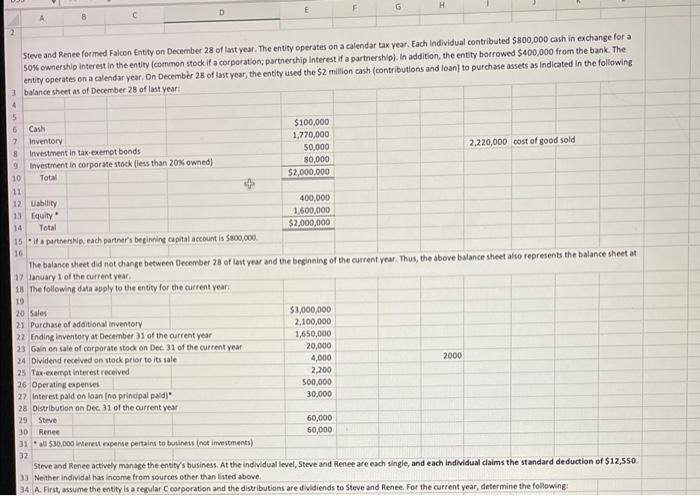

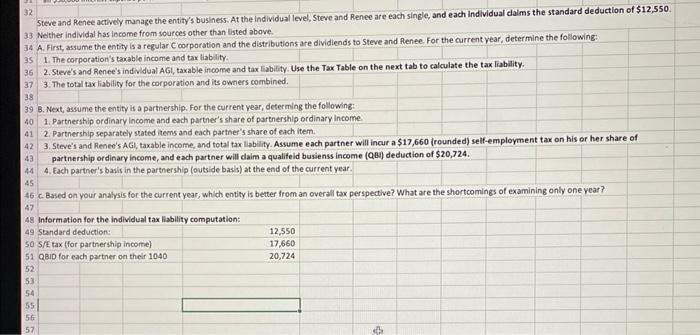

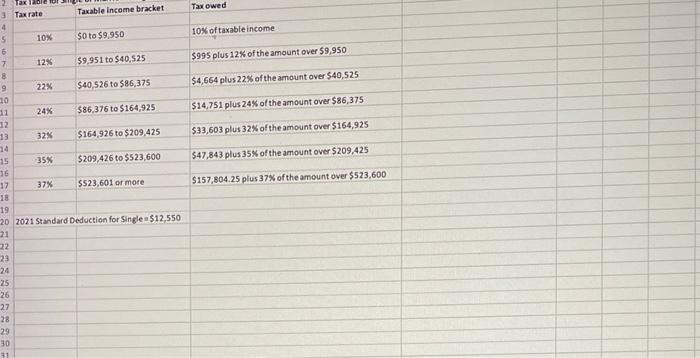

5teve and Renee forined Falcen Entiy on December 28 of last year. The entify operates on a calendar tax year. Each individual contributed $800,000 cash in exchange for a 50 s ownershlp interest in the entiry (common stock if a corporation; partnership interest if a partnership). In addition, the entity borrowed $400,000 from the bank. The entify operates on a calendar year, On Decembir 28 of last year, the entify used the $2 million cash (contributions and loan) to purchase assets as indicated in the following balance sheet as of December 28 of last year: The balance sheet did not change between December 28 of last year and the beginning of the current year. Thus, the above balance sheet also represents the balance sheet at 6 lanwary 1 of the current vear. 32. Steve and Renee actively manage the entity's business. At the individual level, Steve and Renee are each single, and each individual daims the standard de duction of $12,550. 33 Neither individal has income from sources other than listed above. 34. A. First, assume the entity is a regular C corporation and the distributions are dividiends to steve and fenee. For the current year, determine the following: Steve and Renee activey munage the entity's business. At the individual level, Steve and Renee are each single, and each individual daims the standard deduction of $12,550. 33 Nether individal has income from sources other than listed above. A. First, assume the entity is a regular C corporation and the distributions are dividiends to Steve and flenee. For the current year, determine the following: 1. The corporation's taxable income and tax liability. 2. Stere's and Renee's indivdual AGI, taxable income and tax liability. Use the Tax Table on the next tab to calculate the tax liability. 3. The total taxliability for the corporation and its owners combined. B. Next, assume the entity is a partnership. For the current year, determing the following: 1. Partnership ordinary income and each partner's share of partnership ordinary income. 2. Partnership separately stated items and each partner's share of each item. 3. Steve's and Renee's AGl, taxable income, and total tax lisbility. Assume each partner will incur a $17,660 (rounded) self-employment tax on his or her share of partnership ordinary income, and each partner will daim a qualifeid busienss income (QB) deduction of $20,724. 4. Each partner's basis in the partnership (outside basis) at the end of the current year. c. Based on your analysis for the current year, which entity is better from an overall tax perspective? What are the shortcomings of examining only one year? Information for the individual tax liablity computation: 49 Standard deduction: so s/E tax (for partnership income) QBiD for each partner on their 1040 12,55017,66020,724 Taxrate Taxable income bracket Tax owed \begin{tabular}{|l|l|l|} \hline 10% & $0 to $9,950 & 10% of taxable income \\ \hline 12% & $9,951 to $40,525 & $995 plus 12% of the amount over $9,950 \\ \hline 22% & $40,526 to $86,375 & $4,664 plus 22% of the amount over $40,525 \\ \hline 24% & $86,376 to $164,925 & $14,751 plus 24% of the amount over $86,375 \\ \hline 32% & $164,926 to $209,425 & $33,603 plus 32% of the amount over $164,925 \\ \hline 35% & $209,426 to $523,600 & $47,843 plus 35% of the amount over $209,425 \\ \hline 37% & $523,601 or more & $157,804,25 plus 37% of the amount over $523,600 \\ \hline \end{tabular} 2021 Standard Deduction for Single =$12,550