Answered step by step

Verified Expert Solution

Question

1 Approved Answer

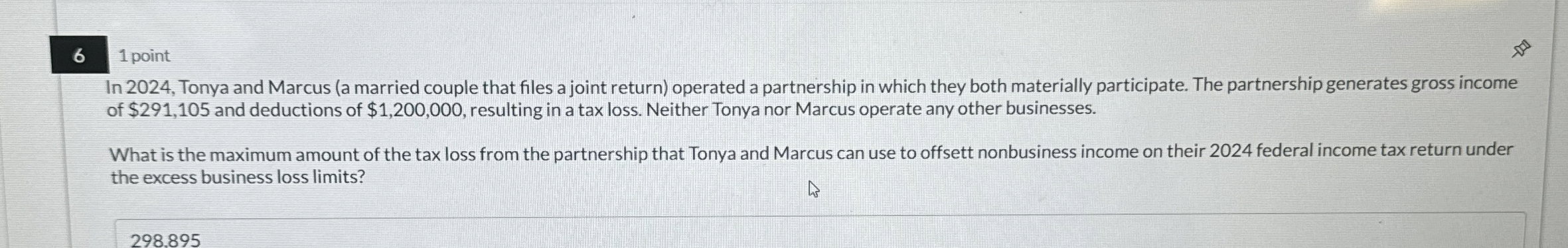

6 1 point In 2 0 2 4 , Tonya and Marcus ( a married couple that files a joint return ) operated a partnership

point

In Tonya and Marcus a married couple that files a joint return operated a partnership in which they both materially participate. The partnership generates gross income

of $ and deductions of $ resulting in a tax loss. Neither Tonya nor Marcus operate any other businesses.

What is the maximum amount of the tax loss from the partnership that Tonya and Marcus can use to offsett nonbusiness income on their federal income tax return under

the excess business loss limits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started