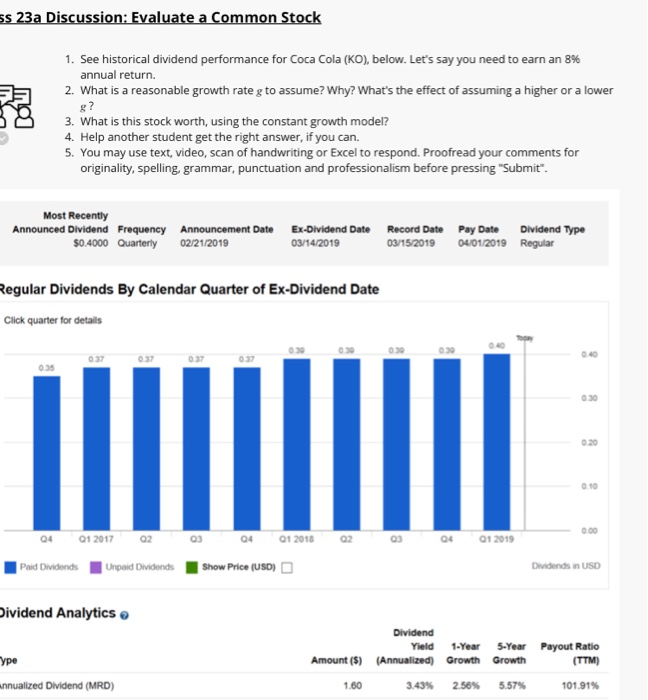

5s 23a Discussion: Evaluate a Common Stock 1. See historical dividend performance for Coca Cola (KO), below. Let's say you need to earn an 8% annual return. 2. What is a reasonable growth rate g to assume? Why? What's the effect of assuming a higher or a lower DOU 3. What is this stock worth, using the constant growth model? 4. Help another student get the right answer, if you can. 5. You may use text, video, scan of handwriting or Excel to respond. Proofread your comments for originality, spelling, grammar, punctuation and professionalism before pressing "Submit". Most Recently Announced Dividend Frequency Announcement Date $0.4000 Quarterly 02/21/2019 Ex-Dividend Date 03/14/2019 Record Date 03/15/2019 Pay Date 04/01/2019 Dividend Type Regular Regular Dividends By Calendar Quarter of Ex-Dividend Date Click quarter for details 04 01 2017 02 03 04 01 2018 02 03 04 01 2019 Paid Dividends Unpaid Dividends Show Price (USD) Dividends in USD Dividend Analytics Dividend Yield 1-Year 5-Year (Annualized) Growth Growth ype Amount ($) Payout Ratio (TTM) annualized Dividend (MRD) 1.60 3.43% 2.56% 5.57% 101.91% 5s 23a Discussion: Evaluate a Common Stock 1. See historical dividend performance for Coca Cola (KO), below. Let's say you need to earn an 8% annual return. 2. What is a reasonable growth rate g to assume? Why? What's the effect of assuming a higher or a lower DOU 3. What is this stock worth, using the constant growth model? 4. Help another student get the right answer, if you can. 5. You may use text, video, scan of handwriting or Excel to respond. Proofread your comments for originality, spelling, grammar, punctuation and professionalism before pressing "Submit". Most Recently Announced Dividend Frequency Announcement Date $0.4000 Quarterly 02/21/2019 Ex-Dividend Date 03/14/2019 Record Date 03/15/2019 Pay Date 04/01/2019 Dividend Type Regular Regular Dividends By Calendar Quarter of Ex-Dividend Date Click quarter for details 04 01 2017 02 03 04 01 2018 02 03 04 01 2019 Paid Dividends Unpaid Dividends Show Price (USD) Dividends in USD Dividend Analytics Dividend Yield 1-Year 5-Year (Annualized) Growth Growth ype Amount ($) Payout Ratio (TTM) annualized Dividend (MRD) 1.60 3.43% 2.56% 5.57% 101.91%