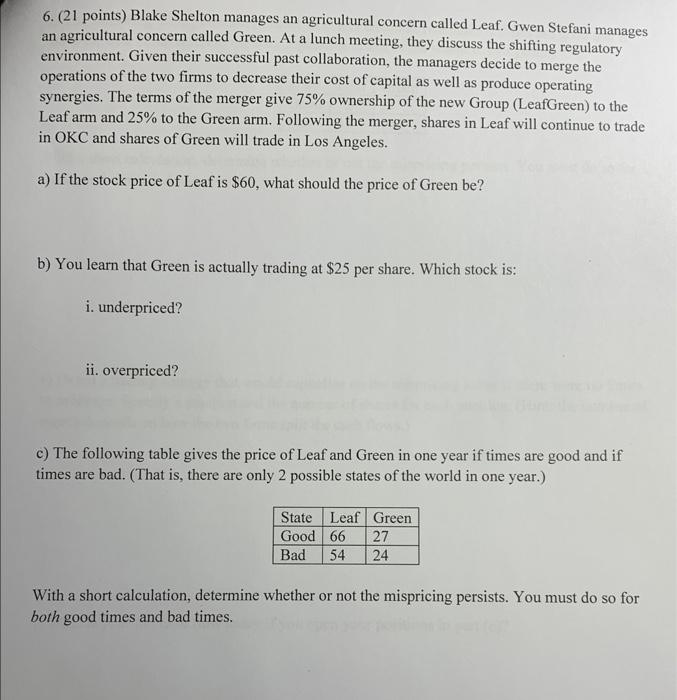

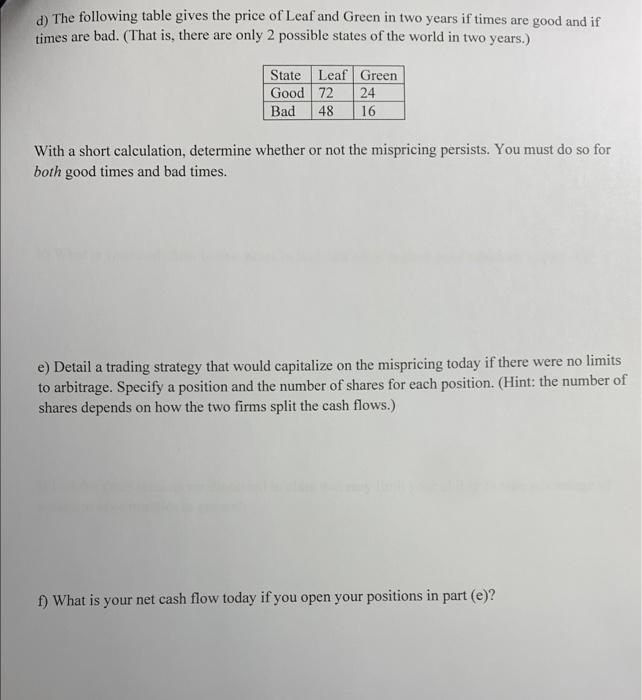

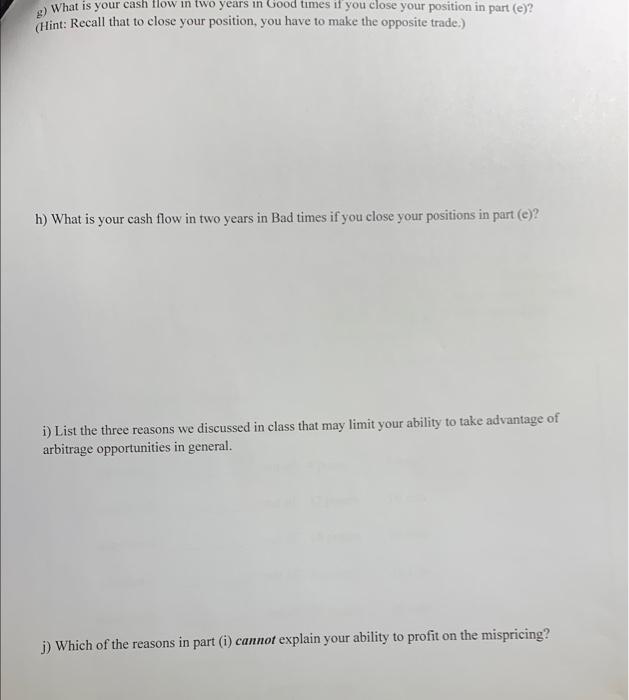

6. (21 points) Blake Shelton manages an agricultural concern called Leaf. Gwen Stefani manages an agricultural concern called Green. At a lunch meeting, they discuss the shifting regulatory environment. Given their successful past collaboration, the managers decide to merge the operations of the two firms to decrease their cost of capital as well as produce operating synergies. The terms of the merger give 75% ownership of the new Group (LeafGreen) to the Leaf arm and 25% to the Green arm. Following the merger, shares in Leaf will continue to trade in OKC and shares of Green will trade in Los Angeles. a) If the stock price of Leaf is $60, what should the price of Green be? b) You learn that Green is actually trading at $25 per share. Which stock is: i. underpriced? ii. overpriced? c) The following table gives the price of Leaf and Green in one year if times are good and if times are bad. (That is, there are only 2 possible states of the world in one year.) With a short calculation, determine whether or not the mispricing persists. You must do so for both good times and bad times. d) The following table gives the price of Leaf and Green in two years if times are good and if times are bad. (That is, there are only 2 possible states of the world in two years.) With a short calculation, determine whether or not the mispricing persists. You must do so for both good times and bad times. e) Detail a trading strategy that would capitalize on the mispricing today if there were no limits to arbitrage. Specify a position and the number of shares for each position. (Hint: the number of shares depends on how the two firms split the cash flows.) f) What is your net cash flow today if you open your positions in part (e)? g) What is your cash flow in two years in Good times if you close your position in part (e)? (Hint: Recall that to close your position, you have to make the opposite trade.) h) What is your cash flow in two years in Bad times if you close your positions in part (e)? i) List the three reasons we discussed in class that may limit your ability to take advantage of arbitrage opportunities in general. j) Which of the reasons in part (i) cannot explain your ability to profit on the mispricing