#6

#7

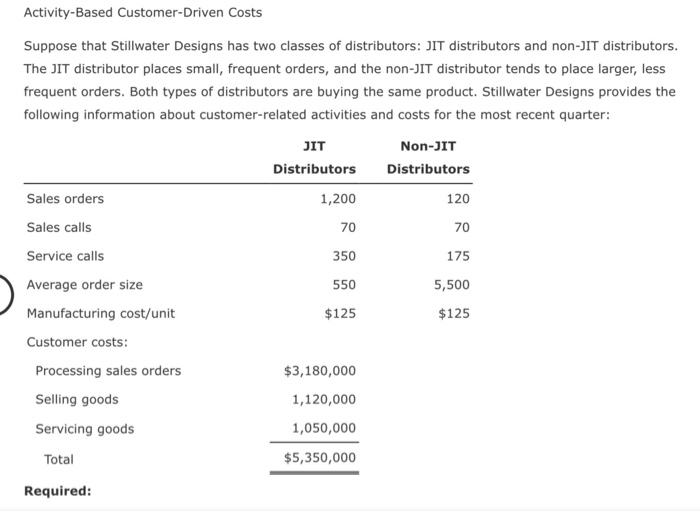

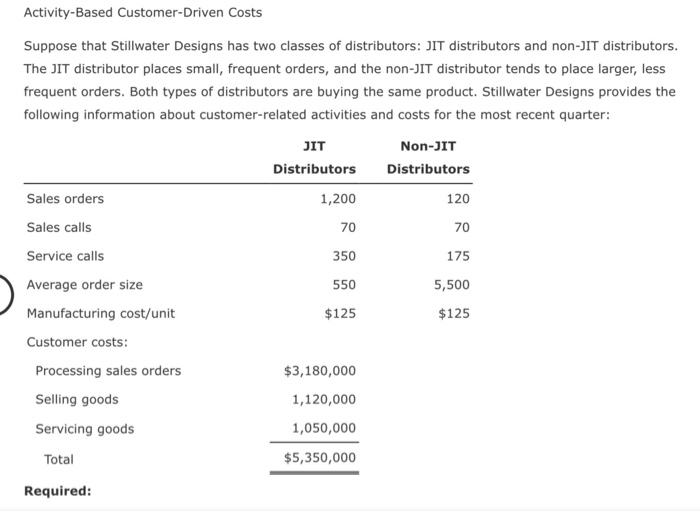

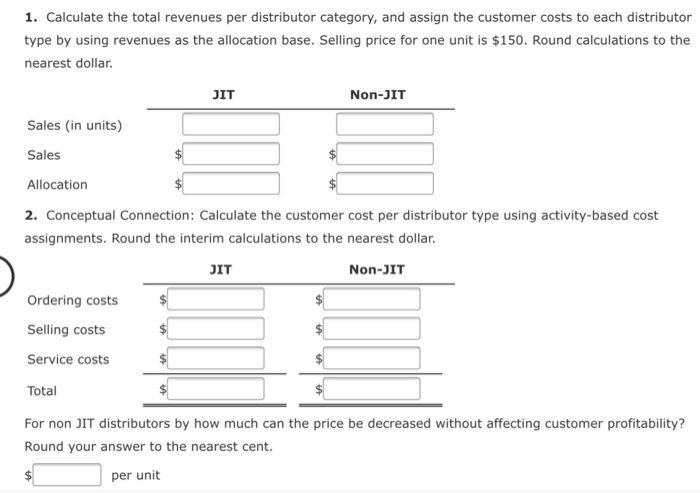

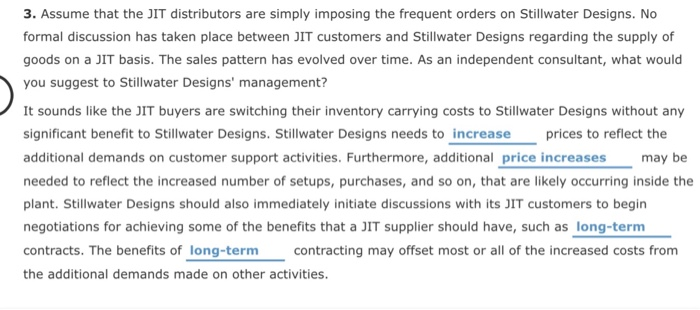

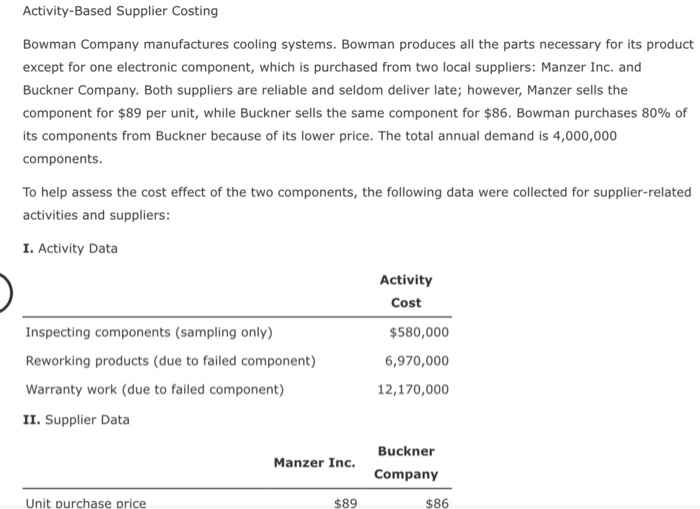

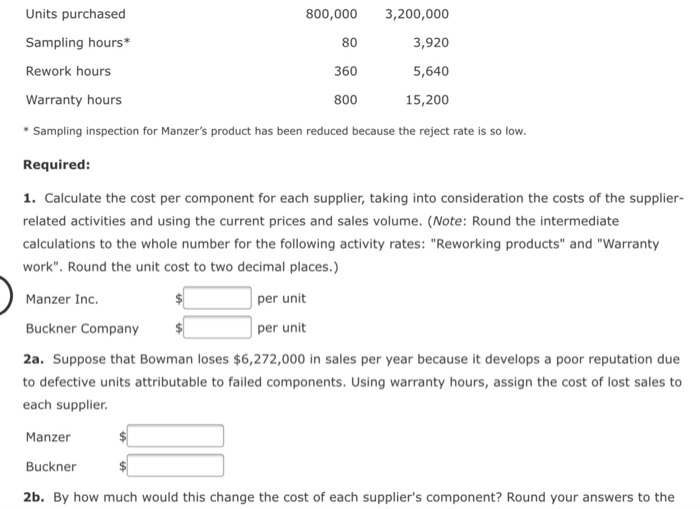

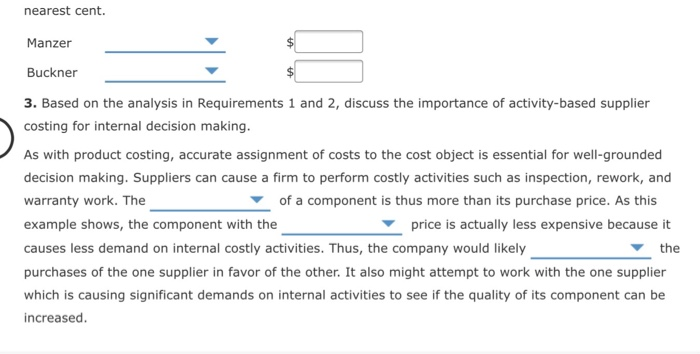

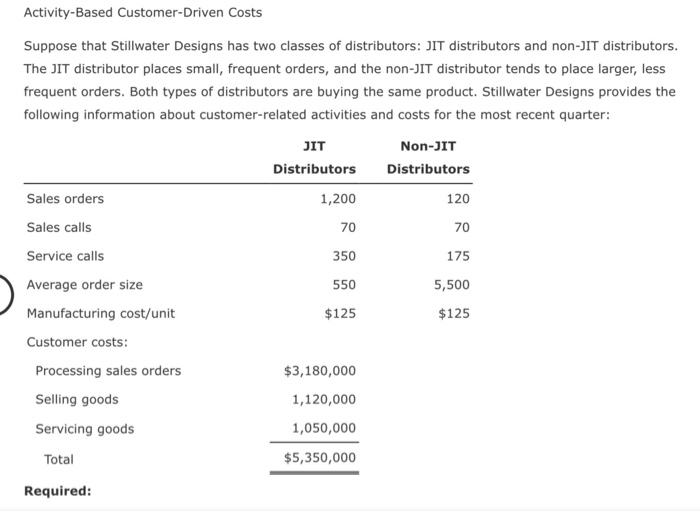

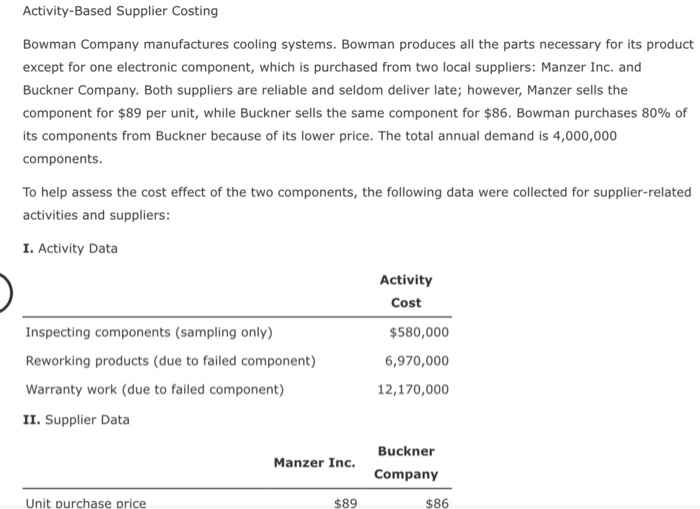

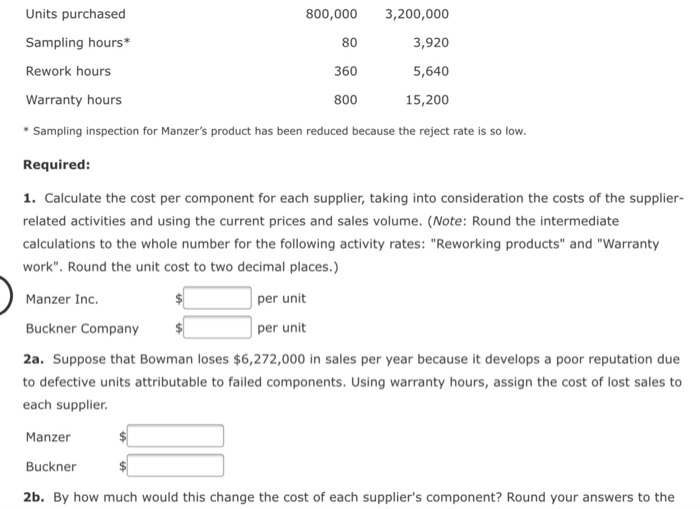

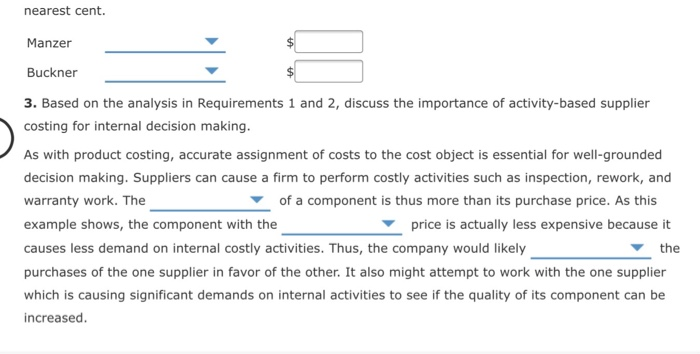

Activity-Based Customer-Driven Costs Suppose that Stillwater Designs has two classes of distributors: JIT distributors and non-JIT distributors. The JIT distributor places small, frequent orders, and the non-JIT distributor tends to place larger, less frequent orders. Both types of distributors are buying the same product. Stillwater Designs provides the following information about customer-related activities and costs for the most recent quarter: JIT Distributors Non-JIT Distributors Sales orders 120 Sales calls 1,200 70 350 70 Service calls 175 550 5,500 Average order size Manufacturing cost/unit $125 $125 Customer costs: Processing sales orders $3,180,000 1,120,000 Selling goods Servicing goods 1,050,000 Total $5,350,000 Required: 1. Calculate the total revenues per distributor category, and assign the customer costs to each distributor type by using revenues as the allocation base. Selling price for one unit is $150. Round calculations to the nearest dollar JIT Non-JIT Sales in units) Sales Allocation 2. Conceptual Connection: Calculate the customer cost per distributor type using activity-based cost assignments. Round the interim calculations to the nearest dollar. JIT Non-JIT Ordering costs Selling costs Service costs Total For non IT distributors by how much can the price be decreased without affecting customer profitability? Round your answer to the nearest cent. per unit 3. Assume that the JIT distributors are simply imposing the frequent orders on Stillwater Designs. No formal discussion has taken place between JIT customers and Stillwater Designs regarding the supply of goods on a JIT basis. The sales pattern has evolved over time. As an independent consultant, what would you suggest to Stillwater Designs' management? It sounds like the JIT buyers are switching their inventory carrying costs to Stillwater Designs without any significant benefit to Stillwater Designs. Stillwater Designs needs to increase prices to reflect the additional demands on customer support activities. Furthermore, additional price increases may be needed to reflect the increased number of setups, purchases, and so on, that are likely occurring inside the plant. Stillwater Designs should also immediately initiate discussions with its JIT customers to begin negotiations for achieving some of the benefits that a JIT supplier should have, such as long-term contracts. The benefits of long-term contracting may offset most or all of the increased costs from the additional demands made on other activities. Activity-Based Supplier Costing Bowman Company manufactures cooling systems. Bowman produces all the parts necessary for its product except for one electronic component, which is purchased from two local suppliers: Manzer Inc. and Buckner Company. Both suppliers are reliable and seldom deliver late; however, Manzer sells the component for $89 per unit, while Buckner sells the same component for $86. Bowman purchases 80% of its components from Buckner because of its lower price. The total annual demand is 4,000,000 components. To help assess the cost effect of the two components, the following data were collected for supplier-related activities and suppliers: I. Activity Data Activity Cost Inspecting components (sampling only) Reworking products (due to failed component) Warranty work (due to failed component) II. Supplier Data $580,000 6,970,000 12,170,000 Manzer Inc. Buckner Company Unit purchase price $89 $86 Units purchased 800,000 Sampling hours* 80 3,200,000 3,920 5,640 15,200 Rework hours 360 Warranty hours 800 * Sampling inspection for Manzer's product has been reduced because the reject rate is so low. Required: 1. Calculate the cost per component for each supplier, taking into consideration the costs of the supplier- related activities and using the current prices and sales volume. (Note: Round the intermediate calculations to the whole number for the following activity rates: "Reworking products" and "Warranty work". Round the unit cost to two decimal places.) Manzer Inc. $ per unit Buckner Company $ per unit 2a. Suppose that Bowman loses $6,272,000 in sales per year because it develops a poor reputation due to defective units attributable to failed components. Using warranty hours, assign the cost of lost sales to each supplier. Manzer Buckner 2b. By how much would this change the cost of each supplier's component? Round your answers to the nearest cent. Manzer Buckner 3. Based on the analysis in Requirements 1 and 2, discuss the importance of activity-based supplier costing for internal decision making. As with product costing, accurate assignment of costs to the cost object is essential for well-grounded decision making. Suppliers can cause a firm to perform costly activities such as inspection, rework, and warranty work. The of a component is thus more than its purchase price. As this example shows, the component with the price is actually less expensive because it causes less demand on internal costly activities. Thus, the company would likely the purchases of the one supplier in favor of the other. It also might attempt to work with the one supplier which is causing significant demands on internal activities to see if the quality of its component can be increased