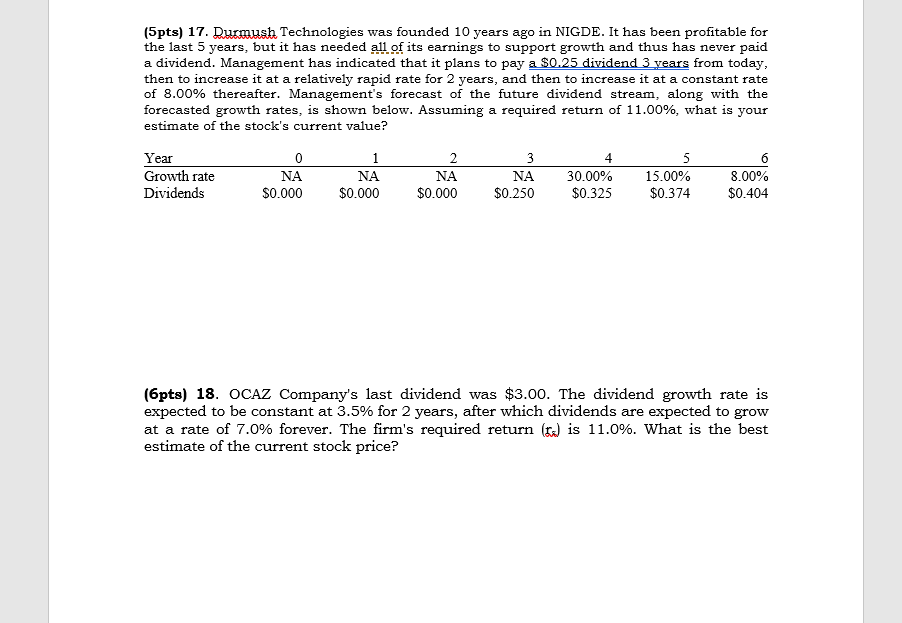

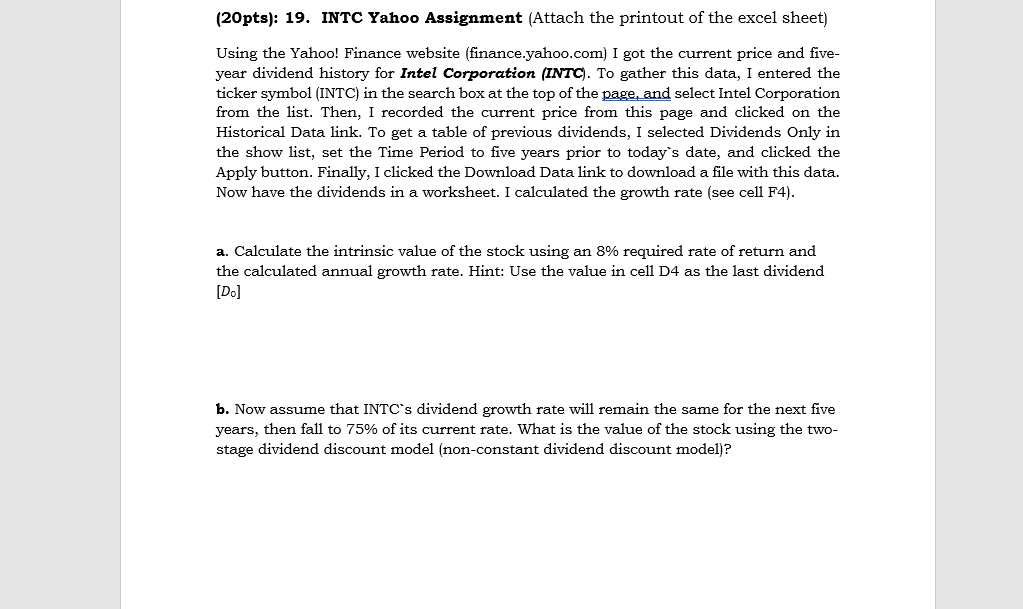

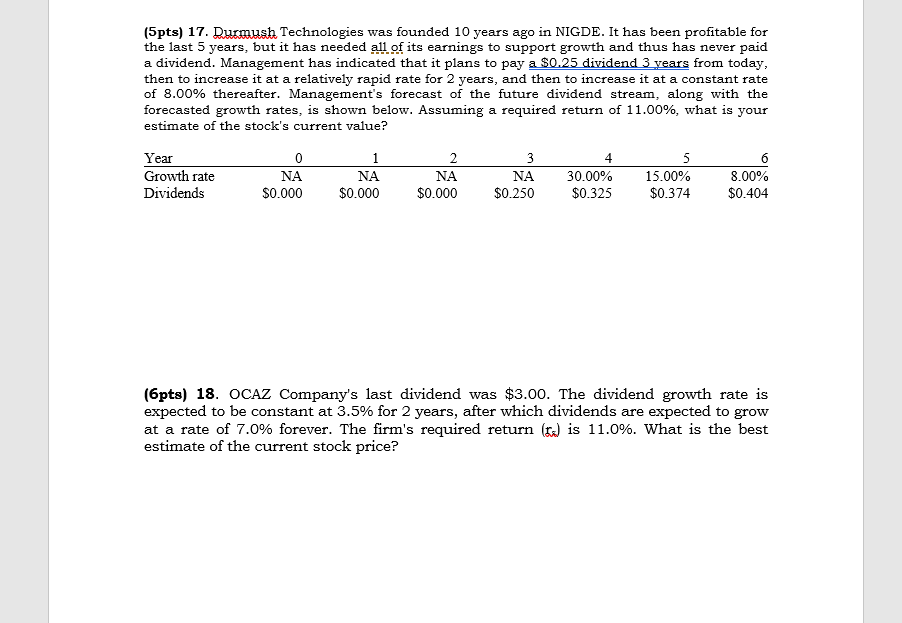

(5pts) 17. Durmush Technologies was founded 10 years ago in NIGDE. It has been profitable for the last 5 years, but it has needed all of its earnings to support growth and thus has never paid a dividend. Management has indicated that it plans to pay a $0.25 dividend 3 years from today, then to increase it at a relatively rapid rate for 2 years, and then to increase it at a constant rate of 8.00% thereafter. Management's forecast of the future dividend stream, along with the forecasted growth rates, is shown below. Assuming a required return of 11.00%, what is your estimate of the stock's current value? Year Growth rate Dividends - 0 NA $0.000 1 NA $0.000 2 NA $0.000 3 NA $0.250 4 30.00% $0.325 5 15.00% $0.374 6 8.00% $0.404 . 16pts) 18. OCAZ Company's last dividend was $3.00. The dividend growth rate is expected to be constant at 3.5% for 2 years, after which dividends are expected to grow at a rate of 7.0% forever. The firm's required return (ra) is 11.0%. What is the best estimate of the current stock price? (20pts): 19. INTC Yahoo Assignment (Attach the printout of the excel sheet) Using the Yahoo! Finance website (finance.yahoo.com) I got the current price and five- year dividend history for Intel Corporation (INTC). To gather this data, I entered the ticker symbol (INTC) in the search box at the top of the page, and select Intel Corporation from the list. Then, I recorded the current price from this page and clicked on the Historical Data link. To get a table of previous dividends, I selected Dividends Only in the show list, set the Time Period to five years prior to today's date, and clicked the Apply button. Finally, I clicked the Download Data link to download a file with this data. Now have the dividends in a worksheet. I calculated the growth rate (see cell F4). a. Calculate the intrinsic value of the stock using an 8% required rate of return and the calculated annual growth rate. Hint: Use the value in cell D4 as the last dividend [D] b. Now assume that INTC's dividend growth rate will remain the same for the next five years, then fall to 75% of its current rate. What is the value of the stock using the two- stage dividend discount model (non-constant dividend discount model)? Font Paragraph Styles year dividend history for Intel Corporation (INTC). To gather this data, I entered the ticker symbol (INTC) in the search box at the top of the page, and select Intel Corporation from the list. Then, I recorded the current price from this page and clicked on the Historical Data link. To get a table of previous dividends, I selected Dividends Only in the show list, set the Time Period to five years prior to today's date, and clicked the Apply button. Finally, I clicked the Download Data link to download a file with this data. Now have the dividends in a worksheet. I calculated the growth rate (see cell F4). a. Calculate the intrinsic value of the stock using an 8% required rate of return and the calculated annual growth rate. Hint: Use the value in cell D4 as the last dividend [Do] b. Now assume that INTC's dividend growth rate will remain the same for the next five years, then fall to 75% of its current rate. What is the value of the stock using the two- stage dividend discount model (non-constant dividend discount model)? c. How does the calculated intrinsic value compare to the actual market price of the stock (i.e. whether the stock is undervalued, overvalued, or fairly valued)? Would you buy the stock at its current price