Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6 9 10 In March 2019, Ms. Rea Navara opened Navara Department Store. The following are the transactions incurred by her business in its first

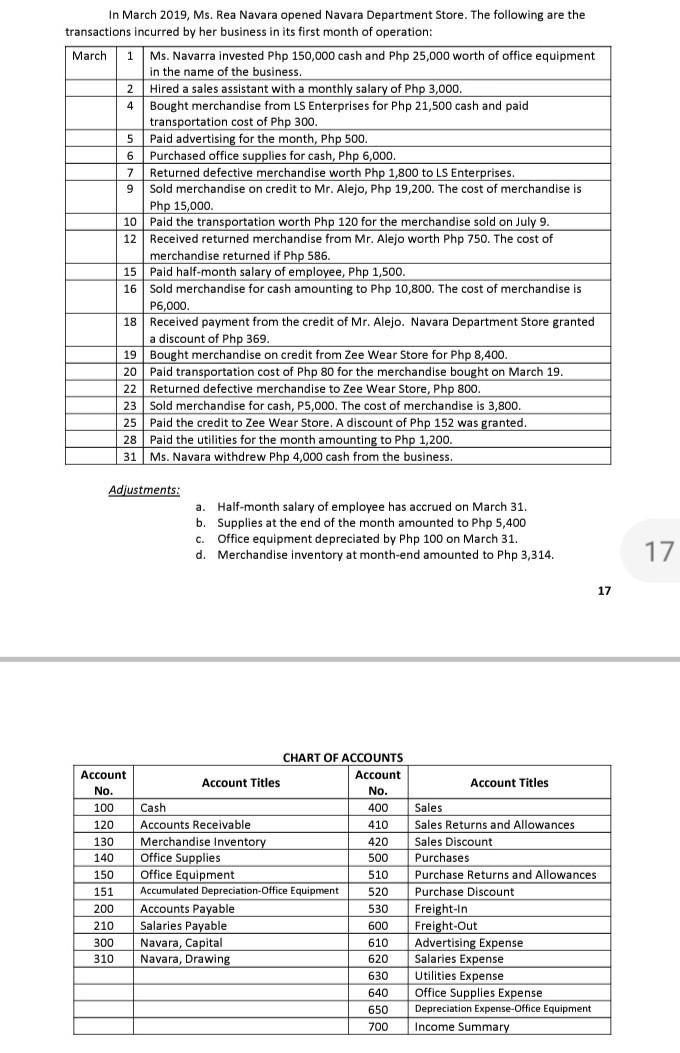

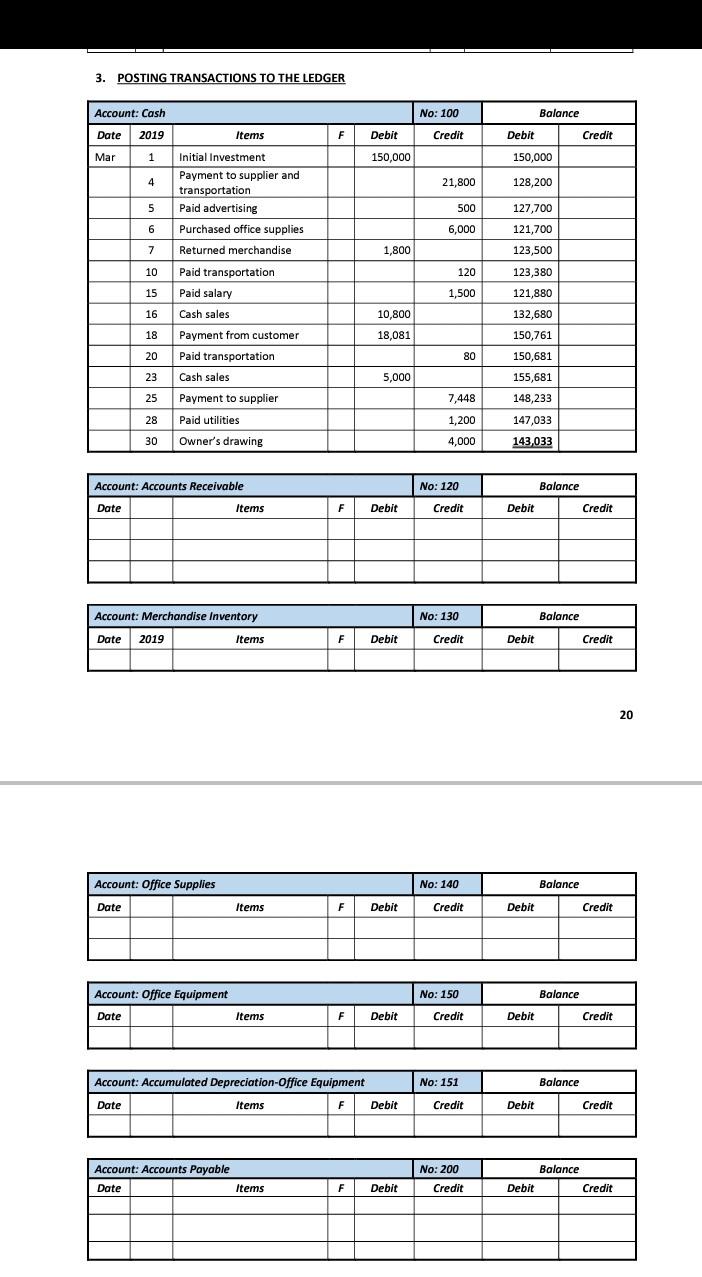

6 9 10 In March 2019, Ms. Rea Navara opened Navara Department Store. The following are the transactions incurred by her business in its first month of operation: March 1 Ms. Navarra invested Php 150,000 cash and Php 25,000 worth of office equipment in the name of the business. 2 Hired a sales assistant with a monthly salary of Php 3,000. 4 Bought merchandise from LS Enterprises for Php 21,500 cash and paid transportation cost of Php 300. 5 Paid advertising for the month, Php 500. Purchased office supplies for cash, Php 6,000. 7 Returned defective merchandise worth Php 1,800 to LS Enterprises. Sold merchandise on credit to Mr. Alejo, Php 19,200. The cost of merchandise is Php 15,000. Paid the transportation worth Php 120 for the merchandise sold on July 9. 12 Received returned merchandise from Mr. Alejo worth Php 750. The cost of merchandise returned if Php 586. 15 Paid half-month salary of employee, Php 1,500. 16 Sold merchandise for cash amounting to Php 10,800. The cost of merchandise is P6,000. 18 Received payment from the credit of Mr. Alejo. Navara Department Store granted a discount of Php 369. 19 Bought merchandise on credit from Zee Wear Store for Php 8,400. 20 Paid transportation cost of Php 80 for the merchandise bought on March 19. 22 Returned defective merchandise to Zee Wear Store, Php 800. Sold merchandise for cash, P5,000. The cost of merchandise is 3,800. 25 Paid the credit to Zee Wear Store. A discount of Php 152 was granted. 28 Paid the utilities for the month amounting to Php 1,200. 31 Ms. Navara withdrew Php 4,000 cash from the business. 23 Adjustments: a. Half-month salary of employee has accrued on March 31. b. Supplies at the end of the month amounted to Php 5,400 c. Office equipment depreciated by Php 100 on March 31. d. Merchandise inventory at month-end amounted to Php 3,314. 17 17 Account No. 100 120 130 140 150 151 200 210 300 310 CHART OF ACCOUNTS Account Titles Account Account Titles No. Cash 400 Sales Accounts Receivable 410 Sales Returns and Allowances Merchandise Inventory 420 Sales Discount Office Supplies 500 Purchases Office Equipment 510 Purchase Returns and Allowances Accumulated Depreciation Office Equipment 520 Purchase Discount Accounts Payable 530 Freight-in Salaries Payable 600 Freight-Out Navara, Capital 610 Advertising Expense Navara, Drawing 620 Salaries Expense 630 Utilities Expense 640 Office Supplies Expense 650 Depreciation Expense-Office Equipment 700 Income Summary 3. POSTING TRANSACTIONS TO THE LEDGER Balance Account: Cash : Date 2019 Mar 1 No: 100 Credit Items F Debit Debit Credit 150,000 150,000 4 21,800 128,200 5 127,700 500 6,000 6 121,700 Initial Investment Payment to supplier and transportation Paid advertising Purchased office supplies Returned merchandise Paid transportation Paid salary Cash sales 7 1,800 123,500 10 120 1,500 123,380 121,880 15 16 10,800 132,680 18 Payment from customer 18,081 150,761 20 80 150,681 23 5,000 155,681 25 Paid transportation Cash sales Payment to supplier Paid utilities Owner's drawing 148,233 7,448 1,200 28 147,033 30 4,000 143,033 No: 120 Balance Account: Accounts Receivable Date Items F Debit Credit Debit Credit Account: Merchandise Inventory No: 130 : Balance Date 2019 Items F Debit Credit Debit Credit 20 No: 140 Balance Account: Office Supplies Date Items F Debit Credit Debit Credit No: 150 Balance Account: Office Equipment Date Items F Debit Credit Debit Credit No: 151 Balance Account: Accumulated Depreciation Office Equipment Date Items F Debit Credit Debit Credit No: 200 Account: Accounts Payable Date Items Balance Debit Credit F Debit Credit 6 9 10 In March 2019, Ms. Rea Navara opened Navara Department Store. The following are the transactions incurred by her business in its first month of operation: March 1 Ms. Navarra invested Php 150,000 cash and Php 25,000 worth of office equipment in the name of the business. 2 Hired a sales assistant with a monthly salary of Php 3,000. 4 Bought merchandise from LS Enterprises for Php 21,500 cash and paid transportation cost of Php 300. 5 Paid advertising for the month, Php 500. Purchased office supplies for cash, Php 6,000. 7 Returned defective merchandise worth Php 1,800 to LS Enterprises. Sold merchandise on credit to Mr. Alejo, Php 19,200. The cost of merchandise is Php 15,000. Paid the transportation worth Php 120 for the merchandise sold on July 9. 12 Received returned merchandise from Mr. Alejo worth Php 750. The cost of merchandise returned if Php 586. 15 Paid half-month salary of employee, Php 1,500. 16 Sold merchandise for cash amounting to Php 10,800. The cost of merchandise is P6,000. 18 Received payment from the credit of Mr. Alejo. Navara Department Store granted a discount of Php 369. 19 Bought merchandise on credit from Zee Wear Store for Php 8,400. 20 Paid transportation cost of Php 80 for the merchandise bought on March 19. 22 Returned defective merchandise to Zee Wear Store, Php 800. Sold merchandise for cash, P5,000. The cost of merchandise is 3,800. 25 Paid the credit to Zee Wear Store. A discount of Php 152 was granted. 28 Paid the utilities for the month amounting to Php 1,200. 31 Ms. Navara withdrew Php 4,000 cash from the business. 23 Adjustments: a. Half-month salary of employee has accrued on March 31. b. Supplies at the end of the month amounted to Php 5,400 c. Office equipment depreciated by Php 100 on March 31. d. Merchandise inventory at month-end amounted to Php 3,314. 17 17 Account No. 100 120 130 140 150 151 200 210 300 310 CHART OF ACCOUNTS Account Titles Account Account Titles No. Cash 400 Sales Accounts Receivable 410 Sales Returns and Allowances Merchandise Inventory 420 Sales Discount Office Supplies 500 Purchases Office Equipment 510 Purchase Returns and Allowances Accumulated Depreciation Office Equipment 520 Purchase Discount Accounts Payable 530 Freight-in Salaries Payable 600 Freight-Out Navara, Capital 610 Advertising Expense Navara, Drawing 620 Salaries Expense 630 Utilities Expense 640 Office Supplies Expense 650 Depreciation Expense-Office Equipment 700 Income Summary 3. POSTING TRANSACTIONS TO THE LEDGER Balance Account: Cash : Date 2019 Mar 1 No: 100 Credit Items F Debit Debit Credit 150,000 150,000 4 21,800 128,200 5 127,700 500 6,000 6 121,700 Initial Investment Payment to supplier and transportation Paid advertising Purchased office supplies Returned merchandise Paid transportation Paid salary Cash sales 7 1,800 123,500 10 120 1,500 123,380 121,880 15 16 10,800 132,680 18 Payment from customer 18,081 150,761 20 80 150,681 23 5,000 155,681 25 Paid transportation Cash sales Payment to supplier Paid utilities Owner's drawing 148,233 7,448 1,200 28 147,033 30 4,000 143,033 No: 120 Balance Account: Accounts Receivable Date Items F Debit Credit Debit Credit Account: Merchandise Inventory No: 130 : Balance Date 2019 Items F Debit Credit Debit Credit 20 No: 140 Balance Account: Office Supplies Date Items F Debit Credit Debit Credit No: 150 Balance Account: Office Equipment Date Items F Debit Credit Debit Credit No: 151 Balance Account: Accumulated Depreciation Office Equipment Date Items F Debit Credit Debit Credit No: 200 Account: Accounts Payable Date Items Balance Debit Credit F Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started