Answered step by step

Verified Expert Solution

Question

1 Approved Answer

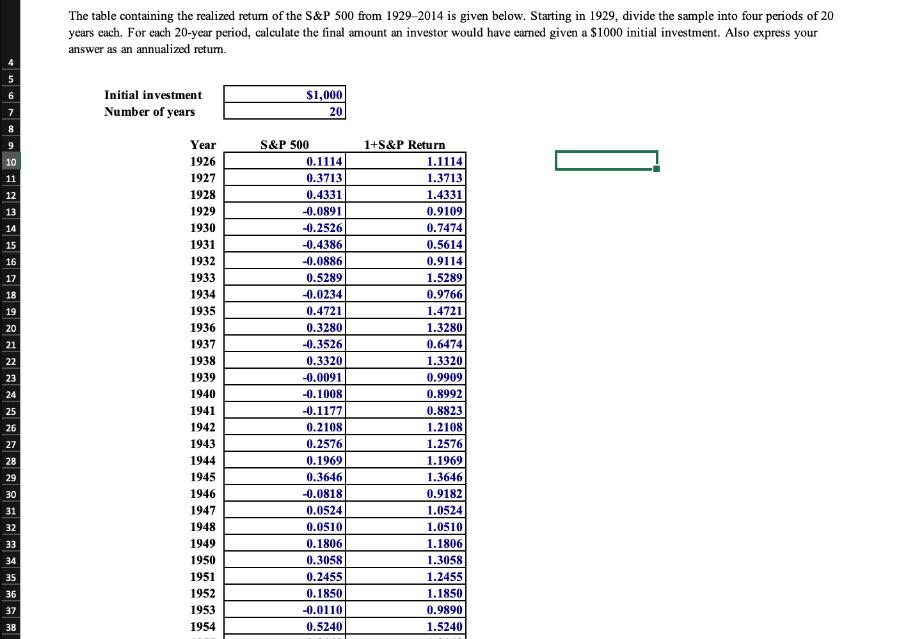

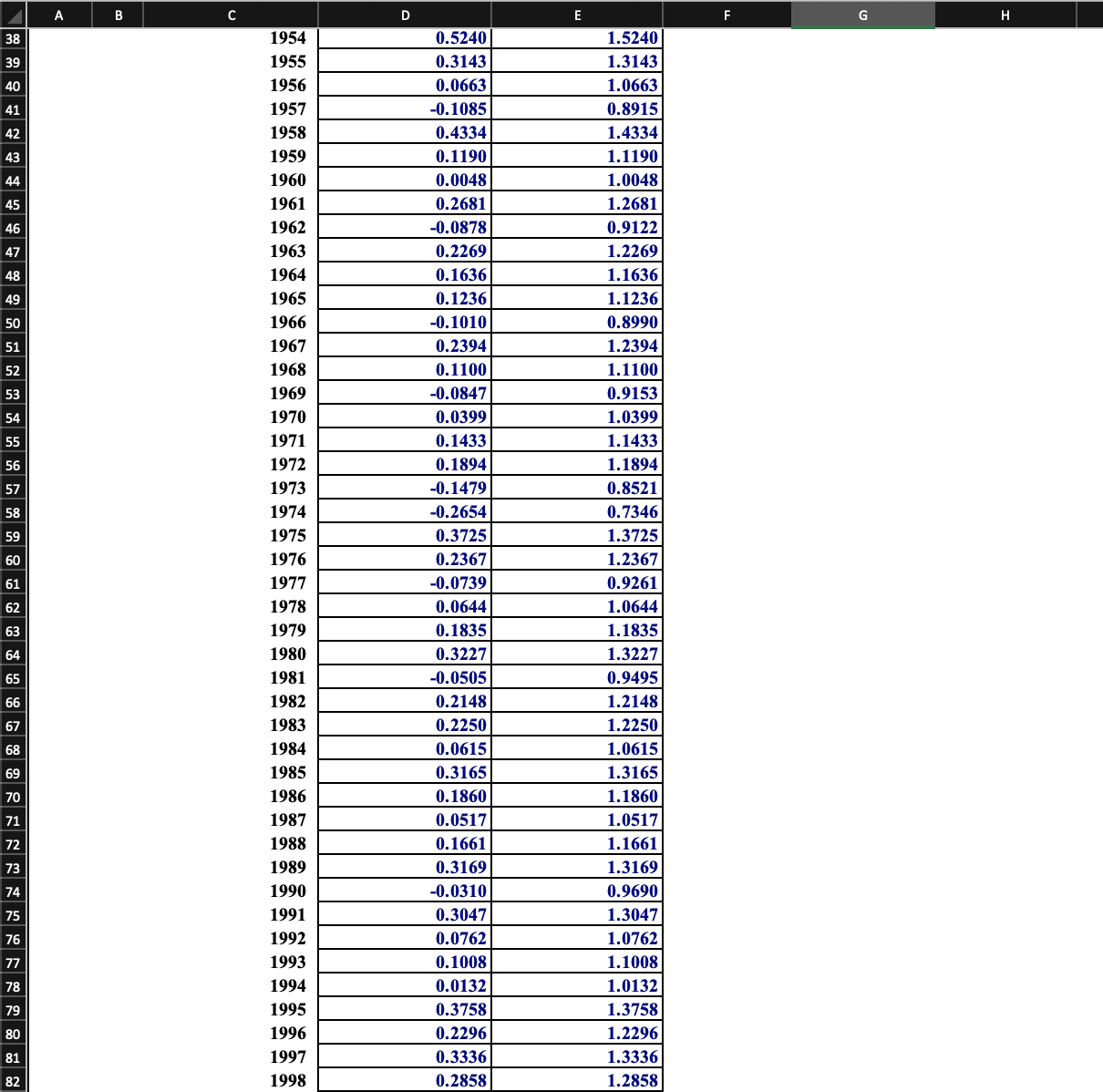

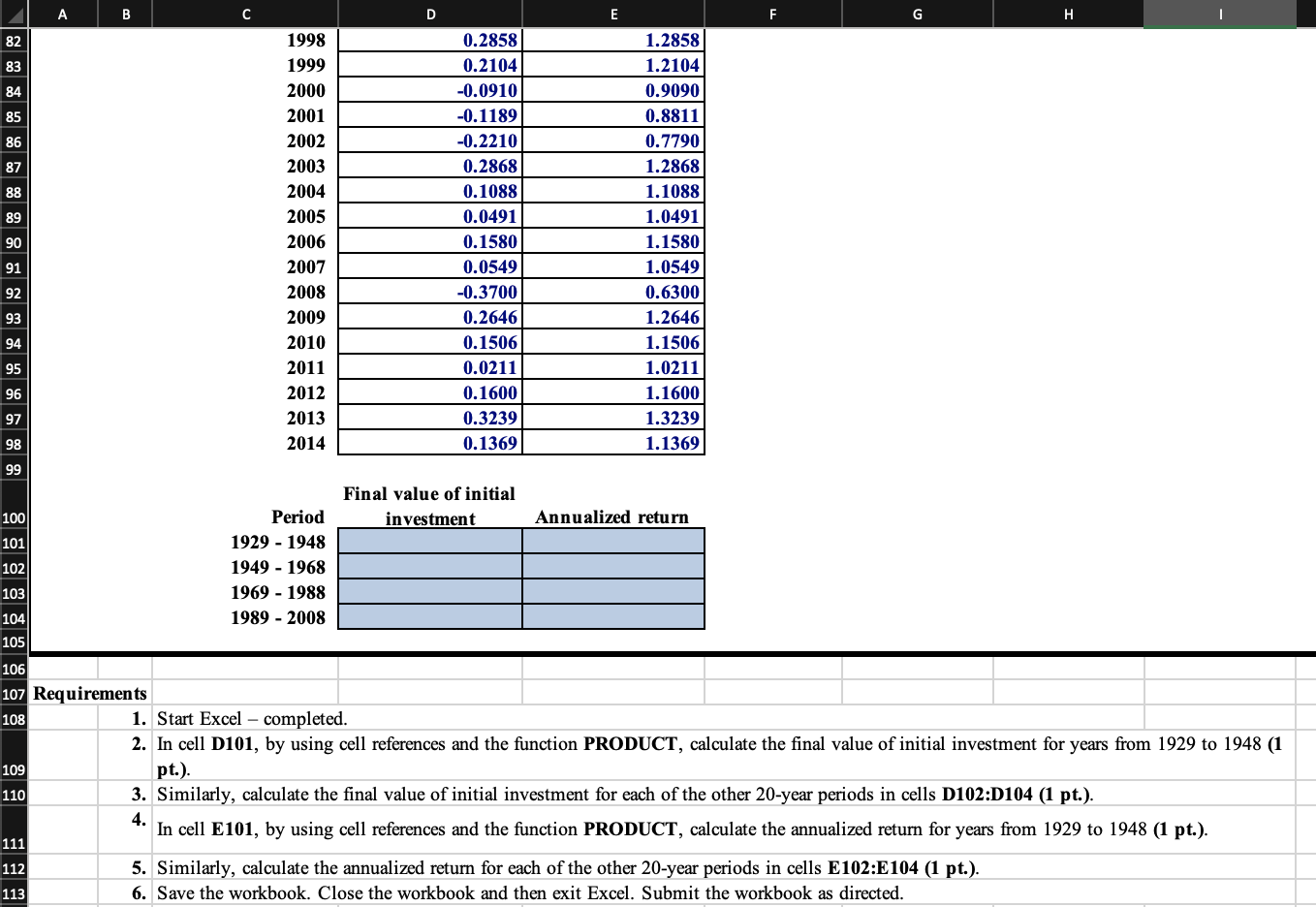

6 8 The table containing the realized return of the S&P 500 from 1929-2014 is given below. Starting in 1929, divide the sample into

6 8 The table containing the realized return of the S&P 500 from 1929-2014 is given below. Starting in 1929, divide the sample into four periods of 20 years each. For each 20-year period, calculate the final amount an investor would have earned given a $1000 initial investment. Also express your answer as an annualized return. Initial investment Number of years $1,000 20 Year S&P 500 1+S&P Return 10 1926 0.1114 1.1114 11 1927 0.3713 1.3713 12 1928 0.4331 1.4331 13 1929 -0.0891 0.9109 14 1930 -0.2526 0.7474 15 1931 -0.4386 0.5614 16 1932 -0.0886 0.9114 17 1933 0.5289 1.5289 18 1934 -0.0234 0.9766 19 1935 0.4721 1.4721 20 1936 0.3280 1.3280 21 1937 -0.3526 0.6474 22 1938 0.3320 1.3320 23 1939 -0.0091 0.9909 24 1940 -0.1008 0.8992 25 1941 -0.1177 0.8823 26 1942 0.2108 1.2108 27 1943 0.2576 1.2576 28 1944 0.1969 1.1969 29 1945 0.3646 1.3646 30 1946 -0.0818 0.9182 31 1947 0.0524 1.0524 32 1948 0.0510 1.0510 33 1949 0.1806 1.1806 34 1950 0.3058 1.3058 35 1951 0.2455 1.2455 36 1952 0.1850 1.1850 37 1953 -0.0110 0.9890 38 1954 0.5240 1.5240 B D E F H 69 79 80 8 8 & & R ^ R R 1954 0.5240 1.5240 39 1955 0.3143 1.3143 40 41 42 1956 0.0663 1.0663 1957 -0.1085 0.8915 1958 0.4334 1.4334 43 1959 0.1190 1.1190 1960 0.0048 1.0048 45 1961 0.2681 1.2681 46 1962 -0.0878 0.9122 1963 0.2269 1.2269 48 1964 0.1636 1.1636 49 1965 0.1236 1.1236 50 1966 -0.1010 0.8990 51 1967 0.2394 1.2394 52 1968 0.1100 1.1100 53 1969 -0.0847 0.9153 54 1970 0.0399 1.0399 55 1971 0.1433 1.1433 56 1972 0.1894 1.1894 57 1973 -0.1479 0.8521 58 1974 -0.2654 0.7346 59 1975 0.3725 1.3725 1976 0.2367 1.2367 61 1977 -0.0739 0.9261 62 1978 0.0644 1.0644 63 1979 0.1835 1.1835 64 1980 0.3227 1.3227 65 1981 -0.0505 0.9495 1982 0.2148 1.2148 1983 0.2250 1.2250 68 1984 0.0615 1.0615 1985 0.3165 1.3165 1986 0.1860 1.1860 71 1987 0.0517 1.0517 72 1988 0.1661 1.1661 73 1989 0.3169 1.3169 74 1990 -0.0310 0.9690 1991 0.3047 1.3047 76 1992 0.0762 1.0762 1993 0.1008 1.1008 78 1994 0.0132 1.0132 1995 0.3758 1.3758 1996 0.2296 1.2296 81 1997 0.3336 1.3336 82 1998 0.2858 1.2858 A B C D E F G H 8 6 8 8 8 8 8 1998 0.2858 1.2858 1999 0.2104 1.2104 2000 -0.0910 0.9090 2001 -0.1189 0.8811 2002 -0.2210 0.7790 2003 0.2868 1.2868 2004 0.1088 1.1088 2005 0.0491 1.0491 2006 0.1580 1.1580 2007 0.0549 1.0549 2008 -0.3700 0.6300 2009 0.2646 1.2646 2010 0.1506 1.1506 2011 0.0211 1.0211 2012 0.1600 1.1600 2013 0.3239 1.3239 2014 0.1369 1.1369 100 Period Final value of initial investment Annualized return 101 1929-1948 102 1949-1968 103 1969-1988 104 1989 - 2008 105 106 107 Requirements 108 109 110 1. Start Excel - completed. 2. In cell D101, by using cell references and the function PRODUCT, calculate the final value of initial investment for years from 1929 to 1948 (1 pt.). 3. Similarly, calculate the final value of initial investment for each of the other 20-year periods in cells D102:D104 (1 pt.). 4. In cell E101, by using cell references and the function PRODUCT, calculate the annualized return for years from 1929 to 1948 (1 pt.). 111 112 5. Similarly, calculate the annualized return for each of the other 20-year periods in cells E102:E104 (1 pt.). 113 6. Save the workbook. Close the workbook and then exit Excel. Submit the workbook as directed.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started