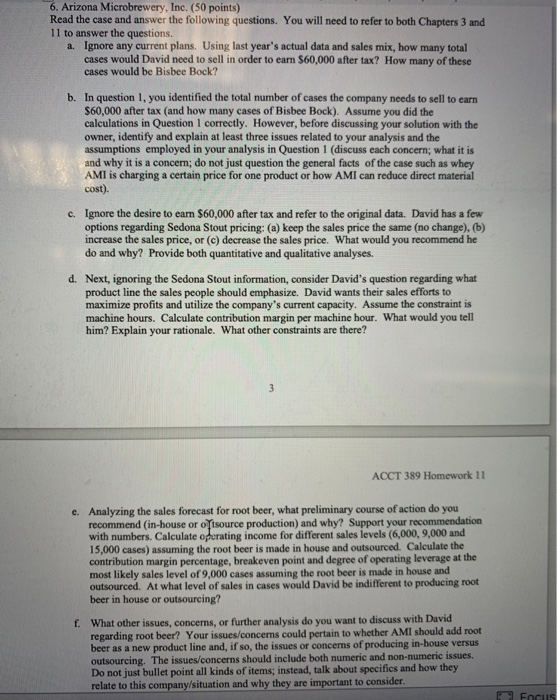

6. Arizona Microbrewery, Inc. (50 points) Read the case and answer the following questions. You will need to refer to both Chapters 3 and 11 to answer the questions. a. Ignore any current plans. Using last year's actual data and sales mix, how many total cases would David need to sell in order to earn $60,000 after tax? How many of these cases would be Bisbee Bock? b. In question 1, you identified the total number of cases the company needs to sell to earn 560,000 after tax (and how many cases of Bisbee Bock). Assume you did the calculations in Question 1 correctly. However, before discussing your solution with the owner, identify and explain at least three issues related to your analysis and the assumptions employed in your analysis in Question 1 (discuss each concern; what it is and why it is a concer; do not just question the general facts of the case such as whey AMI is charging a certain price for one product or how AMI can reduce direct material cost). c. Ignore the desire to earn $60,000 after tax and refer to the original data. David has a few options regarding Sedona Stout pricing: (a) keep the sales price the same (no change), (b) increase the sales price, or (c) decrease the sales price. What would you recommend he do and why? Provide both quantitative and qualitative analyses. d. Next, ignoring the Sedona Stout information, consider David's question regarding what product line the sales people should emphasize. David wants their sales efforts to maximize profits and utilize the company's current capacity. Assume the constraint is machine hours. Calculate contribution margin per machine hour. What would you tell him? Explain your rationale. What other constraints are there? ACCT 389 Homework 11 e. Analyzing the sales forecast for root beer, what preliminary course of action do you recommend (in-house or otsource production) and why? Support your recommendation with numbers. Calculate operating income for different sales levels (6,000, 9,000 and 15,000 cases) assuming the root beer is made in house and outsourced. Calculate the contribution margin percentage, breakeven point and degree of operating leverage at the most likely sales level of 9,000 cases assuming the root beer is made in house and outsourced. At what level of sales in cases would David be indifferent to producing root beer in house or outsourcing? f. What other issues, concerns, or further analysis do you want to discuss with David regarding root beer? Your issues/concerns could pertain to whether AMI should add root beer as a new product line and, if so, the issues or concerns of producing in-house versus outsourcing. The issues/concerns should include both numeric and non-numeric issues. Do not just bullet point all kinds of items; instead, talk about specifics and how they relate to this company/situation and why they are important to consider. Focus 6. Arizona Microbrewery, Inc. (50 points) Read the case and answer the following questions. You will need to refer to both Chapters 3 and 11 to answer the questions. a. Ignore any current plans. Using last year's actual data and sales mix, how many total cases would David need to sell in order to earn $60,000 after tax? How many of these cases would be Bisbee Bock? b. In question 1, you identified the total number of cases the company needs to sell to earn 560,000 after tax (and how many cases of Bisbee Bock). Assume you did the calculations in Question 1 correctly. However, before discussing your solution with the owner, identify and explain at least three issues related to your analysis and the assumptions employed in your analysis in Question 1 (discuss each concern; what it is and why it is a concer; do not just question the general facts of the case such as whey AMI is charging a certain price for one product or how AMI can reduce direct material cost). c. Ignore the desire to earn $60,000 after tax and refer to the original data. David has a few options regarding Sedona Stout pricing: (a) keep the sales price the same (no change), (b) increase the sales price, or (c) decrease the sales price. What would you recommend he do and why? Provide both quantitative and qualitative analyses. d. Next, ignoring the Sedona Stout information, consider David's question regarding what product line the sales people should emphasize. David wants their sales efforts to maximize profits and utilize the company's current capacity. Assume the constraint is machine hours. Calculate contribution margin per machine hour. What would you tell him? Explain your rationale. What other constraints are there? ACCT 389 Homework 11 e. Analyzing the sales forecast for root beer, what preliminary course of action do you recommend (in-house or otsource production) and why? Support your recommendation with numbers. Calculate operating income for different sales levels (6,000, 9,000 and 15,000 cases) assuming the root beer is made in house and outsourced. Calculate the contribution margin percentage, breakeven point and degree of operating leverage at the most likely sales level of 9,000 cases assuming the root beer is made in house and outsourced. At what level of sales in cases would David be indifferent to producing root beer in house or outsourcing? f. What other issues, concerns, or further analysis do you want to discuss with David regarding root beer? Your issues/concerns could pertain to whether AMI should add root beer as a new product line and, if so, the issues or concerns of producing in-house versus outsourcing. The issues/concerns should include both numeric and non-numeric issues. Do not just bullet point all kinds of items; instead, talk about specifics and how they relate to this company/situation and why they are important to consider. Focus