6

1

11

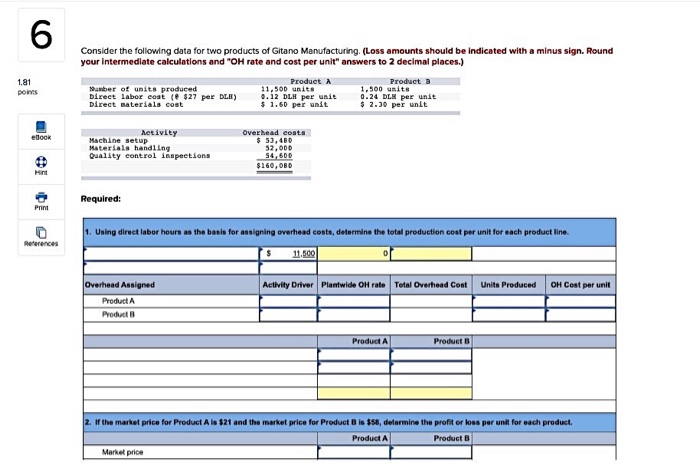

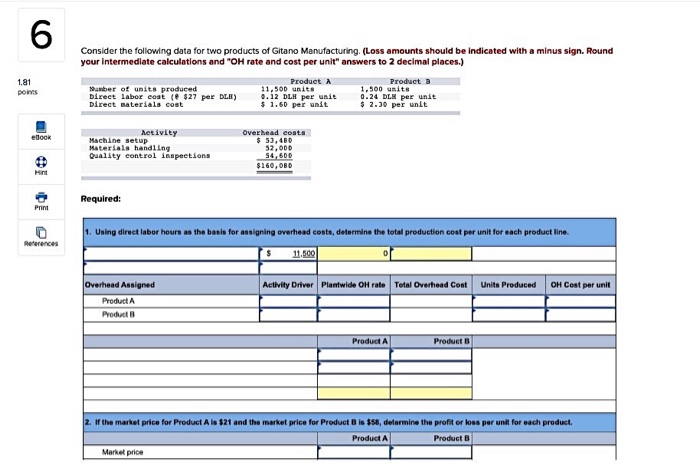

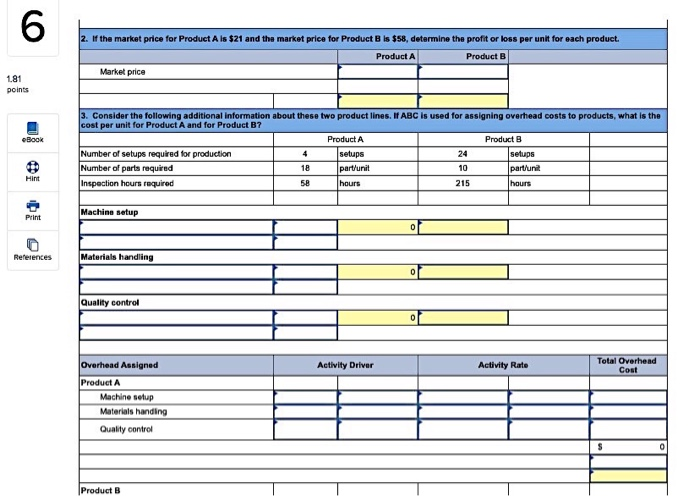

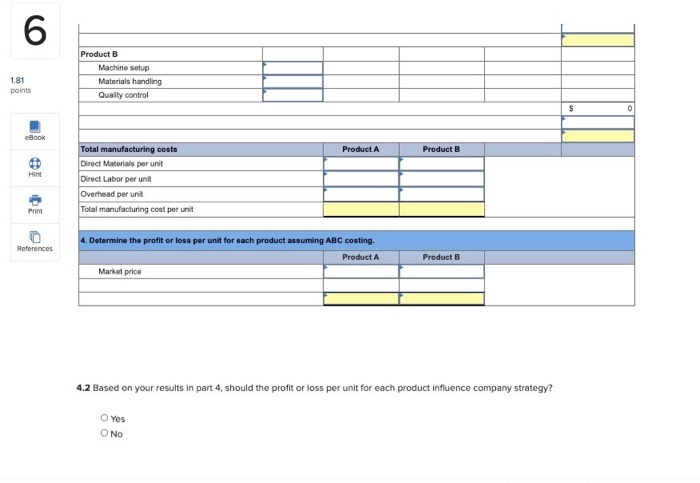

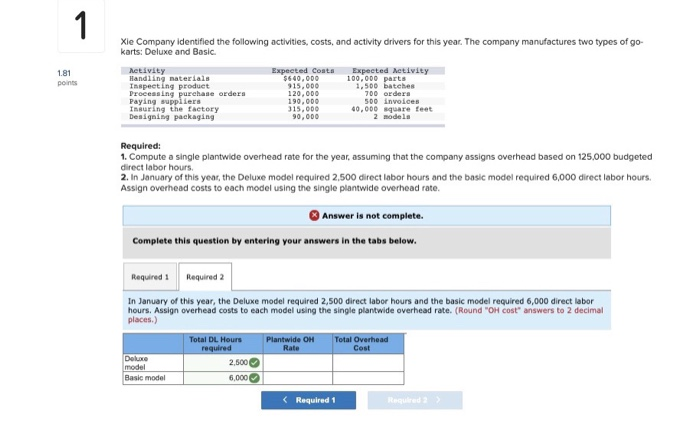

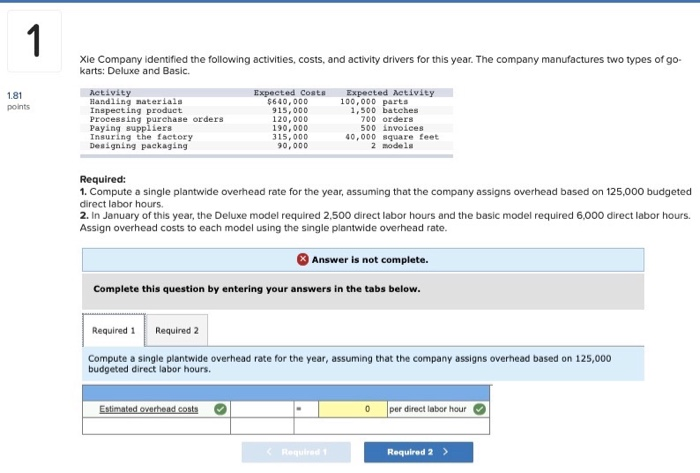

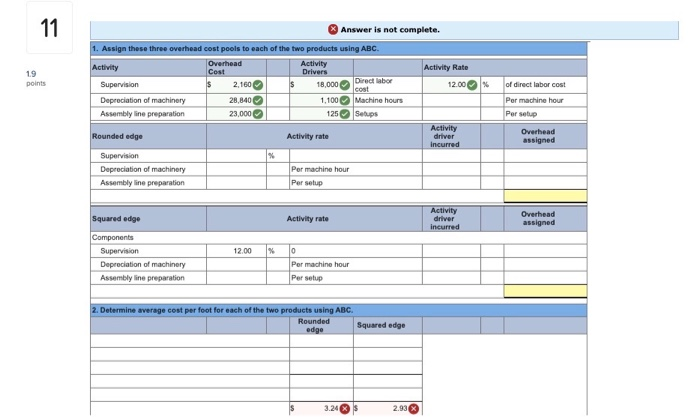

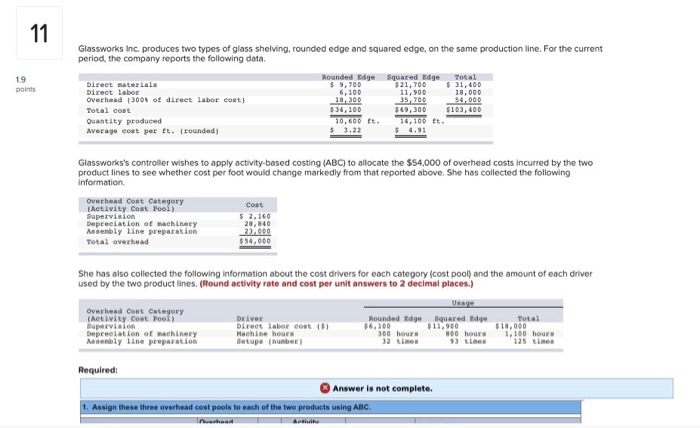

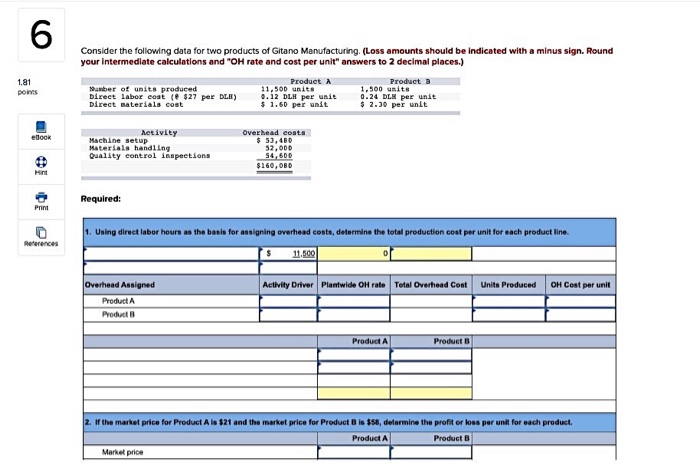

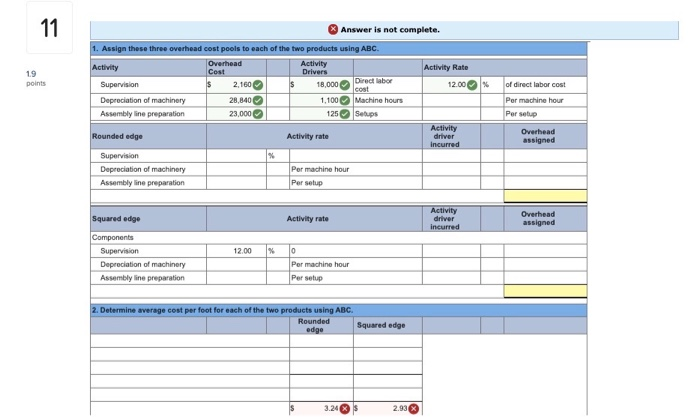

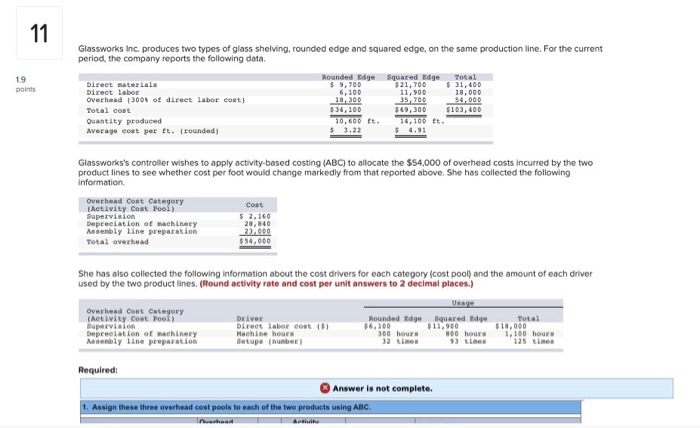

6 1.81 points Consider the following data for two products of Gitano Manufacturing. (Loss amounts should be indicated with a minus sign. Round your intermediate calculations and "OH rate and cost per unit" answers to 2 decimal places.) Product Product Number of units produced 11,500 units 1,500 units Direct Labor coat ( $27 per DLE) 0.12 DLH per unit 0.24 DLH per unit Direct materials cost $ 1.60 per unit $ 2.30 per unit eBook Activity Machine setup Materials handling Quality control inspections Overhead coats $ 53,480 52,000 54,600 $160,080 Required: Print Using direct labor hours as the basis for assigning overhead costs, determine the total production cost per unit for each product line. 11.500 References Activity Driver Plantwide of rato Total Overhead Cost Units Produced OH Cost per unit Overhead Assigned Product A Product Product A Products 2. If the market price for Product A is $21 and the market price for Product B is $58, determine the profit or loss per unit for each product. Product A Product B Market price 6 2. If the market price for Product A ls $21 and the market price for Product B is $58, determine the profit or loss per unit for each product. Product A Product B Market price 1.81 points eBook 3. Consider the following additional Information about these two product lines. If ABC is used for assigning overhead costs to products, what is the cost per unit for Product A and for Product B7 Product A Product B Number of setups required for production 4 setups 24 setups Number of parts required 18 part/unit 10 part unit Inspection hours required 5B hours 215 Hint hours Machine setup Print References Materials handling OL Quality control Activity Driver Activity Rate Total Overhead Cost Overhead Assigned Product A Machine setup Materials handing Quality control S Product B 6 Product B Machine setup Materials handling Quality control 1.81 points $ 0 eBook Product A Product B Hint Total manufacturing costs Direct Materials per unit Direct Labor per unit Overhead per unit Total manufacturing cost per unit Print References 4. Determine the profit or loss per unit for each product assuming ABC costing. Product A Market price Product B 4.2 Based on your results in part 4, should the profit or loss per unit for each product Influence company strategy? Yes O NO 1 181 points Xie Company identified the following activities, costs, and activity drivers for this year. The company manufactures two types of go- karts: Deluxe and Basic Activity Expected Coats Expected Activity Handling materials $640,000 100.000 parts Inspecting product 915,000 1,500 batehes Processing purchase orders 120,000 700 ordera Paying suppliers 190.000 500 Invoices Insuring the factory 315,000 40,000 square feet Designing packaging 90,000 2 models Required: 1. Compute a single plantwide overhead rate for the year, assuming that the company assigns overhead based on 125,000 budgeted 2. In January of this year, the Deluxe model required 2.500 direct labor hours and the basic model required 6,000 direct labor hours. Assign overhead costs to each model using the single plantwide overhead rate. Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 In January of this year, the Deluxe model required 2,500 direct labor hours and the basic model required 6,000 direct labor hours. Assign overhead costs to each model using the single plantwide overhead rate. (Round "OH cost" answers to 2 decimal places.) Total DL Hours Plantwide OH Total Overhead required Rate Cost Deluxe 2,500 model Basic model 6,000 11 19 points Answer is not complete. 1. Assign these three overhead cost pools to each of the two products using ABC. Activity Overhead Activity Cost Drivers Activity Rate Supervision 2.160 $ 18.000 Direct labor 12.00 cost Depreciation of machinery 28,840 1,100 Machine hours Assembly line preparation 23,000 125Setups Activity Rounded edge Activity rate driver incurred Supervision % Depreciation of machinery Per machine hour Assembly line preparation Per setup of direct labor cost Per machine hour Per setup Overhead assigned Activity rate Activity driver incurred Overhead assigned Squared edge Components Supervision Depreciation of machinery Assembly line preparation 12.00 % 0 Per machine hour Per setup 2. Determine average cost per foot for each of the two products using ABC. Rounded odge Squared edge 3.24 2.93 11 19 Dans Glassworks Inc. produces two types of glass shelving, rounded edge and squared edge, on the same production line. For the current period, the company reports the following data. Rounded Edge Squared Edge Total Direct materials $ 9,700 $21,700 $ 31,400 Direct Labor 6,100 11,900 18,000 Overhead (300+ of direct labor cost) 18,300 35,700 54,000 Total cost $34,100 $69,300 $103,400 Quantity produced 10,600 ft. 74,100 Et. Average cost per ft. (rounded) 3.22 Glassworks's controller wishes to apply activity-based costing (ABC) to allocate the $54,000 of overhead costs incurred by the two product lines to see whether cost per foot would change markedly from that reported above. She has collected the following information overhead Cost Category (Activity Coat Tool) Cost Supervision $ 2,160 Depreciation of machinery 28,840 Assembly line preparation 23.000 Total overhead $54,000 She has also collected the following information about the cost drivers for each category (cost pool) and the amount of each driver used by the two product lines. (Round activity rate and cost per unit answers to 2 decimal places.) Overhead Cost Category (Activity Cost Pool) Depreciation of machinery Aasenbly line preparation Driver Direct labor cost (6) Machine hours Setup (number) Rounded Edge Squared de $6,100 $11,900 300 hours 800 hours 3 times Total $10,000 1,100 hours 125 times Required: Answer is not complete. 1. Assign these three overhead cost pools to each of the two products using ABC