Question

6. At this point, the demand in Mexico is pick up nicely. Your company is currently repatriate 47 million pesos per year from Mexico through

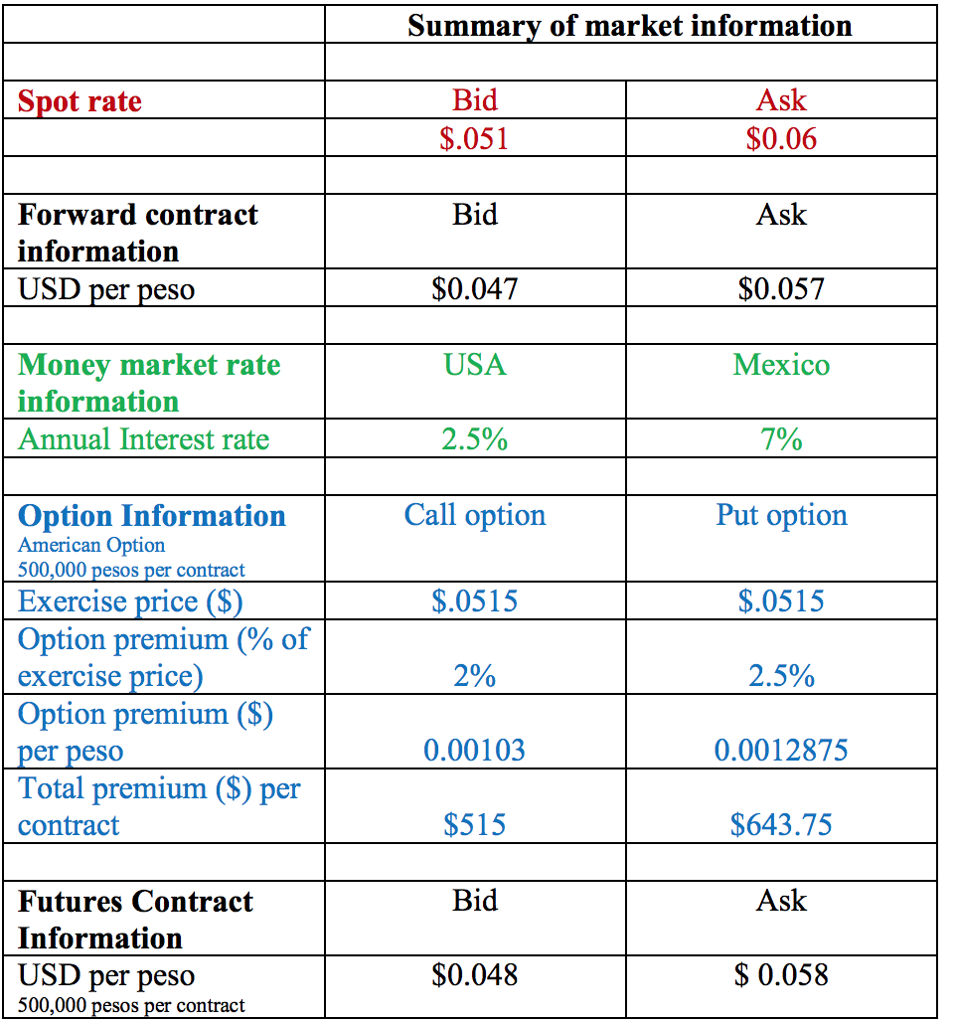

6. At this point, the demand in Mexico is pick up nicely. Your company is currently repatriate 47 million pesos per year from Mexico through ESL class offering and English learning material sales. In addition your company is also import Spanish learning material package produced in Mexico and the company needs to pay about 7 million peso a year from an independent subcontractor located in Mexico. Given recent exchange rate volatility increase, you are asked to identify a good alternative to hedge your companys transaction exposure.

a. Should you hedge peso denominate cash inflow (receivable from export English learning materials and earnings from operation) and cash outflow (payable for import) separately or total cashflows (cash inflow plus cash outflow) or net cashflows (the difference between cash inflow and case outflow)? Why?

b. Based on the following information, please calculate the amounts you would have received based on the following information. You have alternatives of using forward hedge, money market hedge, futures and options. Based on your analysis and calculation, which hedging alternative will you recommend?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started