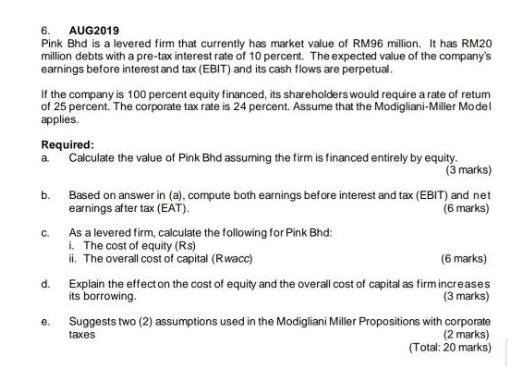

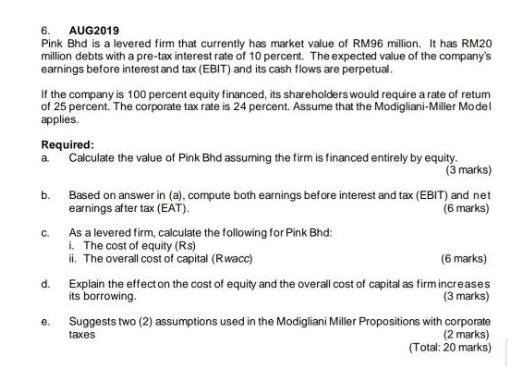

6. a b. AUG2019 Pink Bhd is a levered firm that currently has market value of RM96 million. It has RM20 million debts with a pre-tax interest rate of 10 percent. The expected value of the company's earnings before interest and tax (EBIT) and its cash flows are perpetual If the company is 100 percent equity financed, its shareholders would require a rate of retum of 25 percent. The corporate tax rate is 24 percent. Assume that the Modigliani-Miller Model applies Required: Calculate the value of Pink Bhd assuming the firm is financed entirely by equity. (3 marks) Based on answer in (a), compute both earnings before interest and tax (EBIT) and net earnings after tax (EAT). (6 marks) As a levered firm, calculate the following for Pink Bhd: i. The cost of equity (Rs) i. The overall cost of capital (Rwacc) (6 marks) Explain the effect on the cost of equity and the overall cost of capital as firm increases its borrowing. (3 marks) Suggests two (2) assumptions used in the Modigliani Miller Propositions with corporate (2 marks) (Total: 20 marks) c. d. e. taxes 6. a b. AUG2019 Pink Bhd is a levered firm that currently has market value of RM96 million. It has RM20 million debts with a pre-tax interest rate of 10 percent. The expected value of the company's earnings before interest and tax (EBIT) and its cash flows are perpetual If the company is 100 percent equity financed, its shareholders would require a rate of retum of 25 percent. The corporate tax rate is 24 percent. Assume that the Modigliani-Miller Model applies Required: Calculate the value of Pink Bhd assuming the firm is financed entirely by equity. (3 marks) Based on answer in (a), compute both earnings before interest and tax (EBIT) and net earnings after tax (EAT). (6 marks) As a levered firm, calculate the following for Pink Bhd: i. The cost of equity (Rs) i. The overall cost of capital (Rwacc) (6 marks) Explain the effect on the cost of equity and the overall cost of capital as firm increases its borrowing. (3 marks) Suggests two (2) assumptions used in the Modigliani Miller Propositions with corporate (2 marks) (Total: 20 marks) c. d. e. taxes