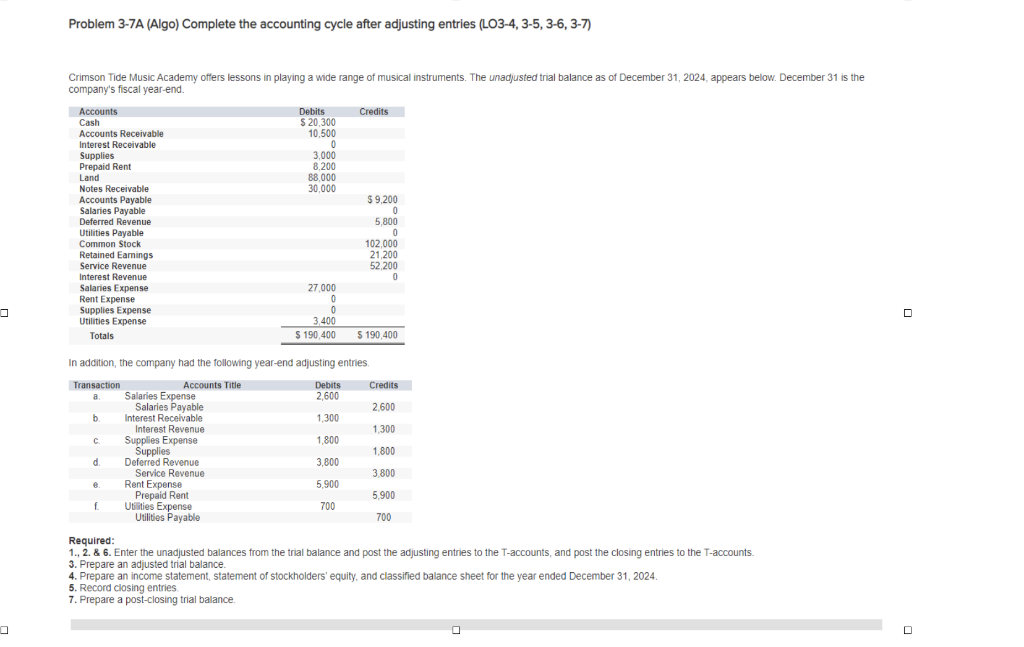

Problem 3-7A (Algo) Complete the accounting cycle after adjusting entries (LO3-4, 3-5, 3-6, 3-7) Crimson Tide Music Academy offers lessons in playing a wide

Problem 3-7A (Algo) Complete the accounting cycle after adjusting entries (LO3-4, 3-5, 3-6, 3-7) Crimson Tide Music Academy offers lessons in playing a wide range of musical instruments. The unadjusted trial balance as of December 31, 2024, appears below. December 31 is the company's fiscal year-end. Accounts Cash Accounts Receivable Interest Receivable Supplies Debits $20,300 Credits 10,500 0 3,000 Prepaid Rent 8,200 Land 88,000 Notes Receivable 30,000 Accounts Payable $9,200 Salaries Payable 0 Deferred Revenue Utilities Payable Common Stock Retained Earnings Service Revenue Interest Revenue Salaries Expense Rent Expense 5,800 0 102,000 21,200 52,200 0 Supplies Expense Utilities Expense Totals 27,000 0 0 3,400 $ 190,400 $ 190,400 In addition, the company had the following year-end adjusting entries. Transaction Accounts Title Salaries Expense Salaries Payable Interest Receivable Interest Revenue Debits Credits 2,600 2,600 1,300 1,300 Supplies Expense 1,800 Supplies 1,800 Deferred Revenue 3,800 Service Revenue 3,800 Rent Expense 5,900 Prepaid Rent 5,900 Utilities Expense 700 Utilities Payable 700 Required: 1., 2. & 6. Enter the unadjusted balances from the trial balance and post the adjusting entries to the T-accounts, and post the closing entries to the T-accounts. 3. Prepare an adjusted trial balance. 4. Prepare an income statement, statement of stockholders' equity, and classified balance sheet for the year ended December 31, 2024. 5. Record closing entries. 7. Prepare a post-closing trial balance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Heres a detailed breakdown of how to address each of the four points given in the requirement 1 Enter Unadjusted Balances and Post Adjusting Entries to TAccounts Unadjusted Balances Record the balances from the unadjusted trial balance into their respective Taccounts Adjusting Entries Post the adjusting entries to their respective Taccounts a Salaries Expense Debit 2600 and Salaries Payable Credit 2600 b Interest Receivable Debit 1300 and Interest Revenue Credit 1300 c Supplies Expense Debit 1800 and Supplies Credit 1800 d Deferred Revenue Debit 3800 and Service Revenue Credit 3800 e Rent Expense Debit 5900 and Prepaid Rent Credit 5900 f Utilities Expense Debit 700 and Utilities Payable Credit 700 2 Prepare the Adjusted Trial Balance After posting all the adjusting entries to the Taccounts sum up the debits and credits to prepare the adjusted trial balance The adjusted trial balance should show the updated balances of all accounts reflecting the impact of the adjusting entries 3 Prepare Financial Statements Income Statement Revenues Include Service Revenue and Interest Revenue Expenses Include Salaries Expense Supplies Expense Rent Expense and Utilities Expense Net Income Subtract total expenses from total revenues Statement of Stockholders Equity Start with the beginning balance of retained earnings Add Net Income from the Income Statement Subtract any dividends if applicable to get the ending retained earnings Classified Balance Sheet Assets Include Current Assets eg Cash Accounts Receivable Supplies and Noncurrent Assets eg Land Liabilities Include Current Liabilities eg Accounts Payable Salaries Payable Utilities Payable Equity Include Common Stock and Retained Earnings from the Statement of Stockholders Equity 4 Record Closing Entries Close Revenue accounts Service Revenue Interest Revenue by debiting them and crediting Income Summary Close Expense accounts Salaries Expense Supplies Expense Rent Expense Utilities Expense by crediting them and debiting Income Summary Transfer the balance ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started