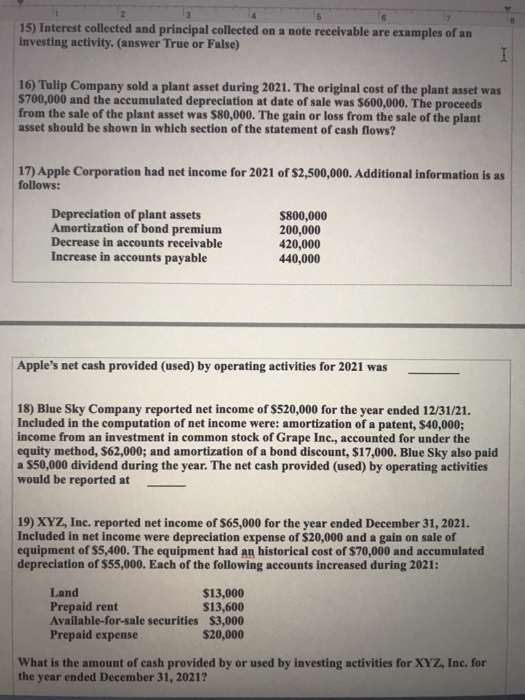

6 15) Interest collected and principal collected on a note receivable are examples of an investing activity. (answer True or False) I 16) Tulip Company sold a plant asset during 2021. The original cost of the plant asset was $700,000 and the accumulated depreciation at date of sale was $600,000. The proceeds from the sale of the plant asset was $80,000. The gain or loss from the sale of the plant asset should be shown in which section of the statement of cash flows? 17) Apple Corporation had net income for 2021 of $2,500,000. Additional information is as follows: Depreciation of plant assets Amortization of bond premium Decrease in accounts receivable Increase in accounts payable $800,000 200,000 420,000 440,000 Apple's net cash provided (used) by operating activities for 2021 was 18) Blue Sky Company reported net income of $520,000 for the year ended 12/31/21. Included in the computation of net income were: amortization of a patent, $40,000; income from an investment in common stock of Grape Inc., accounted for under the equity method, 562,000; and amortization of a bond discount, $17,000. Blue Sky also paid a $50,000 dividend during the year. The net cash provided (used) by operating activities would be reported at 19) XYZ, Inc. reported net income of $65,000 for the year ended December 31, 2021. Included in net income were depreciation expense of $20,000 and a gain on sale of equipment of $5,400. The equipment had an historical cost of $70,000 and accumulated depreciation of $55,000. Each of the following accounts increased during 2021: Land $13,000 Prepaid rent $13,600 Available-for-sale securities $3,000 Prepaid expense $20,000 What is the amount of cash provided by or used by investing activities for XYZ, Inc. for the year ended December 31, 2021? 6 15) Interest collected and principal collected on a note receivable are examples of an investing activity. (answer True or False) I 16) Tulip Company sold a plant asset during 2021. The original cost of the plant asset was $700,000 and the accumulated depreciation at date of sale was $600,000. The proceeds from the sale of the plant asset was $80,000. The gain or loss from the sale of the plant asset should be shown in which section of the statement of cash flows? 17) Apple Corporation had net income for 2021 of $2,500,000. Additional information is as follows: Depreciation of plant assets Amortization of bond premium Decrease in accounts receivable Increase in accounts payable $800,000 200,000 420,000 440,000 Apple's net cash provided (used) by operating activities for 2021 was 18) Blue Sky Company reported net income of $520,000 for the year ended 12/31/21. Included in the computation of net income were: amortization of a patent, $40,000; income from an investment in common stock of Grape Inc., accounted for under the equity method, 562,000; and amortization of a bond discount, $17,000. Blue Sky also paid a $50,000 dividend during the year. The net cash provided (used) by operating activities would be reported at 19) XYZ, Inc. reported net income of $65,000 for the year ended December 31, 2021. Included in net income were depreciation expense of $20,000 and a gain on sale of equipment of $5,400. The equipment had an historical cost of $70,000 and accumulated depreciation of $55,000. Each of the following accounts increased during 2021: Land $13,000 Prepaid rent $13,600 Available-for-sale securities $3,000 Prepaid expense $20,000 What is the amount of cash provided by or used by investing activities for XYZ, Inc. for the year ended December 31, 2021