Answered step by step

Verified Expert Solution

Question

1 Approved Answer

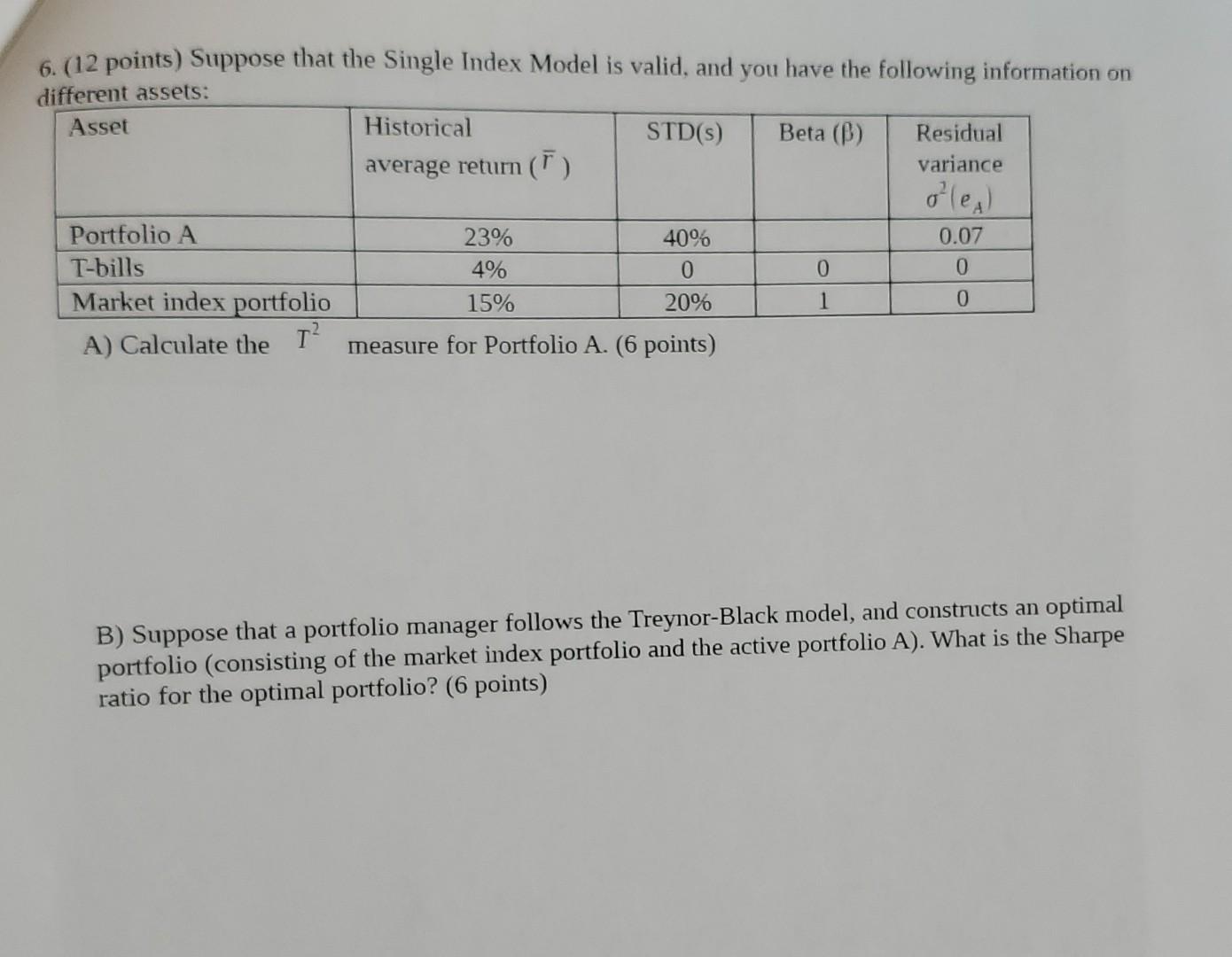

6. (12 points) Suppose that the Single Index Model is valid, and you have the following information on different assets: Asset Historical STD(S) Beta (B)

6. (12 points) Suppose that the Single Index Model is valid, and you have the following information on different assets: Asset Historical STD(S) Beta (B) Residual average return () variance ole) Portfolio A 23% 40% 0.07 T-bills 4% 0 0 Market index portfolio 15% 20% 1 0 A) Calculate the I? measure for Portfolio A. (6 points) 0 B) Suppose that a portfolio manager follows the Treynor-Black model, and constructs an optimal portfolio (consisting of the market index portfolio and the active portfolio A). What is the Sharpe ratio for the optimal portfolio? (6 points) 6. (12 points) Suppose that the Single Index Model is valid, and you have the following information on different assets: Asset Historical STD(S) Beta (B) Residual average return () variance ole) Portfolio A 23% 40% 0.07 T-bills 4% 0 0 Market index portfolio 15% 20% 1 0 A) Calculate the I? measure for Portfolio A. (6 points) 0 B) Suppose that a portfolio manager follows the Treynor-Black model, and constructs an optimal portfolio (consisting of the market index portfolio and the active portfolio A). What is the Sharpe ratio for the optimal portfolio? (6 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started