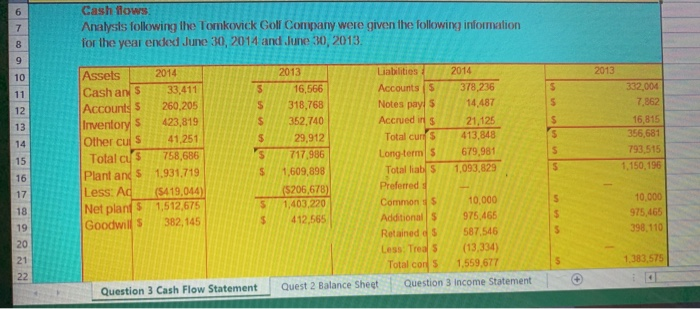

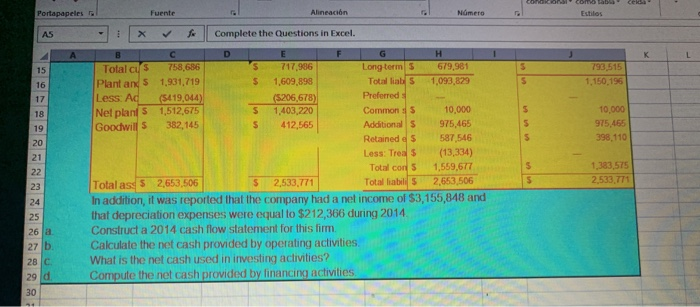

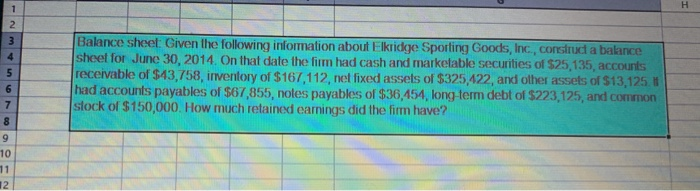

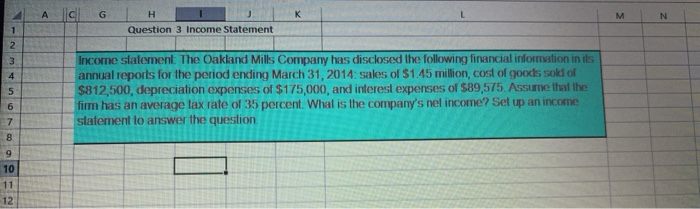

6 7 Cash flows Analysis following the Tomkovick Golf Company were given the following information for the year ended June 30, 2014 and June 30, 2013 8 9 2013 10 $ 5 11 12 13 S $ $ $ $ $ $ s Assets 2014 Cash ans 33,411 Accounts 260,205 Inventory s 423,819 Other cus 41,251 Total cus 758,686 Plant and $ 1.931,719 Less: Ad (5419,044) Net plan 1,512,675 Goodwill s 382,145 332004 7,862 16,815 356,681 793,515 1,150.196 14 15 16 5 S 2013 Liabilities 2014 16,566 Accounts 378,236 318,768 Notes pays 14.487 352,740 Accrued its 21,125 29,912 Total curs 413,848 717986 Long-terms 679,981 1,609,898 Total liabl 5 1,093,829 (5206,678) Preferred 1,403,220 Commons 10,000 412,565 Additional 975,465 Retained 5 587,546 Less Treas (13,334) Total cons 1.559,677 Quest 2 Balance Sheet Question 3 Income Statement 17 5 $ 18 19 20 5 $ 5 10,000 975,465 398,110 21 1.383.575 22 Question 3 Cash Flow Statement Portapapeles Fuente Alineacin Nmero Estilos AS Complete the Questions in Excel. F G K L 5 15 793 515 1,150,195 5 16 17 $ 18 10,000 975,465 398,110 19 S S 20 21 22 23 B C D E H Total cu's 758,686 S 717,986 Long term 5 679,981 Plant and S 1,931,719 $ 1,609,898 Totallas 1,093,829 Less: Ad (5419,044) (5206,678) Preferred Nel plants 1,512,675 $ 1,403,220 Commons 5 10,000 Goodwill 382,145 $ 412,565 Additionals 975,465 Retained as 587,546 Less: Treas (13,334) Total con 5 1,559,677 Total ass 5 2,653,506 $ 2,533,771 Total liabilis 2,553,506 In addition, it was reported that the company had a net income of $3,155,848 and that depreciation expenses were equal to $212,366 during 2014 Construct a 2014 cash flow statement for this firm Calculate the net cash provided by operating activities What is the net cash used in investing activities? Compute the net cash provided by financing activities $ S 1,383,575 2,533.771 24 25 26 a 27 b 28 C 29 d 30 1 H 2 3 4 5 6 7 8 9 10 11 12 Balance sheet: Given the following information about Elkridge Sporting Goods, Inc., construct a balance sheet for June 30, 2014. On that date the firm had cash and marketable securities of $25,135, accounts receivable of $43,758, inventory of $167,112, net fixed assets of $325,422, and other assets of $13,125 1 had accounts payables of $67,855, noles payables of $36,454, long term debt of $223,125, and common stock of $150,000. How much retained earnings did the firm have? A G H K M N Question 3 Income Statement 1 2 3 4 5 6 7 8 9 Income statement The Oakland Mills Company has disclosed the following financial information in its annual reports for the period ending March 31, 2014: sales of $1.45 million, cost of goods sokl of $812,500, depreciation expenses of $175,000, and interest expenses of $89,575. Assume that the firm has an average tax rate of 35 percent. What is the company's net income? Set up an income statement to answer the question 10 11 12 6 7 Cash flows Analysis following the Tomkovick Golf Company were given the following information for the year ended June 30, 2014 and June 30, 2013 8 9 2013 10 $ 5 11 12 13 S $ $ $ $ $ $ s Assets 2014 Cash ans 33,411 Accounts 260,205 Inventory s 423,819 Other cus 41,251 Total cus 758,686 Plant and $ 1.931,719 Less: Ad (5419,044) Net plan 1,512,675 Goodwill s 382,145 332004 7,862 16,815 356,681 793,515 1,150.196 14 15 16 5 S 2013 Liabilities 2014 16,566 Accounts 378,236 318,768 Notes pays 14.487 352,740 Accrued its 21,125 29,912 Total curs 413,848 717986 Long-terms 679,981 1,609,898 Total liabl 5 1,093,829 (5206,678) Preferred 1,403,220 Commons 10,000 412,565 Additional 975,465 Retained 5 587,546 Less Treas (13,334) Total cons 1.559,677 Quest 2 Balance Sheet Question 3 Income Statement 17 5 $ 18 19 20 5 $ 5 10,000 975,465 398,110 21 1.383.575 22 Question 3 Cash Flow Statement Portapapeles Fuente Alineacin Nmero Estilos AS Complete the Questions in Excel. F G K L 5 15 793 515 1,150,195 5 16 17 $ 18 10,000 975,465 398,110 19 S S 20 21 22 23 B C D E H Total cu's 758,686 S 717,986 Long term 5 679,981 Plant and S 1,931,719 $ 1,609,898 Totallas 1,093,829 Less: Ad (5419,044) (5206,678) Preferred Nel plants 1,512,675 $ 1,403,220 Commons 5 10,000 Goodwill 382,145 $ 412,565 Additionals 975,465 Retained as 587,546 Less: Treas (13,334) Total con 5 1,559,677 Total ass 5 2,653,506 $ 2,533,771 Total liabilis 2,553,506 In addition, it was reported that the company had a net income of $3,155,848 and that depreciation expenses were equal to $212,366 during 2014 Construct a 2014 cash flow statement for this firm Calculate the net cash provided by operating activities What is the net cash used in investing activities? Compute the net cash provided by financing activities $ S 1,383,575 2,533.771 24 25 26 a 27 b 28 C 29 d 30 1 H 2 3 4 5 6 7 8 9 10 11 12 Balance sheet: Given the following information about Elkridge Sporting Goods, Inc., construct a balance sheet for June 30, 2014. On that date the firm had cash and marketable securities of $25,135, accounts receivable of $43,758, inventory of $167,112, net fixed assets of $325,422, and other assets of $13,125 1 had accounts payables of $67,855, noles payables of $36,454, long term debt of $223,125, and common stock of $150,000. How much retained earnings did the firm have? A G H K M N Question 3 Income Statement 1 2 3 4 5 6 7 8 9 Income statement The Oakland Mills Company has disclosed the following financial information in its annual reports for the period ending March 31, 2014: sales of $1.45 million, cost of goods sokl of $812,500, depreciation expenses of $175,000, and interest expenses of $89,575. Assume that the firm has an average tax rate of 35 percent. What is the company's net income? Set up an income statement to answer the question 10 11 12