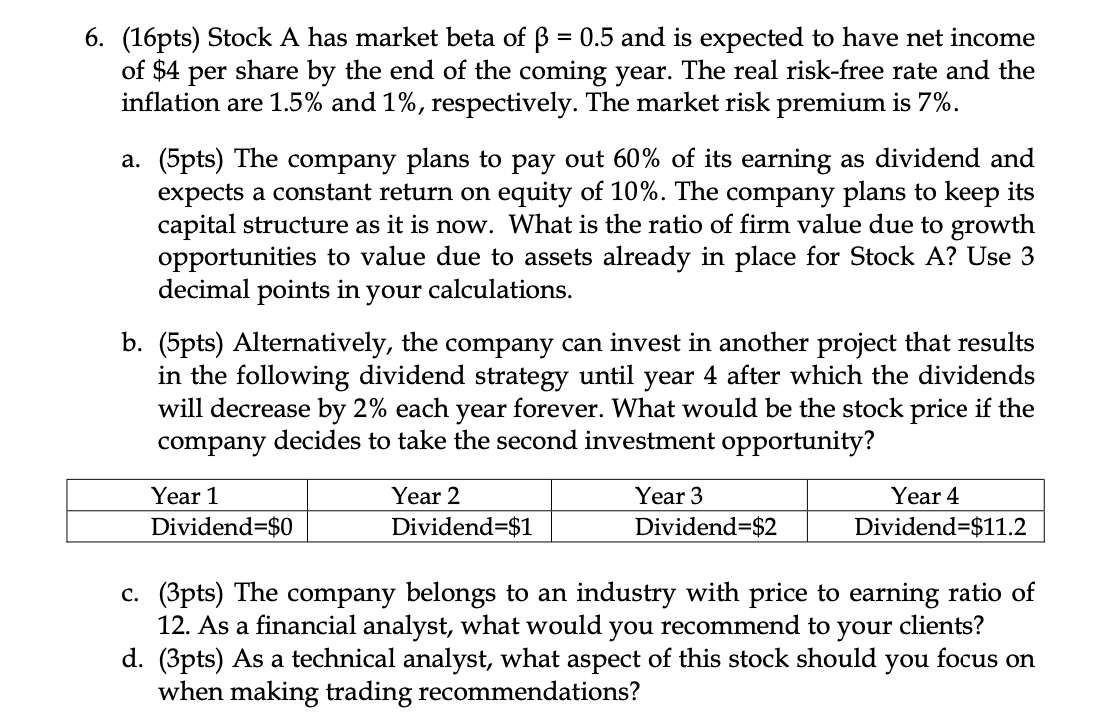

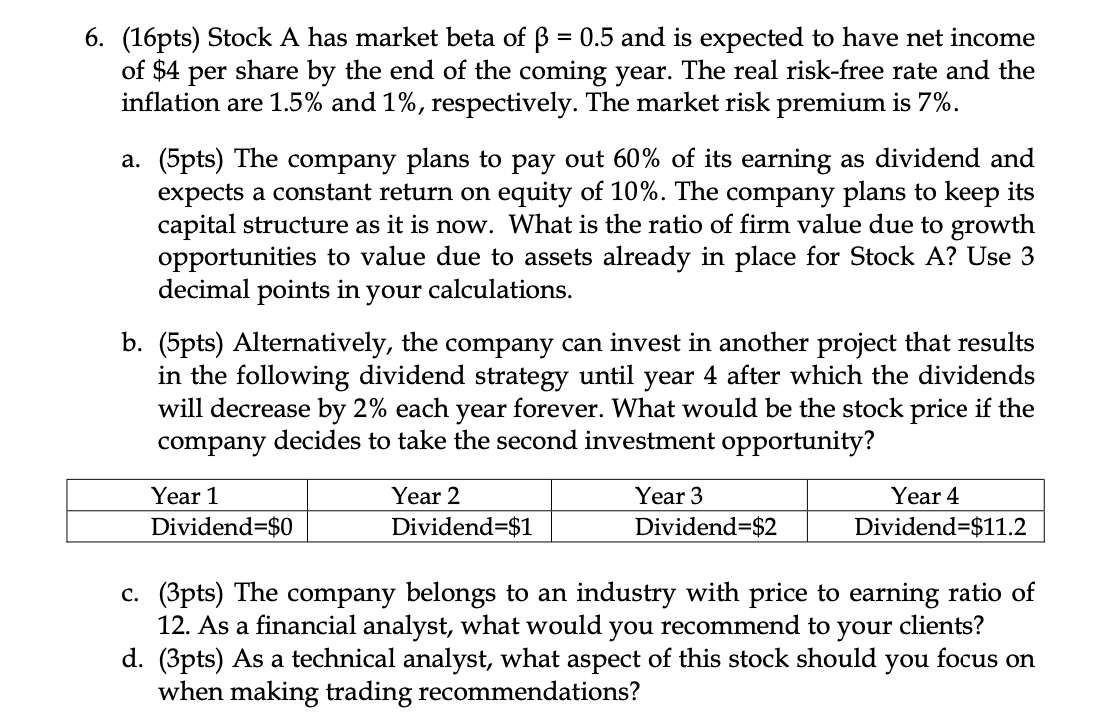

6. (16pts) Stock A has market beta of = 0.5 and is expected to have net income of $4 per share by the end of the coming year. The real risk-free rate and the inflation are 1.5% and 1%, respectively. The market risk premium is 7%. a. (5pts) The company plans to pay out 60% of its earning as dividend and expects a constant return on equity of 10%. The company plans to keep its capital structure as it is now. What is the ratio of firm value due to growth opportunities to value due to assets already in place for Stock A? Use 3 decimal points in your calculations. b. (5pts) Alternatively, the company can invest in another project that results in the following dividend strategy until year 4 after which the dividends will decrease by 2% each year forever. What would be the stock price if the company decides to take the second investment opportunity? Year 1 Dividend=$0 Year 2 Dividend=$1 Year 3 Dividend=$2 Year 4 Dividend=$11.2 c. (3pts) The company belongs to an industry with price to earning ratio of 12. As a financial analyst, what would you recommend to your clients? d. (3pts) As a technical analyst, what aspect of this stock should you focus on when making trading recommendations? 6. (16pts) Stock A has market beta of = 0.5 and is expected to have net income of $4 per share by the end of the coming year. The real risk-free rate and the inflation are 1.5% and 1%, respectively. The market risk premium is 7%. a. (5pts) The company plans to pay out 60% of its earning as dividend and expects a constant return on equity of 10%. The company plans to keep its capital structure as it is now. What is the ratio of firm value due to growth opportunities to value due to assets already in place for Stock A? Use 3 decimal points in your calculations. b. (5pts) Alternatively, the company can invest in another project that results in the following dividend strategy until year 4 after which the dividends will decrease by 2% each year forever. What would be the stock price if the company decides to take the second investment opportunity? Year 1 Dividend=$0 Year 2 Dividend=$1 Year 3 Dividend=$2 Year 4 Dividend=$11.2 c. (3pts) The company belongs to an industry with price to earning ratio of 12. As a financial analyst, what would you recommend to your clients? d. (3pts) As a technical analyst, what aspect of this stock should you focus on when making trading recommendations