Answered step by step

Verified Expert Solution

Question

1 Approved Answer

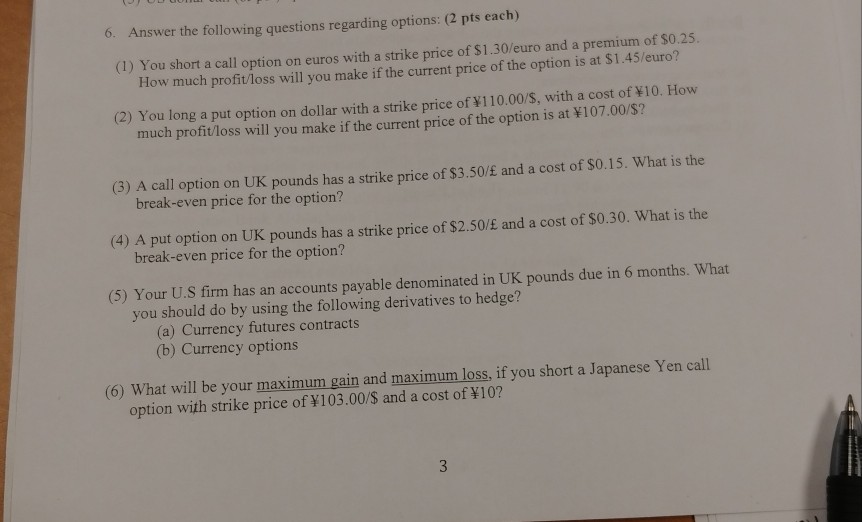

6. Answer the following questions regarding options: (2 pts each) (1) You short a call option on euros with a strike price of $1.30/euro and

6. Answer the following questions regarding options: (2 pts each) (1) You short a call option on euros with a strike price of $1.30/euro and a premium of $0.25. How much profit/loss will you make if the current price of the option is at $1.45/euro? (2) You long a put option on dollar with a strike price of110.00/S, with a cost of 10. How much profitloss will you make if the current price of the option is at Y107.00/5? (3) A call option on UK pounds has a strike price of $3.50/f and a cost of $0.15. What is the (4) A put option on UK pounds has a strike price of $2.50/f and a cost of $0.30. What is the (5) Your U.S firm has an accounts payable denominated in UK pounds due in 6 months. What break-even price for the option? break-even price for the option? you should do by using the following derivatives to hedge? (a) Currency futures contracts (b) Currency options (6) What will be your maximum gain and maximum loss, if you short a Japanese Yen call option with strike price of Y103.00/S and a cost of Y10? 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started