Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5th digit of ID = 8 As a financial analyst, you are responsible for determining the intrinsic value of IBM Corporation at the end of

5th digit of ID = 8

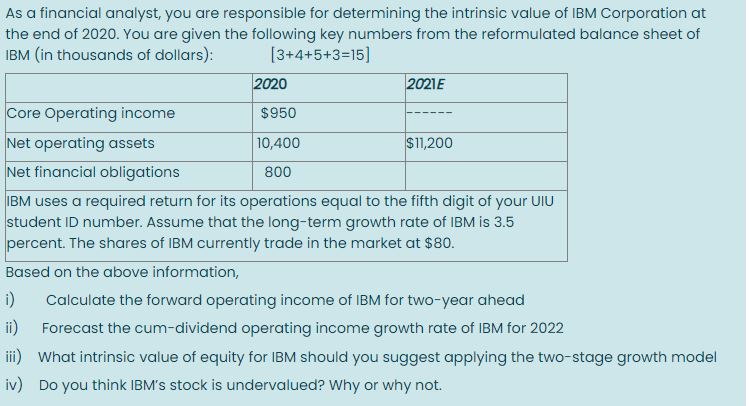

As a financial analyst, you are responsible for determining the intrinsic value of IBM Corporation at the end of 2020. You are given the following key numbers from the reformulated balance sheet of IBM (in thousands of dollars): [3+4+5+3=15] $950 2020 2021E Core Operating income Net operating assets 10,400 $11,200 Net financial obligations IBM uses a required return for its operations equal to the fifth digit of your VIU student ID number. Assume that the long-term growth rate of IBM is 3.5 percent. The shares of IBM currently trade in the market at $80. 800 Based on the above information, i) Calculate the forward operating income of IBM for two-year ahead ii) Forecast the cum-dividend operating income growth rate of IBM for 2022 iii) What intrinsic value of equity for IBM should you suggest applying the two-stage growth model iv) Do you think IBM's stock is undervalued? Why or why not. As a financial analyst, you are responsible for determining the intrinsic value of IBM Corporation at the end of 2020. You are given the following key numbers from the reformulated balance sheet of IBM (in thousands of dollars): [3+4+5+3=15] $950 2020 2021E Core Operating income Net operating assets 10,400 $11,200 Net financial obligations IBM uses a required return for its operations equal to the fifth digit of your VIU student ID number. Assume that the long-term growth rate of IBM is 3.5 percent. The shares of IBM currently trade in the market at $80. 800 Based on the above information, i) Calculate the forward operating income of IBM for two-year ahead ii) Forecast the cum-dividend operating income growth rate of IBM for 2022 iii) What intrinsic value of equity for IBM should you suggest applying the two-stage growth model iv) Do you think IBM's stock is undervalued? Why or why notStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started