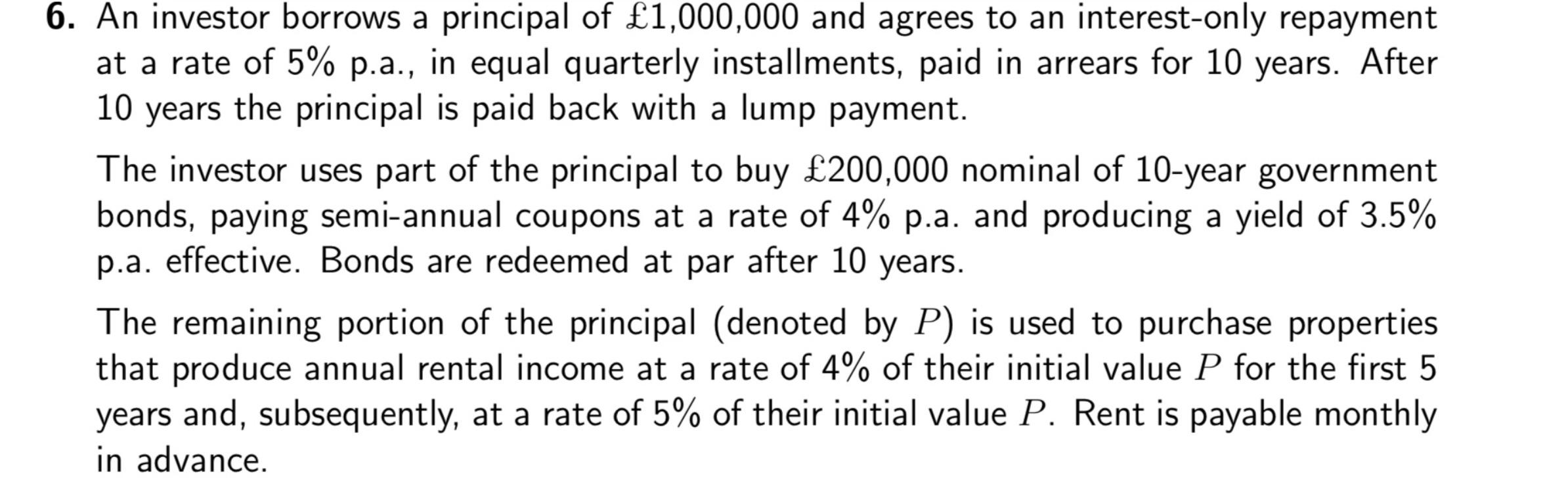

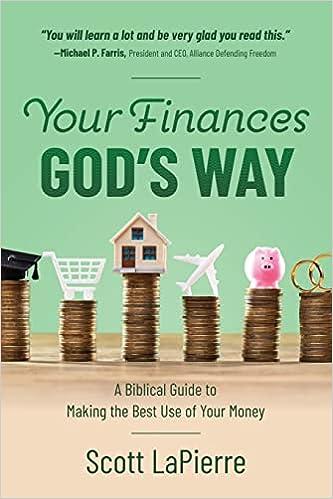

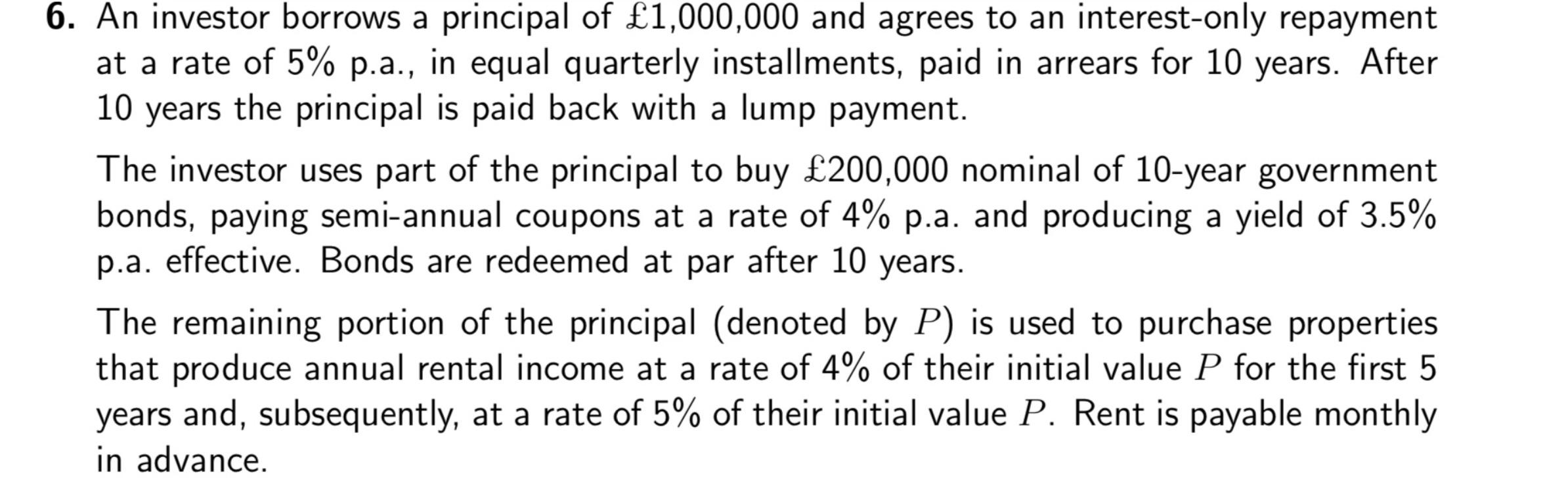

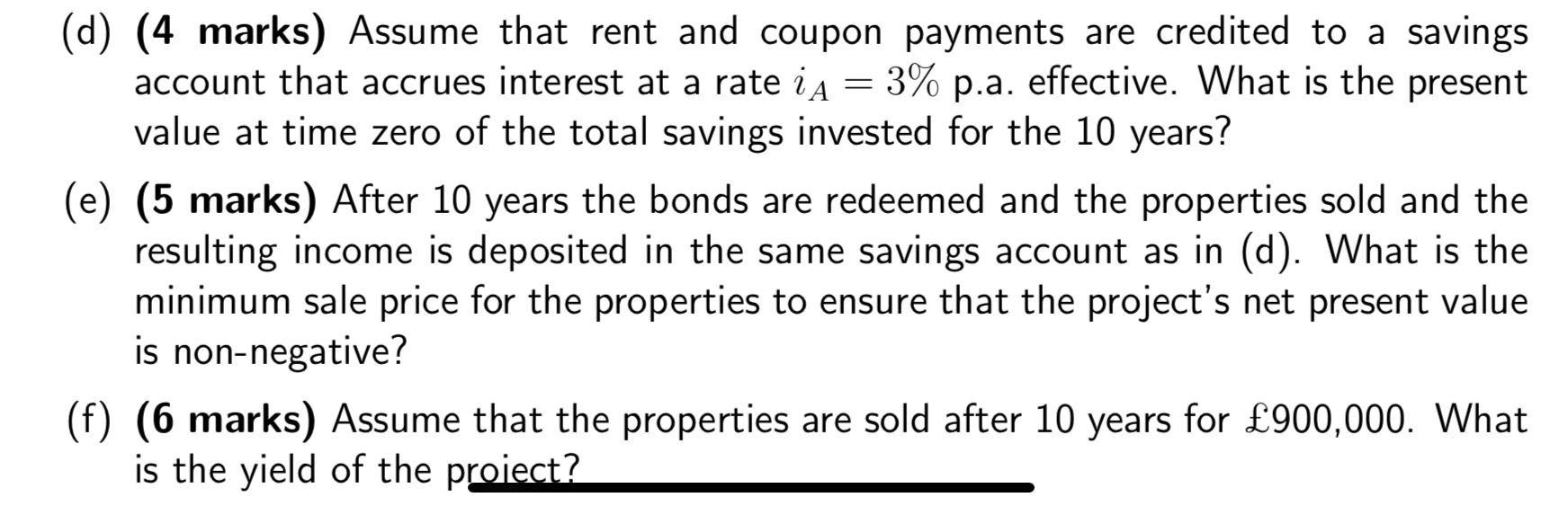

6. An investor borrows a principal of 1,000,000 and agrees to an interest-only repayment at a rate of 5% p.a., in equal quarterly installments, paid in arrears for 10 years. After 10 years the principal is paid back with a lump payment. The investor uses part of the principal to buy 200,000 nominal of 10-year government bonds, paying semi-annual coupons at a rate of 4% p.a. and producing a yield of 3.5% p.a. effective. Bonds are redeemed at par after 10 years. The remaining portion of the principal (denoted by P) is used to purchase properties that produce annual rental income at a rate of 4% of their initial value P for the first 5 years and, subsequently, at a rate of 5% of their initial value P. Rent is payable monthly in advance. = (d) (4 marks) Assume that rent and coupon payments are credited to a savings account that accrues interest at a rate i A = 3% p.a. effective. What is the present value at time zero of the total savings invested for the 10 years? (e) (5 marks) After 10 years the bonds are redeemed and the properties sold and the resulting income is deposited in the same savings account as in (d). What is the minimum sale price for the properties to ensure that the project's net present value is non-negative? (f) (6 marks) Assume that the properties are sold after 10 years for 900,000. What is the yield of the project? 6. An investor borrows a principal of 1,000,000 and agrees to an interest-only repayment at a rate of 5% p.a., in equal quarterly installments, paid in arrears for 10 years. After 10 years the principal is paid back with a lump payment. The investor uses part of the principal to buy 200,000 nominal of 10-year government bonds, paying semi-annual coupons at a rate of 4% p.a. and producing a yield of 3.5% p.a. effective. Bonds are redeemed at par after 10 years. The remaining portion of the principal (denoted by P) is used to purchase properties that produce annual rental income at a rate of 4% of their initial value P for the first 5 years and, subsequently, at a rate of 5% of their initial value P. Rent is payable monthly in advance. = (d) (4 marks) Assume that rent and coupon payments are credited to a savings account that accrues interest at a rate i A = 3% p.a. effective. What is the present value at time zero of the total savings invested for the 10 years? (e) (5 marks) After 10 years the bonds are redeemed and the properties sold and the resulting income is deposited in the same savings account as in (d). What is the minimum sale price for the properties to ensure that the project's net present value is non-negative? (f) (6 marks) Assume that the properties are sold after 10 years for 900,000. What is the yield of the project