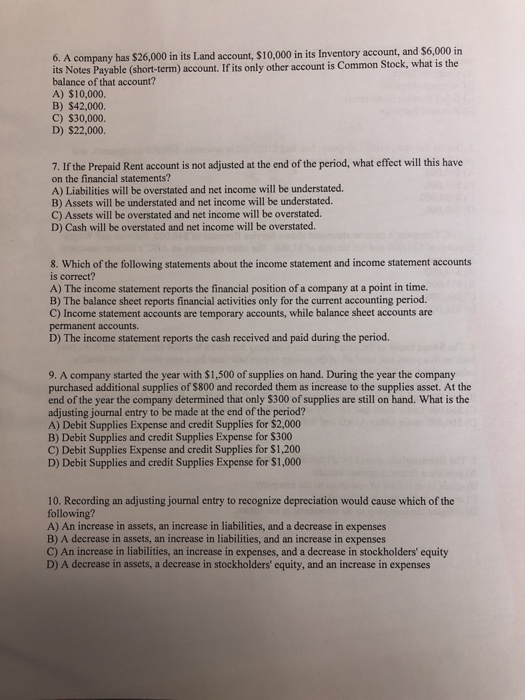

6. A company has $26,000 in its Land account, S10,000 in its Inventory account, and $6,000 in its Notes Payabl le (short-term) account. If its only other account is Common Stock, what is the balance of that account? A) $10,000. B) $42,000 C) S30,000. D) $22,000. 7. If the Prepaid Rent account is not adjusted at the end of the period, what effect will this have on the financial statements? A) Liabilities will be overstated and net income will be understated. B) Assets will be understated and net income will be understated. C) Assets will be overstated and net income will be overstated. D) Cash will be overstated and net income will be overstated. 8. Which of the following statements about the income statement and income statement accounts is correct? A) The income statement reports the financial position of a company at a point in time. B) The balance sheet reports financial activities only for the current accounting period. C) Income statement accounts are temporary accounts, while balance sheet accounts are permanent accounts D) The income statement reports the cash received and paid during the period 9. A company started the year with $1,500 of supplies on hand. During the year the company purchased additional supplies of $800 and recorded them as increase to the supplies asset. At the end of the year the company determined that only $300 of supplies are still on hand. What is the adjusting journal entry to be made at the end of the period? A) Debit Supplies Expense and credit Supplies for $2,000 B) Debit Supplies and credit Supplies Expense for $300 C) Debit Supplies Expense and credit Supplies for $1,200 D) Debit Supplies and credit Supplies Expense for $1,000 10. Recording an adjusting journal entry to recognize depreciation would cause which of the following? A) An increase in assets, an increase in liabilities, and a decrease in expenses B) A decrease in assets, an increase in liabilities, and an increase in expenses C) An increase in liabilities, an increase in expenses, and a decrease in stockholders' equity D) A decrease in assets, a decrease in stockholders' equity, and an increase in expenses