Answered step by step

Verified Expert Solution

Question

1 Approved Answer

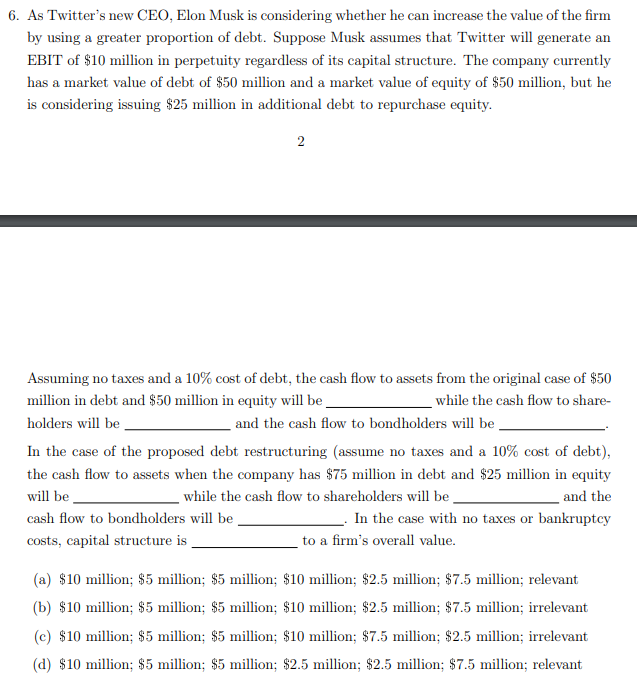

6 . As Twitter's new CEO, Elon Musk is considering whether he can increase the value of the firm by using a greater proportion of

As Twitter's new CEO, Elon Musk is considering whether he can increase the value of the firm by using a greater proportion of debt. Suppose Musk assumes that Twitter will generate an EBIT of $ million in perpetuity regardless of its capital structure. The company currently has a market value of debt of $ million and a market value of equity of $ million, but he is considering issuing $ million in additional debt to repurchase equity.

Assuming no taxes and a cost of debt, the cash flow to assets from the original case of $ million in debt and $ million in equity will be while the cash flow to shareholders will be and the cash flow to bondholders will be

In the case of the proposed debt restructuring assume no taxes and a cost of debt the cash flow to assets when the company has $ million in debt and $ million in equity will be while the cash flow to shareholders will be and the cash flow to bondholders will be In the case with no taxes or bankruptcy costs, capital structure is to a firm's overall value.

a$ million; $ million; $ million; $ million; $ million; $ million; relevant

b$ million; $ million; $ million; $ million; $ million; $ million; irrelevant

c$ million; $ million; $ million; $ million; $ million; $ million; irrelevant

d$ million; $ million; $ million; $ million; $ million; $ million; relevant

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started