Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6 15 Problem 3 0o pts) GUMO, Inc., a leading manufacturer of Solar Panels in Carefree, Arizona, is planning to expand ils operations. Using the

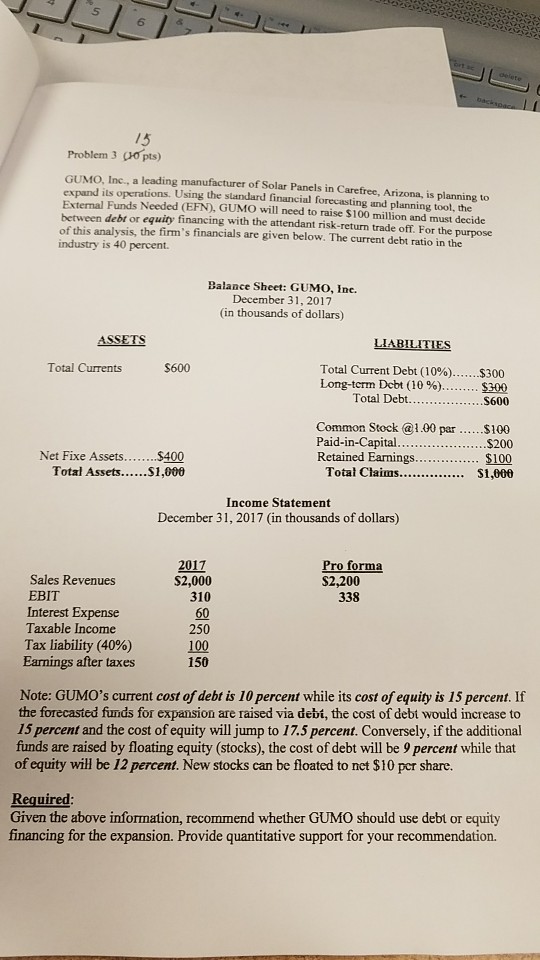

6 15 Problem 3 0o pts) GUMO, Inc., a leading manufacturer of Solar Panels in Carefree, Arizona, is planning to expand ils operations. Using the slandard financial forecasting and planning tool, the External Funds Needed (EFN), GUMO will need to raise $100 million and must decide between debt or equity financing with the attendant risk-return trade off. For the purpose of this analysis, the firm's financials are given below. The current debt ratio in the industry is 40 percent. Balance Sheet: GUMO, Ine. December 31, 2017 (in thousands of dollars) ASSETS Total Currents $600 Total Current Debt (10%) 5300 Long-term Debt (10%) $300 S600 Total Debt.... Common Stock @1.00 pars100 $200 $100 Paid-in-Capital Retained Earnings.. Net Fixe Asset .$400 Income Statement December 31, 2017 (in thousands of dollars) 2017 $2,000 310 60 250 100 150 Sales Revenues $2,200 338 EBIT Interest Expense Taxable Income Tax liability (40%) Earnings after taxes Note: GUMO's current cost of debt is 10 percent while its cost of equity is 15 percent. If the forecasted funds for expansion are raised via debt, the cost of debt would increase to 15 percent and the cost of equity will jump to 17.5 percent. Conversely, if the additional funds are raised by floating equity (stocks), the cost of debt will be 9 percent while that of equity will be 12 percent. New stocks can be floated to net $10 per share. Reguired Given the above information, recommend whether GUMO should use debt or equity financing for the expansion. Provide quantitative support for your recommendation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started