Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6. As a loan officer for Allium National Bank, you have been responsible for the bank's relationship with USF Corporation, a major producer of

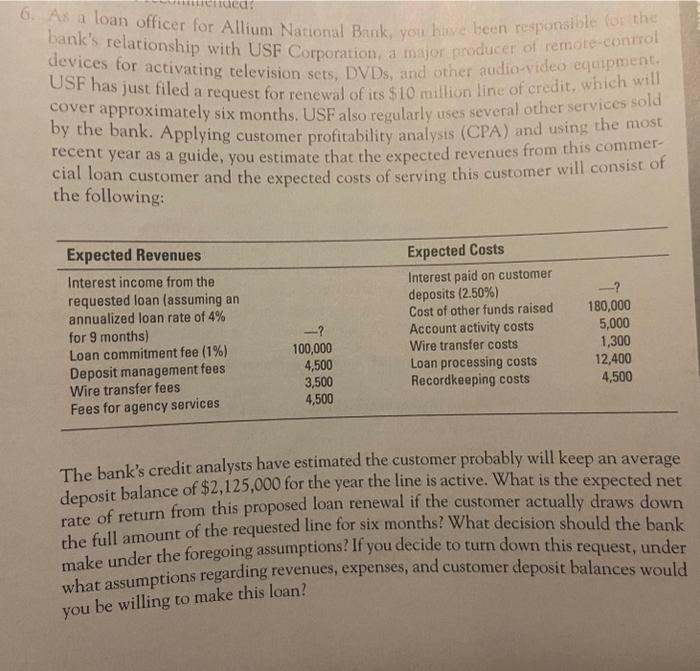

6. As a loan officer for Allium National Bank, you have been responsible for the bank's relationship with USF Corporation, a major producer of remote-control devices for activating television sets, DVDs, and other audio-video equipment. USF has just filed a request for renewal of its $10 million line of credit, which will cover approximately six months. USF also regularly uses several other services sold by the bank. Applying customer profitability analysis (CPA) and using the most recent year as a guide, you estimate that the expected revenues from this commer cial loan customer and the expected costs of serving this customer will consist of the following: Expected Revenues Interest income from the requested loan (assuming an Expected Costs Interest paid on customer deposits (2.50%) annualized loan rate of 4% Cost of other funds raised 180,000 for 9 months) Account activity costs 5,000 Loan commitment fee (1%) 100,000 Wire transfer costs 1,300 Deposit management fees 4,500 Loan processing costs 12,400 Wire transfer fees 3,500 Recordkeeping costs 4,500 Fees for agency services 4,500 The bank's credit analysts have estimated the customer probably will keep an average deposit balance of $2,125,000 for the year the line is active. What is the expected net rate of return from this proposed loan renewal if the customer actually draws down the full amount of the requested line for six months? What decision should the bank make under the foregoing assumptions? If you decide to turn down this request, under what assumptions regarding revenues, expenses, and customer deposit balances would be willing to make this loan? you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started